Bulls Regain The Narrative: “They Want To Believe”

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Review & Update

Last week, we laid out 6-points about the market as the risk to the downside outweighed the potential reward.

-

Historically, September is one of the weakest months of the year, particularly when it follows a weak August.

-

The market remains range bound and failed at both the 50-dma and downtrend line on Friday

-

The oversold condition has now reversed. (Top panel)

-

Volatility is continuing to remain elevated.

-

Important downside support moves up to 2875

-

The bulls regain control of the narrative on a breakout above 2945.

The chart above is updated through Friday’s close. As noted, the bulls did regain control of the narrative for now as the breakout above consolidation sets the market up to rally towards 3000 and the July highs. However, with the markets already pushing back into overbought conditions, in conjunction with an extended buy signal, there is not a lot of “upside” in the markets currently.

As we have reiterated over the last several weeks, this continues to be an opportunity to reduce portfolio risk and raise cash levels.

I say this because it took a bevy of positive overtones to reverse the selloff early in the week. After a sloppy Monday and Tuesday, the rally started on Wednesday with numerous Fed speakers all suggesting the Fed was likely to move forward with cutting rates and increasing monetary accommodation. (H/T Zerohedge)

Williams (Dovish): “Ready to act as appropriate”, July cut was right move, economy mixed (admitted consumer spending not a leading indicator), international news matters, low inflation biggest problem.

Kaplan (Dovish): “Monetary policy a potent force”, worried about yield curve inversion, economy mixed (factories weak due to trade, consumer strong), watching for “psychological effects” on consumers, “if you wait for consumer weakness, it might be too late.”

Kashkari (Dovish): Tariffs, “trade war are really concerning business”, job market not overheating, slower global growth will impact US, most concerned about inverted yield curve. Fed’s policy is “moderately contractionary.”

Bullard/Bowman (Looked Dovish): Took part in “Fed Listens” conference but made no comment on policy but then again when has Jim Bullard ever not been dovish.

Beige Book (Mixed): Moderate expansion but trade fears are mounting, but optimism remains, despite what Kashkari says: “although concerns regarding tariffs and trade policy uncertainty continued, the majority of businesses remained optimistic about the near-term outlook”

Evans (Dovish): Trade policy increases uncertainty and immigration restrictions lower trend growth to 1.5%, Auto industry especially challenged

Furthermore, on Tuesday, we suggested it wouldn’t be long before the Trump Administration dropped an announcement for “trade deal negotiation.”

Meh! Just need a tweet that “trade talks” are back on and the Fed is cutting rates.

“Tis but a flesh wound.” https://t.co/nDPLBeXInw

— Lance Roberts (@LanceRoberts) September 3, 2019

https://platform.twitter.com/widgets.js

Of course, on Thursday, our wish was granted as the Administration announced that “trade talks” were back on for October.

“China’s Ministry of Commerce said Thursday that the leaders of the U.S. and Chinese trade talks held a phone call in the morning and agreed to meet in early October for another round of negotiations.

In a statement to CNBC, a U.S. Trade Representative spokesperson confirmed the phone call, but not the October meeting.

Beijing said the two sides agreed to hold another round of trade negotiations in Washington, D.C. — at the beginning of next month, and consultations will be made in mid-September in preparation for the meeting.”

While the markets once again rallied on the news, this is the same news we have repeatedly seen for the last 18-months. As @stockcats aptly noted:

I hope someone is keeping track of how many times this cycle has repeated pic.twitter.com/5kft4b8lGY

— StockCats (@StockCats) September 5, 2019

https://platform.twitter.com/widgets.js

The last few months has been this gyration of exuberance and disappointment as the market has lived from one “trade headline” to the next.

Then, of course, on Friday, Jerome Powell spoke suggesting there was “no recession” in sight but gave confidence to the markets the Fed would cut rates at the next meeting. To wit:

“As we move forward, we’re going to continue to watch all of these factors, and all the geopolitical things that are happening, and we’re going to continue to act as appropriate to sustain this expansion.”

This was all enough to spark investor’s “animal spirits” and force a rotation from “defense” back to “offense.” This is an outcome we discussed with our RIAPRO subscribers last week specifically as it related to adding to our Gold positions. To wit: (Chart updated through Friday)

- Both GDX and IAU look identical.

- A near-vertical spike has taken these holdings to extreme overbought and extended conditions.

- We need a decent pullback, or consolidation, to add to holdings at this juncture. A rally in the market should give us that opportunity as it will pull Gold and Rates back to support.

- Looking for an entry point between $14-14.25 to add to holdings.

On Thursday, rates and gold both pulled back as the equity rally accelerated above the breakout level. This pulled the algo’s out of defensive holdings and back into equities confirming the breakout short-term.

The next major hurdle is going to be the 3000-level initially, but our bullish target for 2019 could be challenged which resides at the top of the trend channel.

That is assuming that nothing disrupts the current bullish narrative.

But, there are many issues from failed trade talks, to earnings, to economic disappointment which could do just that.

This is why, despite the bullish overtone, we continue to hold an overweight position in cash (see 8-Reasons), have taken steps to improve the credit-quality in our bond portfolios, and shifted our equity portfolios to more defensive positioning.

We did modestly add to our equity holdings with the breakout on Thursday from a trading perspective. However, we still maintain an overall defensive bias which continues to allow us to navigate market uncertainty until a better risk/reward opportunity presents itself.

The Last Hoorah?

September 11, 2018, I wrote “3000 or Bust” and almost precisely one-year later we are finally, for the second time, approaching that level.

Here is the problem.

The rally has been driven almost entirely by multiple expansion rather than improving fundamentals. This was a point made in last Tuesday’s missive:

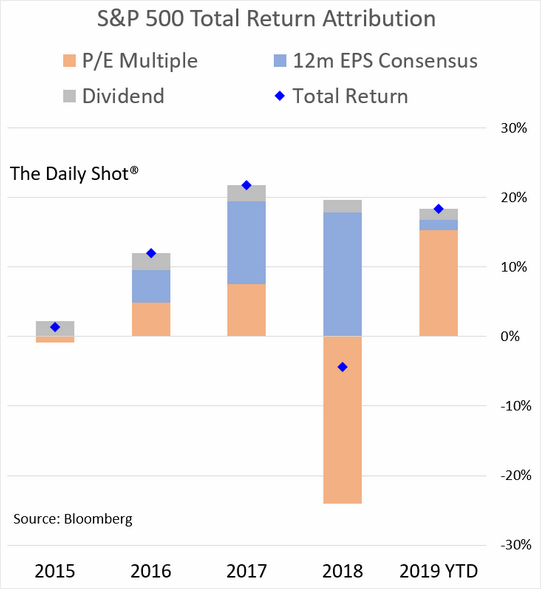

“Investing is ultimately about buying assets at a discounted price and selling them for a premium. However, so far in 2019, while asset prices have soared higher on ‘optimism,’ earnings and profits have deteriorated markedly. This is shown in the attribution chart below for the S&P 500.

In 2019, the bulk of the increase in asset prices is directly attributable to investors ‘paying more’ for earnings, even though they are ‘getting less’ in return.”

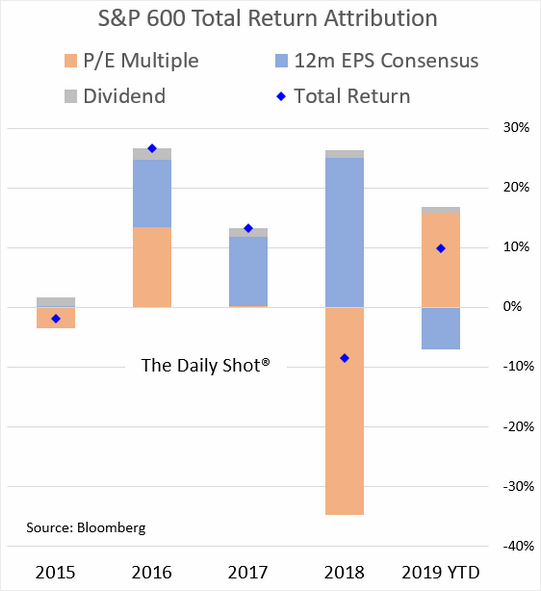

The discrepancy is even larger in small-capitalization stocks which don’t benefit from things like “share repurchases” and “repatriation.”

Just remember, at the end of the day, valuations do matter.

Here is another way to look at the data. Since the beginning of 2018, to support the bullish meme that companies are “beating expectations,” those expectations have been, and continue to be, dramatically lowered.

This is particularly important given that “operating earnings” (which are fantasy earnings before any of the “bad sh**,”) are extremely elevated above reported profits.

S&P EPS BUBBLE: When equity earnings rise stupidly relative to (NIPA) profits, subsequent 2-year S&P500 returns are negative. Since mid-90, two episodes stand out – late 1990s and NOW! pic.twitter.com/htgHTzilt5

— Gaurav Saroliya (@GauravSaroliya) July 31, 2019

https://platform.twitter.com/widgets.js

Of course, this all shows up in how much investors are currently “over-paying” for equity ownership.

As is always the case, investors forget during their momentary bout of exuberance, that valuations are all that matter over the long-term. The greater that over-valuation, the great the reversion to mean will ultimately be.

But Lance, the markets just keep going up because Central Banks have it all under control.”

I know it certainly seems that way currently. However, this is a market driven by “financial engineering”rather than fundamental measures. As noted previously, stock buybacks have continued to be a major support for asset prices since the financial crisis accounting for the bulk of the advance in the S&P 500.

Not surprisingly, as rates of buybacks have slowed, so has the advance of the market. However, they have remained strong enough to offset the effects of negative economic news and trade wars.

At least, so far.

Importantly, as the benefit of “repatriation” from the tax reform legislation fades, it has been the rush to the corporate debt market to leverage up balance sheets to facilitate those repurchases.

“On Wednesday new investment-grade issuance accelerated even more, rising to $28.8bn across 15 deals today, bringing the total for the two days of the week to a whopping $54.3 billion, as refinancing trades continued to dominate with $21.1bn of today’s issuance partially towards commercial paper, credit revolver, term loan, short and long-term debt repayments, according to BofA’s Hans Mikkelsen.” – Via Zerohedge

So, what was the reason for the rush to gobble up more debt at lower costs?

To refinance existing debt at lower rates for longer maturities, and, as Apple noted with their $5 Billion offering, to repurchase shares and issue dividends.

At the same time, due to excessive confidence and complacency in the financial markets, investors are willing to take substantial credit risk without getting paid for it. Such previous periods of exuberance have also always ended badly.

With corporate debt to GDP levels now at record levels, it is only a function of time until something breaks.

All this brings to mind a note from my friend Doug Kass this past week that summed up well what investors are currently doing.

They Want To Believe

“Price has a way of changing sentiment.” – The Divine Ms M

“It is remarkable to me that the many that hated stocks a large percentage ago (when some of us were buying in the face of a more favorable reward vs. risk) are now bullish and buying.

Investors and traders seem to want to believe.

They want to believe that the trade talks between the U.S. and China will be real this time.

They want to believe that there is no “earnings recession” even though S&P profits through the first half of 2019 are slightly negative (year over year) and that S&P EPS estimates have been regularly reduced as the year has progressed. (see above)

They want to believe that stocks are cheap relative to bonds even though there is little natural price discovery as central banks are artificially impacting global credit markets and passive investing is artificially buoying equities.

They want to believe that technicals and price are truth – even though the markets materially influenced by risk parity and other products and strategies that exaggerates daily and weekly price moves.

They want to believe that today’s economic data is an “all clear” – forgetting the weak ISM of a few days ago, the lackluster auto and housing markets, the U.S. manufacturing recession and the continued overseas economic weakness.

They want to believe that, given no U.S. corporate profit growth, that valuations can continue to expand (after rising by more than three PEs year to date).

They want to believe though that the EU broadly has negative interest rates and Germany is approaching recession (while the peripheral countries are in recession) – that the Fed will be able to catalyze domestic economic growth through more rate cuts.

They want to believe that the U.S. can be an oasis of growth even though the economic world is increasingly flat and interconnected and the S&P is nearly 50% dependent on non U.S. economies.

I don’t know with certainty where the markets will be three or six months from today.

But I do know that, given the recent rise in the stock market, the reward vs. risk is vastly diminished and less favorable compared to other opportunities that existed since December, 2018.”

When it comes to investing, believing in “fairy tales” and “We Work” uhm, I mean, “unicorns” has repeatedly led to terrible outcomes.

The data continues to deteriorate as the late-stage economic cycle advances.

This is as it should be as we move into a late-stage economy.

It is not a bad thing; it is just part of a healthy cycle. It is when entities take action to “extend” the cycle beyond norms, and into extremes, which leads to extremely poor outcomes.

While none of this means the markets will crash tomorrow, next month, or even next year, it also doesn’t mean that it can’t, or won’t.

Complacency is an investor’s worst enemy.

Tyler Durden

Sun, 09/08/2019 – 10:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com