Bias

Tyler Durden

Sun, 09/20/2020 – 12:30

By Eric Peters, CIO of One River Asset Management

Bias

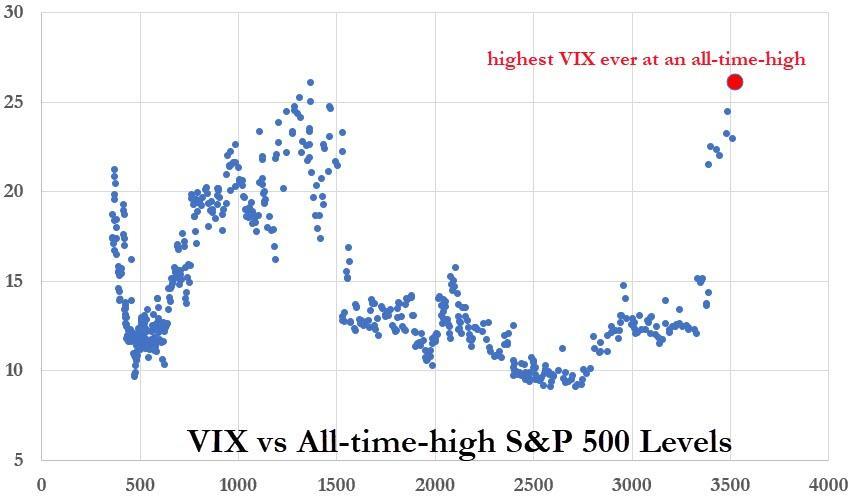

S&P 500 implied volatility remained unusually elevated even as the index erased Q1 losses and hit all-time highs. Like most things in markets, there are no definitive explanations, only theories. The Nov 3rd election supports implied vol (election-day vol implies a 5.6% S&P and 7% Nasdaq move up or down – 2.4x the presidential election avg). And the disconnect between economic fundamentals and equity prices leaves uneasy investors eager to own protection. Then there’s the institutional option buying, Softbank, retail speculation, Portnoy, Robinhood…

S&P 500 implied vol also remained elevated during the 1999 melt-up, so it’s critical to maintain an open mind about what today’s vol levels might be telling us. And part of maintaining openness is understanding one’s own biases. For the past couple years, I’ve been anticipating a transition to a far more volatile vol regime when this cycle finally turns. It appears to have. A higher vol regime appeared inevitable because decades of increasingly aggressive monetary interventions left the system ever more dependent, just as the Fed has grown impotent.

While the Fed can quite obviously lift financial asset prices, its ability to stimulate the real economy declined steadily in recent decades. It is this growing impotence that widened the chasm between asset prices and the real economy; simultaneously amplifying inequality and financial instability. The Fed understands this even as they deny it, which is why they’ve increasingly called on politicians to support monetary easing with increased deficit spending. This naturally leads to monetary/fiscal coordination. And this is where we are now.

Monetary/fiscal coordination in a world of Fed impotence transfers power from central bankers to politicians, because it is the latter who control spending. This leaves the Fed as a political entity that to a greater or lesser degree monetizes government debt. Once this role is broadly understood, the Fed’s independence is lost. We’re nearly there. The resulting ascendance of fiscal policy in determining the pace of economic growth introduces greater volatility to the system, because while central bankers are a homogeneous lot, politicians come in all shapes and sizes.

But not only are politicians rather heterogeneous within the US, leaving the fiscal choices they make (the winning/losing industries they choose) rather different under Trump relative to Biden, but politicians are heterogeneous across nations too. And as we transition away from a world dominated by homogeneous global central bankers who have all adopted the Fed’s playbook, we move toward a world swayed by an array of heterogeneous political leaders, each with their pet projects, their priorities, philosophies, biases, their dreams of grand legacies.

When economy-wide debt reaches levels where each incremental dollar yields very little real economic growth, either cascading defaults will accompany a recession, or government fiscal and monetary policy coordination is applied to obfuscate the problem and eventually inflate it away. The US and by extension the developed world have chosen the latter, having no appetite whatsoever for the former. Neither path is right or wrong, just different. Each carries profound risks, though unique. And on each, heightened volatility is inevitable. That is my bias.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com