The One-Chart Summary Of All That Is Wrong With The US Financial System: Deposits Over Loans

Tyler Durden

Sun, 10/18/2020 – 17:25

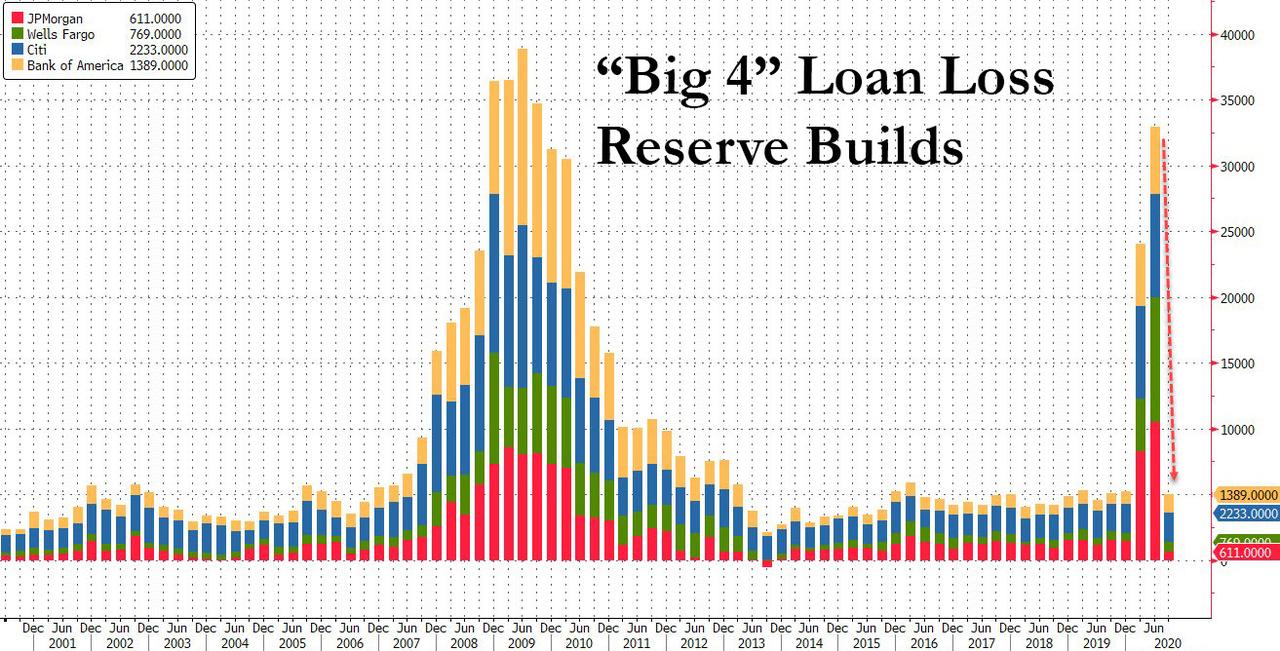

Now that the big banks have concluded their earnings season, with the top highlight being the collapse in loan loss reserve builds from $33 billion in Q2 to just $5 billion in the quarter ended Sept 30…

… in what some have taken as a vote of confidence for the economy as bank risk managers clearly don’t anticipate another sharp leg lower in the economy (that may change if a second wave of covid forces new shutdowns), we can take a closer look at some of the other, just as notable observations within the US financial sector.

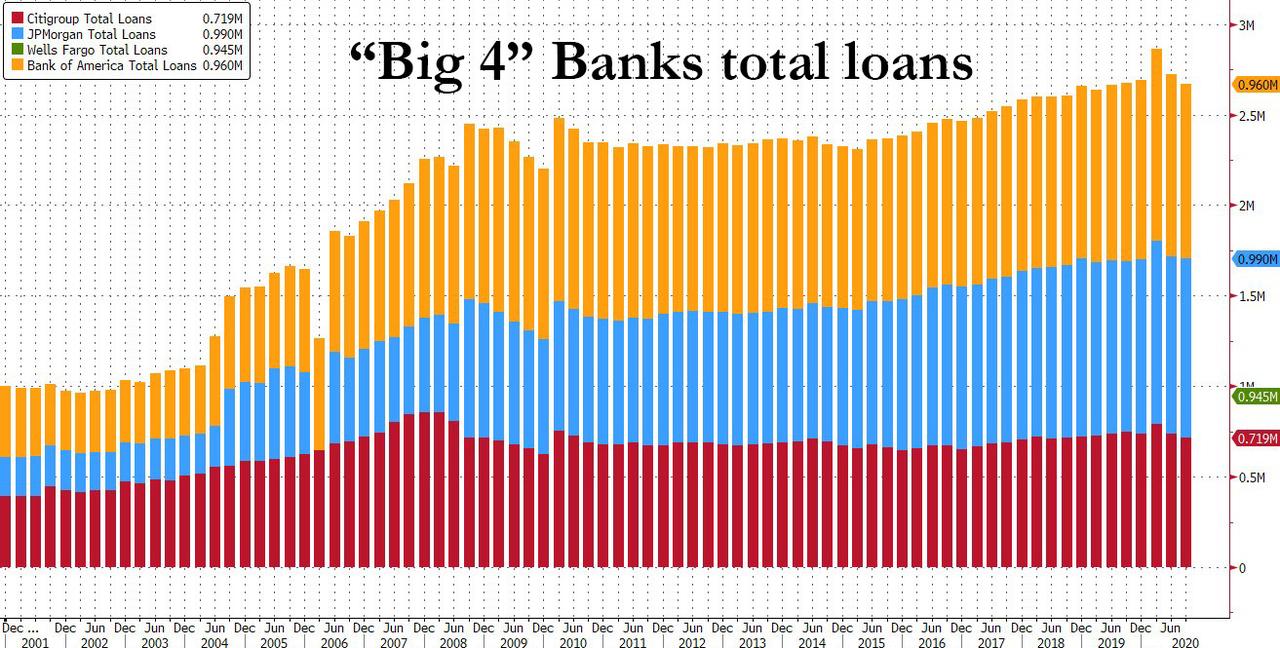

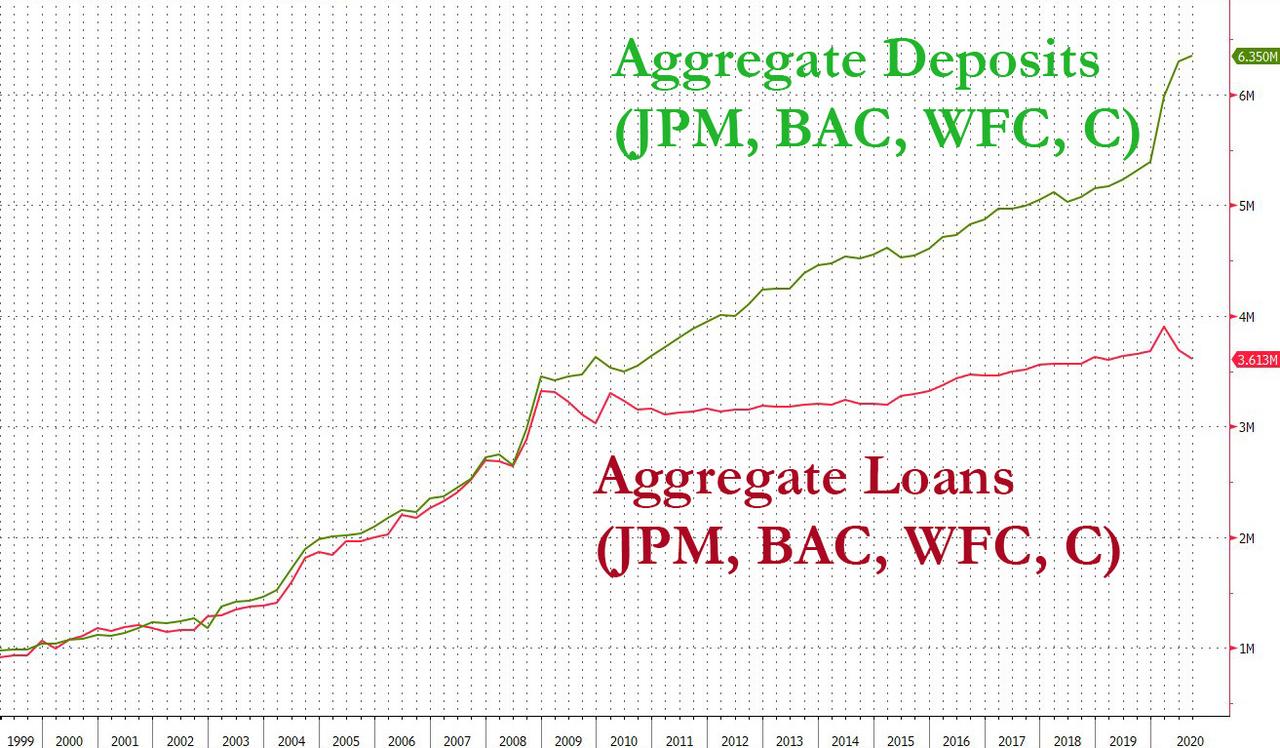

First, we looked at the amount of total loans across the 4 megabanks, where for the second consecutive quarter aggregate loans declined after the Q1 surge (which as a reminder was driven almost entirely by revolver drawdowns, which have since been refinanced by bonds and other debt instruments).

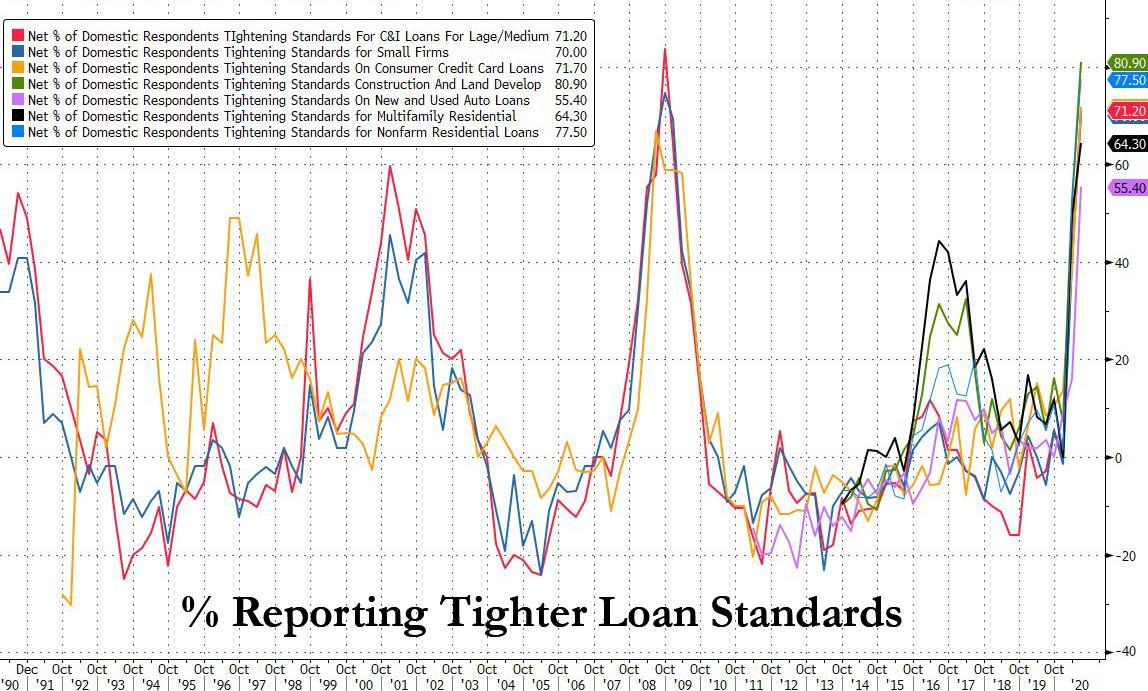

Those who have followed our reporting on the surge in bank lending standards, which recently spiked to levels not seen since the financial crisis, will not be surprised by the ongoing freeze in loan issuance: after all, banks remain terrified about lending across most verticals, including C&I, consumer (credit card and auto loans) and residential and commercial real estate.

Yet while the continued flatlining in US bank loans – which haven’t budged in the past two years and have barely increased since the financial crisis – is explainable, it is nonetheless quite troubling: after all, if there is neither supply nor demand for loans, the economy simply won’t grow, period. It’s also why the velocity of money will be catastrophic and is approaching that monetary “singularity” of 1 for the first time ever.

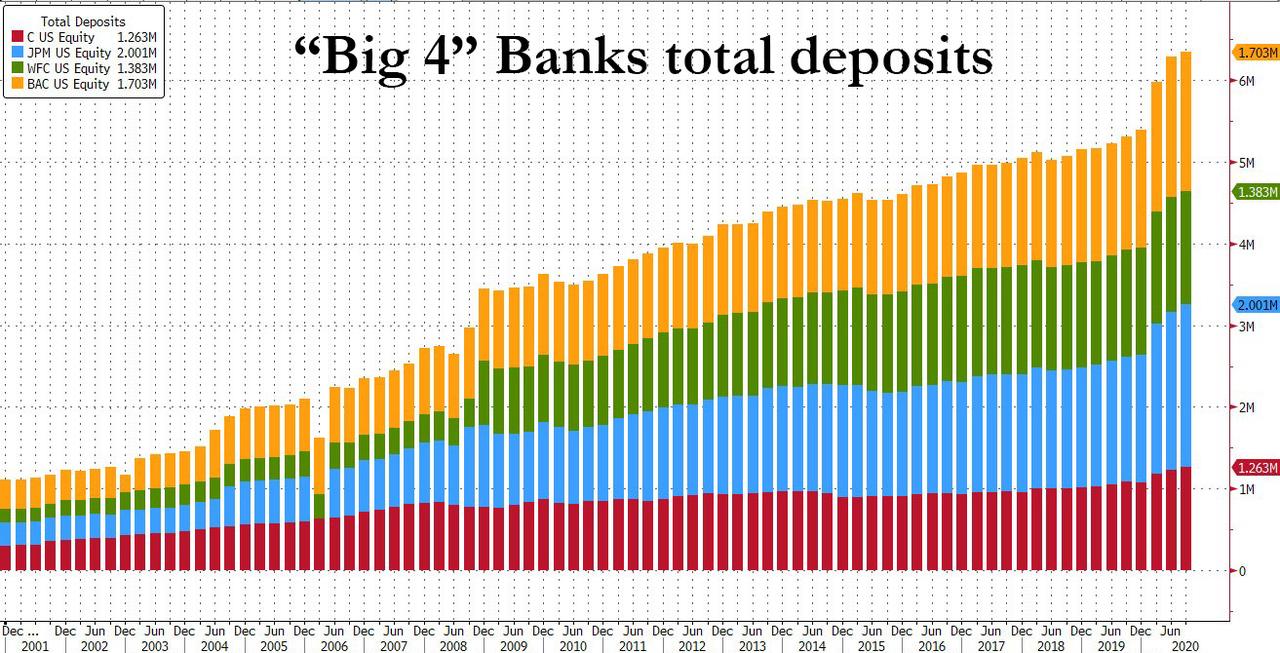

However, while it is hardly surprising that loan growth has refused to pick up during the worst economic depression since the “Great” one, what is certainly remarkable is when one looks at the corresponding bank liability: deposits. Here, there is no such problem, and in fact, in recent quarter (and years), deposits have exploded higher and continued to do so last quarter too.

Why is this notable? Well, for one, it crushes the socialism-enabling “theory” known as MMT, or Modern Money Theory, also known as Helicopter Money. Recall that according to the hodgepodge of confused concerts that were thrown at the wall in hopes of coming up with some comprehensive monetary theory, from the perspective of Modern Monetary Theory private bank lending is unconstrained by the quantity of reserves the bank holds at any point in time. In other words, according to MMT loans create deposits (see here, here, and here). Only… clearly in reality that’s not the case.

Which then brings us to what may be the best one-chart summary of all that is wrong with the US financial system. It is a very simple chart – it shows consolidated deposits and loans within the US financial system (which consists of both US and foreign banks).

Why is it a good summary? Because, for one, total loans issued by US bank were $3.6 trillion in Q3 2020: just a tiny $300 billion more than in the quarter Lehman blew up. More than a decade later, and the US commercial bank lending apparatus is still in a state of shock…

But why don’t banks lend out more: after all that is the main pathway to stimulate the economy as all pundits will tell us. Simple: it doesn’t need to. As the green line above shows, total consumer deposits held by the banks has continued to explode higher, rising to a record $6.35 trillion, up more than $50 billion in the quarter, and pushing the deposit-over-loan difference to a new record of $2.7 trillion! So much for loans creating deposits.

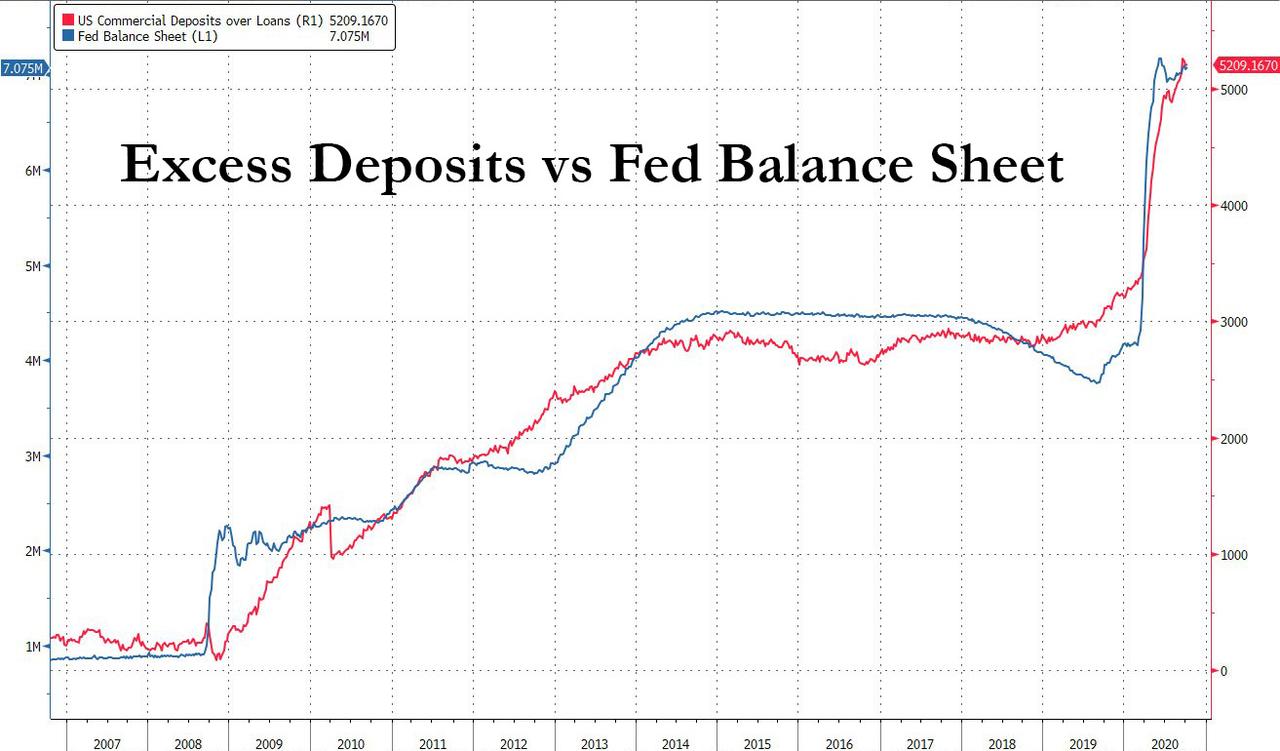

Of course, as can be clearly seen in the chart above where the breach between the red and green lines emerged when the Fed started QE, all this is happening exclusively due to the Fed, which had to step in with QE and create exogenous money of its own, as banks still refuse to “create” money from loans. the next chart of Excess Deposits within the US commercial bank system vs the Fed’s balance sheet, shows quite clearly just what is going on.

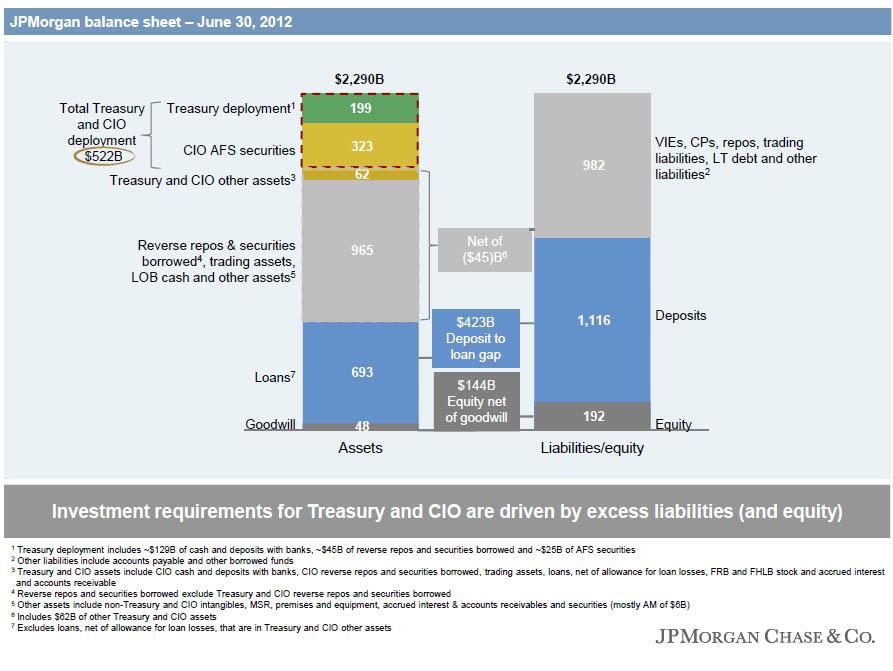

This also means that banks have had to allocate this excess capital somehow – as a reminder, it was precisely “excess deposits” that JPMorgan was using to fund its prop trading desk and corner various derivative markets courtesy of the London Whale traders, something we explained back in 2013.

Incidentally, the above also shows explicitly how the Fed’s reserves – which most still erroneously believe are inert for US Commercial Banks – end up being used to manipulate markets once they end up as excess deposits on bank balance sheets.

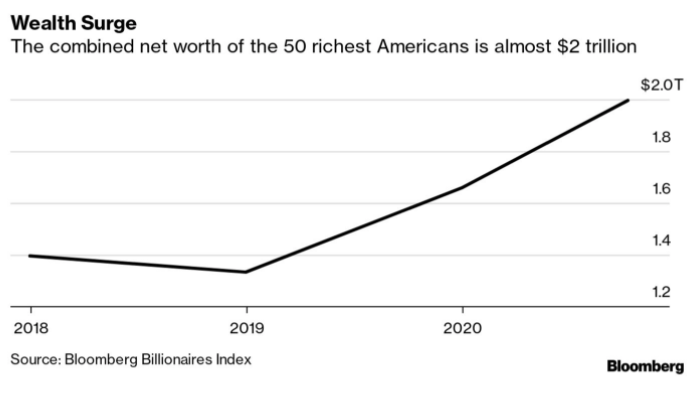

Another consequence is that risk assets continue to be bid up to record highs on the back of QE, even as the actual flow through of the Fed’s “wealth effect” to the economy is halted precisely due to the complete collapse in new loan creation – the primary “transmission mechanism” of economic growth.

In other words, by keeping the pedal to the metal on QE, the Fed is giving the banks all the benefits of money creation (soaring deposits), without any of the risks (loan creation in a record low Net Interest Margin environemnt). Any if you are a major US bank – say JPMorgan – you will be perfectly happy with this arrangement and not seek to lend out any money, as the case has been for the past 12 years. Which means consumers who wish to take out loans to fund ventures and other growth strategies are fresh out of luck, because the banks that ordinarily supply them with this risk capital have simply shut down the process as the latest Fed’s Senior Loan Officer Opinion Survey showed.

And that is precisely the crux of all that is broken in the US financial system, and why the Fed’s QE is making things worse, not better, and is progressively destroying the wealth of the middle class, stunting any growth opportunities the US may have, and all the residual wealth is pumped into the hands of those benefiting solely from rising asset prices. The result: as we reported last week, the 50 Richest Americans Now Worth More Than Poorest 165 Million…

… and all thanks to the Fed.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com