S&P Futures Surge, Nasdaq, Treasuries Plunge On “Game-Changer” Moderna Covid Vaccine

Tyler Durden

Mon, 11/16/2020 – 07:31

Last night, when discussing the euphoric surge in Sunday markets, we said that the move is on expectations that the “Moderna covid vaccine may hit as early as tomorrow, and a favorable outcome would have a similar result to last Monday’s Pfizer surprise which sent the S&P as high as 3,668 before fading much of the losses.”

Well, we were right because just before 7am, Moderna picked up where Pfizer left off exactly one week ago last Monday, when the biotech company announced that Moderna’s Covid-19 vaccine was 94.5% effective in a preliminary analysis of a large late-stage clinical trial, or in other words even more effective than Pfizer’s vaccine which had shown 90% efficacy.

Analysis from more than 30,000 volunteers showed the vaccine prevented virtually all symptomatic cases of Covid-19, while only five participants who received two doses of the vaccine became sick, compared with 90 coronavirus cases in participants who received a placebo. The vaccine also appeared to be effective in preventing the most serious infections. “That for me is a game-changer,” Moderna CEO Stephane Bancel said, noting perhaps most importantly that the Moderna vaccine was stable at refrigerator temperatures for 30 days, much longer than a previously estimated seven days, and thus making it much easier to transport than the Pfizer vaccine.

The news sparked a buying frenzy not only in Moderna shares, which jumped over 10% to $100/share…

… but across markets, and with the Emini already trading as much as 1% higher on expectations of this news, it jumped to a session high of 3,637 on the MRNA news…

…. which however was about 30 points below the intraday all time high hit last Monday in response to the virtually identical Pfizer news.

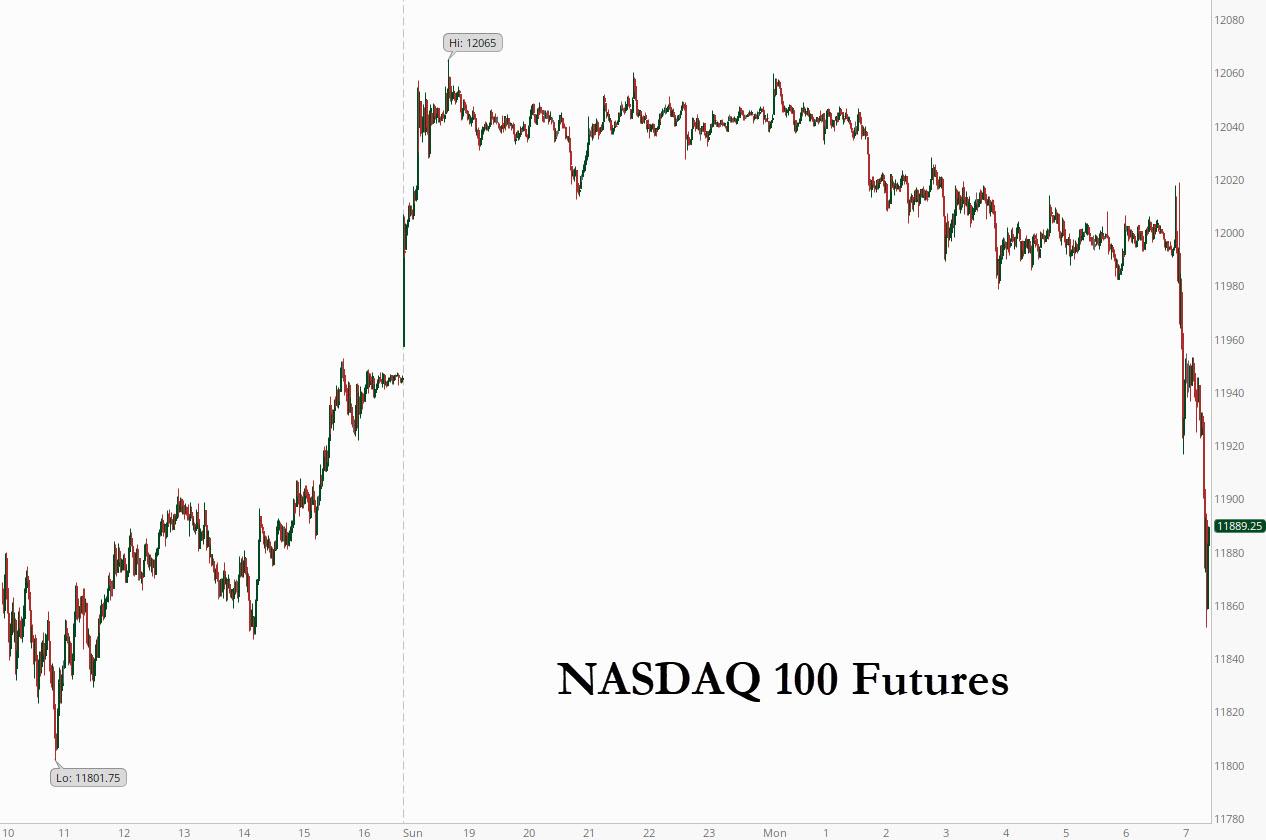

In another carbon copy of last Monday’s market reaction, as value stocks surged, tech and momentum tumbled, with Nasdaq plunging on the Moderna news after rising as much as 1% earlier in the session.

This prompted some – such as us – to ask if we are about to see another 15-sigma crash in momentum stocks, identical to what we observed last week.

Are we going to have another 15 sigma crash in momentum today

— zerohedge (@zerohedge) November 16, 2020

And with 10Y yields doing the Pfizer tango one week later, as rates spiked 5bps to 0.93% – which again was a deja vu of what happened one week ago. 10-year Treasury futures fell on heavy volume after the Moderna news. Futures volumes jumped with 51.1k 10- year note contracts trading over 3-minute period on move down to 137-29. Treasury 10-year yields flipped to cheaper on the day, rising as much as 2.8bp vs Friday’s close; curve steepens, widening 5s30s spread by ~2bp on the day.

At the same time, gold and PMs tumbled as the dollar jumped and as markets priced in, however briefly, a return to normalcy.

As Bloomberg notes, the vaccine news “adds yet another driver to global stocks after optimism last week spurred a rotation into value and cyclical sectors, and out of more defensive industries” while there was also some modest upside in risk after Joe Biden advisers said they opposed a nationwide shutdown despite surging virus cases.

“We do see a positive stream of news going forward,” Sean Fenton, chief investment officer at Sage Capital Pty in Sydney, said on Bloomberg TV. “The market looking forward towards eventual reopenings, real yields probably bottoming out, and cyclical and value stocks doing better, I think that’s a momentum that will be carried through at least over the next three to six months if not longer.”

One reason why the response to the news may not be quite as robust as last Monday, is that concerns about a sustainable economic recovery are persisting amid a flare-up in virus cases around the world. The pandemic continues to escalate in regions such as Europe and the U.S. American coronavirus cases have topped 11 million. Germany must live with “considerable restrictions” against the spread of Covid-19 for at least the next four to five months, its economy minister said.

While European stocks were already solidly in the green ahead of the Moderna news, share of European stocks whose businesses have benefited from lockdowns dip and vice versa for stocks that have been hammered from the pandemic. Shares in meal kit maker HelloFresh fall 5.2%, grocery- delivery firm Ocado -2.9% and online food delivery firm Just Eat Takeaway -2.6%. Online fashion retailers Zalando -2.9%, Asos -6.1%, while Polish e-commerce platform Allegro -3.7%. Payments firm Adyen -1.9%, while companies that have benefited from more people working from home, including mobile messaging firm Sinch, IT equipment provider Logitech, remote-access firm TeamViewer and call-center operator Teleperformance also drop.

Earlier in the session, and even before the Moderna news, the MSCI Asia Pacific index hit a new record close following the signing of the world’s largest regional trade agreement and solid sets of economic data from both Japan and China.

The Nikkei index rallied 2%, pushing it to the highest since 1991…

… while Korea’s Kospi hit its best intra-day level since 2018. Meanwhile, Australia’s stock exchange was hit by a software issue that forced it to close for most of Monday’s session.

In FX, according to BMO’s Stephen Gallo vaccine-related headlines will dominate the news cycle between now and year-end, with positive news supportive for risk appetite (so, by extension, USD negative). Yet while the dollar jumped initially in kneejerk reaction to the news, in FX the highlight was on commodity-linked currencies (NOK, NZD, RUB, BRL and MXN) which posted gains of 0.4% to 1.1%. The ADXY traded back above the 108.00 level, with the more ‘pro-cyclical’ currencies in the Index leading (TWD, IDR, KRW). Two or more daily closes north of 108.00 in the Index would reaffirm the near-term bullish environment for Asian currencies. The CNY strengthened 0.4% after PBOC adds 800 billion yuan of one-year MLF cash; Shanghai Composite index 0.8% higher.

As noted above, Treasuries tumbled just before 7am ET in response to the Moderna Covid-19 vaccine news. Yields erased what remained of their declines during Asia session and European morning. Treasury yields cheapened by nearly 4bp at long end with front- end yields anchored, steepening 2s10s by nearly 3bp, 5s30s by ~2bp; 10-year yields exceeded 0.92% vs last week’s high 0.973%. Futures volume surged on the vaccine news, with over 50k 10-year note contracts trading as price fell to 137-27+. IG credit issuance may be in focus during U.S. session after Saudi Aramco hired banks for a possible USD offering.

In commodities, LME copper spiked to the highest since June 2018; while gold initially rose to $1,895 before sliding to $1875 on the covid news. Brent and WTI both spiked on the covid news, with Brent last trading above $44/bbl.

Top Overnight News from Bloomberg

- The dollar fell versus almost all Group-of-10 currencies, with risk-sensitive Scandinavian and Antipodean currencies leading gains after stronger Chinese data and as Asia Pacific nations including China, Japan and South Korea on Sunday signed the world’s largest regional free-trade accord

- Sentiment was also buoyed after two of President-elect Joe Biden’s coronavirus advisers said they favor targeted local measures to stem the pandemic and oppose a nationwide U.S. lockdown as too blunt

- The euro swung versus the greenback, reaching a high of $1.1869 before paring its advance; one-month implied volatility in the euro rebounds as traders focus on the ECB meeting next month

- The pound erased an early advance; the gains had been fueled as investors took an optimistic view on Brexit negotiations, with U.K. hinting on Sunday that talks could stretch out beyond this week

- The Chinese yuan extended its surge over the past six months after a slew of economic data showed the nation’s economic rebound gathered pace in October, and as the central bank eased policy

- Australian and New Zealand dollars rose a second day versus the greenback; Australian central bank chief Philip Lowe said generating sufficient employment will probably be more of a challenge for his nation than containing inflation in the years to come

A quick look at global markets courtesy of NewsSquawk (this is prior to the Moderna news).

Asian bourses kickstarted the week on the front foot and US equity futures extended on last Friday’s gains on Wall St, where all major US bourses notched respectable gains and the S&P 500 posted a fresh record close with the upside led by the resurgence in cyclicals. ASX 200 (+1.2%) and Nikkei 225 (+2.0%) were positive as energy and financials in Australia mirrored the recent outperformance of the sectors stateside but with markets halted in the ASX within the first hour of trade due to a data-related issue, while the Japanese benchmark extended on its best levels in nearly 3 decades after stronger than expected GDP data for Q3 which showed the widest expansion in the economy since comparable data was available in 1980. Furthermore, the region was also boosted by the recent signing of the Regional Comprehensive Economic Partnership (RCEP) trade pact involving 15 countries for the world’s largest trade bloc with members accounting for nearly a third of the global population and around 30% of global GDP, while the latest Chinese activity data added to the tailwinds after Industrial Production topped estimates and although Retail Sales missed, it still showed an improvement in growth from the prior month. Hang Seng (+0.9%) and Shanghai Comp. (+1.1%) were supported by the data and PBoC announcement of a CNY 800bln 1-year Medium-term Lending Facility operation, but with gains capped on uncertainty as reports suggested US President Trump plans a last-minute crackdown on China and will enact a series of hard-line policies in his final weeks. The announcement of a rejig to the Hang Seng Index also provided a catalyst for price action with the index to be increased to 52 constituents from the current 50 which saw Anta Sports, Budweiser APAC and Meituan Dianping benefit from their inclusion to the index and Swire Pacific shares suffered on their expulsion, effective December 7th. Finally, 10yr JGBs were flat amid similar uneventful trade in T-notes and with prices hampered by the broad appetite for riskier assets, as well as weaker demand at the enhanced liquidity auction for longer-dated JGBs.

Top Asian News

- Budweiser, Anta, Meituan Rise After Hang Seng Index Inclusion

- China’s Big Coal Gets Lift With Winter Seen Boosting Consumption

- First Man Charged Under Hong Kong Security Law Pleads Not Guilty

Major European bourses trade mostly higher (Euro Stoxx 50 +0.8%) after picking up the bullish APAC baton, as the resurgence of State-side and APAC cyclicals reverberated into the region at the cash open – although in recent trade, the growth to value rotation seems to have garnered some traction (ahead of Moderna’s COVID-19 vaccine update this week) following the pause at the back-end of last week, with ES (+0.8%) and RTY (+1.1%) overtaking the NQ (+0.6%) which briefly gave up its 12,000 status. This has also become evident in European sectors, with Banks, Basic Resource, Travel & Leisure, Autos, Oil & Gas topping the charts, whilst Healthcare, Consumer Staples and Utilities lag and Tech inching lower towards the bottom of the spectrum after a firm open. The banking sectors has also been bolstered by BBVA (+15%) whose shares sky-rocketed some 20% at the open amid reports PNC is in advanced discussions regarding the acquisition of BBVA’s US operations in a USD 11bln transaction, subsequently underpinning the IBEX 35 (+2.0%). Meanwhile, the sub-par performance in Healthcare keeps the SMI (-0.1%) underwater. Elsewhere, Vodafone (+3.4%) holds onto gains despite overall downbeat earnings as the group is reportedly looking to raise USD 5bln in an IPO of their towers unit next year, according to sources.

Top European News

- Johnson Is Forced to Isolate as He Starts U.K. Relaunch Week

- Carlyle Said to Weigh Sale of Dutch Lingerie Brand Hunkemoller

- Biggest Swedish Bank Chases U.K. Growth Despite Brexit Risks

In FX, nowhere near as pronounced as last Monday when the Pfizer/BioNTech results broke and really boosted sentiment, but nevertheless the risk environment is positive. Hence, the DXY is choppy around 92.500, with last week’s low (92.129) the only real ‘support’ ahead of 92.000 unless the market mood changes dramatically. Ahead, only NY Fed manufacturing before a couple of Fed speakers on a relatively quiet start to the week in terms of scheduled data and events.

- NZD/AUD/NOK – The main beneficiaries of risk appetite as the Kiwi eyes 0.6900 and Aussie retests 0.7300 in wake of upbeat comments from RBA Governor Lowe on the economy that could rebound rapidly on more good news regarding the recovery from latest COVID-19 outbreaks and in advance of a speech from Kent tonight. Meanwhile, the Norwegian Crown is riding on the crest of firmer oil prices along with the trade balance returning to surplus from deficit, as Eur/Nok retreats through 10.8000.

- EUR/CAD/JPY/GBP/CHF – Also firmer vs their US counterpart, with the Euro probing 1.1850 and untethered by option expiries, the Loonie firming beyond 1.3100 against the backdrop of rising crude and awaiting Canadian manufacturing sales, while the Yen pivots 104.50 following firmer than forecast Japanese Q3 GDP. Elsewhere, the Pound straddles 1.3200 ahead of the next round of Brexit trade talks as EU diplomats note progress in drafting a legal text, but still no mutually acceptable solutions on the key sticking points (fisheries, governance and level playing field) and the Franc is lagging near 0.9100 as Swiss sight deposits reveal a hefty increase in domestic bank balances.

- EM – Broad gains vs the Dollar, as the Cnh extends off a firmer PBoC Cny midpoint fix amidst somewhat mixed Chinese data and a 12 month MLF injection to compliment Sunday’s RCEP. However, the Try has lost recovery momentum in the run up to Thursday’s CBRT policy meeting after reports that Turkey has submitted a Presidential motion to send troops to Azerbaijan.

In commodities, WTI and Brent front-month futures see respectable gains in early European hours as prices drifted higher in APAC trade on account of the overall risk-positive sentiment across markets, and ahead of the key JMMC meeting tomorrow which will lay the groundwork for the all-important OPEC/OPEC+ meeting at month-end. The committee (composed of Saudi, Russia, Iraq, UAE, Kuwait, Nigeria, Algeria, Venezuela and Kazakhstan) will track compliance among members and review secondary source data alongside current market fundamentals before proposing policy recommendations – thus no policy decision will be taken at this meeting. Consensus prior the Pfizer/BioNTech COVID-19 vaccine update was tilted towards OPEC+ extending current production levels through Q1 2021 vs. an output cut rollback to 5.7mln BPD from 7.7mln BPD in January under the pact. However, there has also been chatter of deeper output curbs, with recent sources noting that talks between OPEC and allies are closing in on a delay of three-to-six months, whilst deeper cuts have not garnered supported so far from other members – with unanimous consent needed for any revision to the pact. Note: today sees the Joint Technical Meeting (JTC) where a drip feed of early source reports cannot be dismissed. WTI Dec and Brent Jan have been waning off highs in recent trade after posting peaks at USD 41.24/bbl (vs. low 40.15/bbl) and 43.80/bbl (vs. low 42.71/bbl) respectively in a move coinciding with a pullback in sentiment. Elsewhere, spot gold and silver trade in lockstep with the Buck awaiting the next fundamental catalyst, with the former coming close to the USD 1900/oz in APAC trade, whilst the latter meanders on either side of USD 25/oz. Meanwhile, LME copper coattails on the APAC outperformance in the red metal, with prices getting a boost by the stronger than expected Chinese Industrial Production data and softer Dollar.

US Event Calendar

- 8:30am: Empire Manufacturing, est. 13.8, prior 10.5

- 1:45pm: Fed’s Daly Discusses Building a More Inclusive Economy

- 2pm: Fed’s Clarida Discusses the Economic Outlook

DB’s Jim Reid concludes the overnight wrap

At around 8am we’ll release the results of our monthly market sentiment survey conducted from November 11-13 covering around 575 market professionals across the world. Thanks for all the responses. Although responders were not convinced last week’s vaccine news would bring a much quicker return to normal (slightly quicker at 53% being the top response), we did see views on equities markets reaching their most positive in the 13-month life of our survey. It was a similar story for US rates with the most bearish responses since we started asking about their directionality. A sign of confidence or a warning sign on positioning? Lots more in the full report including how many of our readers have had a positive Covid-19 test.

On paper it doesn’t look like the busiest week ahead after a hectic last two. However, markets will be on high alert for any further vaccine news, especially efficacy data from Moderna and AstraZeneca even if we don’t know the exact timings. We could also hear that the Pfizer/BioNTech vaccine will get FDA emergency use approval later in the week. So one to watch.

Ahead of that, risk assets in Asia have got the week off to a very positive start, with the Nikkei (+2.01%), the KOSPI (+2.05%), the Hang Seng (+0.41%) and the Shanghai Comp (+0.82%) all seeing sizeable advances. The moves come on the back of the signing of the Regional Comprehensive Economic Partnership (RCEP), which is the world’s largest regional free-trade agreement, and covers 15 nations including China, Japan, South Korea, Australia, New Zealand and the 10 ASEAN countries. In total, it includes nearly a third of the global population and economic output, though India isn’t included following its withdrawal from the talks last year. There were also positive signs regarding China’s economic recovery, with October industrial production up +6.9% year-on-year (vs. +6.7% expected). And though retail sales came in slightly below expectations, with a +4.3% year-on-year increase (vs. +5.0% expected), that’s still the fastest annual increase seen this year.

It’s a similar story in the US, where S&P 500 futures are up +0.87%, and follows the index reaching an all-time closing high on Friday. One factor that might be supporting US equities are that two of President-elect Biden’s advisers on the coronavirus said that they were against a nationwide lockdown for the US, in spite of rising case growth across the country. Elsewhere over the weekend, there were a number of further developments on the pandemic, including a report from Reuters, which said that Germany was considering tougher measures, according to a draft document they’d seen, which included people being asked to abstain from private parties until Christmas. Meanwhile, UK Prime Minister Johnson was forced to self-isolate after coming into contact with another MP who tested positive.

Staying on the UK, the Brexit negotiations with the EU will continue to be in focus this week as the two sides continue discussions in Brussels on their future relationship. There will be added intrigue as towards the end of last week PM Johnson saw a number of senior advisors (including his chief adviser Dominic Cummings) pushed out of their positions. With a number of the original Brexit advisors on the Leave campaign having now been sidelined, we’ll see if that makes a difference to the direction of talks. However, the UK’s chief negotiator, David Frost, tweeted over the weekend that “We are working to get a deal, but the only one that’s possible is one that is compatible with our sovereignty and takes back control of our laws, our trade, and our waters. That has been our consistent position from the start and I will not be changing it.” So no obvious signs of any softening in the UK stance.

Time is running out before the year-end deadline when the transition period concludes and the UK will no longer be part of the EU’s single market and customs union. We’ve passed all the earlier informal deadlines now, so we’re running into overtime but the two sides are still talking and it’s not totally impossible this gets stretched into early December. However, any agreement document is expected to be several hundred legal pages long and needs to be translated into around 23 languages and then get ratified around Europe. So a logistical challenge. This week is yet another important one though, as EU leaders will be meeting via videoconference on Thursday, so a chance to get up to speed on progress.

On the data side, the US will release an increasing amount of hard data for October this week, including retail sales, industrial production (both tomorrow), housing starts and building permits (Wednesday). The more timely weekly initial jobless claims on Thursday will also be watched, having fallen to a post-pandemic low of 709k in the most recent data for the week through November 7.

From central banks, we’ll hear from a number of speakers including ECB President Lagarde (today), Bank of England Governor Bailey (tomorrow) and Fed Vice Chair Clarida (today). The main policy decisions will be coming from emerging markets, however, including the Central Bank of Turkey, the South African Reserve Bank and Bank Indonesia, who are all announcing their decisions on Thursday.

Lastly, earnings season is nearly over, with around 90% of the S&P 500 companies having reported now. Around 84% have reported a positive surprise on earnings and 72% have reported a positive surprise on sales. The coming week sees a further 12 S&P 500 companies report, along with a further 31 from the STOXX 600. Among the highlights are Vodafone today, before we get Walmart, Home Depot, Experian and EasyJet tomorrow. Then on Wednesday, reports include Nvidia, Lowe’s, Target and TJX, before Thursday sees Intuit report.

Recapping the week just gone, the agenda was dominated by the news that Pfizer’s Covid-19 vaccine was found to have a 90% efficacy rate in an initial reading of its late-stage trial with nearly 44,000 participants. The company indicated that they can produce up to 50m doses this year and up to 1.3bn doses next year. Markets reacted strongly to the news as the S&P 500 rallied +2.16% on the week (+1.36% Friday), while the VIX fell another -1.8pts to 23.1, its lowest level since August.

This led to a strong rotation into cyclicals stocks as the vaccine news gave renewed hope of an economic rebound. While the NASDAQ fell back -0.55% (+1.02% Friday), bank stocks on both sides of the Atlantic rallied in particular as yields rose, with US banks up +10.99% while European Banks climbed +20.01%. Similarly, European equities outperformed given the STOXX 600’s greater concentration of cyclical stocks. The STOXX 600 ended the week +5.13% higher (+0.01% Friday) while the FTSE MIB (+6.21%), CAC 40 (+8.45%), and IBEX (+13.29%) all gained sharply.

Sovereign bonds sold off as the vaccine news saw yields bounce to near pandemic highs. US 10yr Treasury yields rose +7.8bps (+1.5bps Friday) to finish at 0.896% as 10yr Gilt yields rose +6.4bps (-1.0bps Friday) to 0.34%, while 10yr Bund yields were up +7.4bps (-1.1bps Friday) to -0.55%. Yield curves also steepened on the vaccine news, with the US 2s10s curve reaching its steepest level since February 2018 on Tuesday. The curve has now steepened 5 of the last 7 weeks.

Elsewhere, the improving sentiment saw credit spreads in the US and Europe tighten on the week. US HY cash spreads were -14bps tighter, while European HY cash spreads tightened -31bps. IG saw US cash spreads -2bps tighter and -5bps in Europe. With risk sentiment improving, safe havens being sold, and rates moving higher, gold fell -3.18%, its worst week since the end of September. Elsewhere in commodities, WTI (+8.05%) and Brent crude (+8.44%) rose sharply as global demand forecasts improved with the vaccine hopes.

In terms of data from Friday, the second release of the Euro Area’s Q3 GDP showed the region’s economy growing +12.6% (vs. +12.7% first estimate) while year-over-year growth is now down -4.4%. This quarter will inevitably bring a second dip given increased restrictions. Meanwhile in the US, the October PPI reading showed prices slowing with PPI-ex food and energy rising +0.1% month-over-month (+0.2% expected), this was the smallest gain since June and down from +0.4%. On a yearly basis, core PPI rose +1.1%, just slightly lower than last month’s +1.2% reading. Lastly, the preliminary November reading of the University of Michigan’s consumer sentiment index fell unexpectedly to 77.0 (vs 82.0 expected) from last month’s 81.8. Following the US election, there was a significant negative shift in Republicans’ expectations with very little gain among Democrats.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com