Not All Hedge Funds Had A Dismal Year: Coatue Is Up 53%, Balyasny Gains 30% As Some Veterans Flourish

Tyler Durden

Thu, 12/03/2020 – 18:44

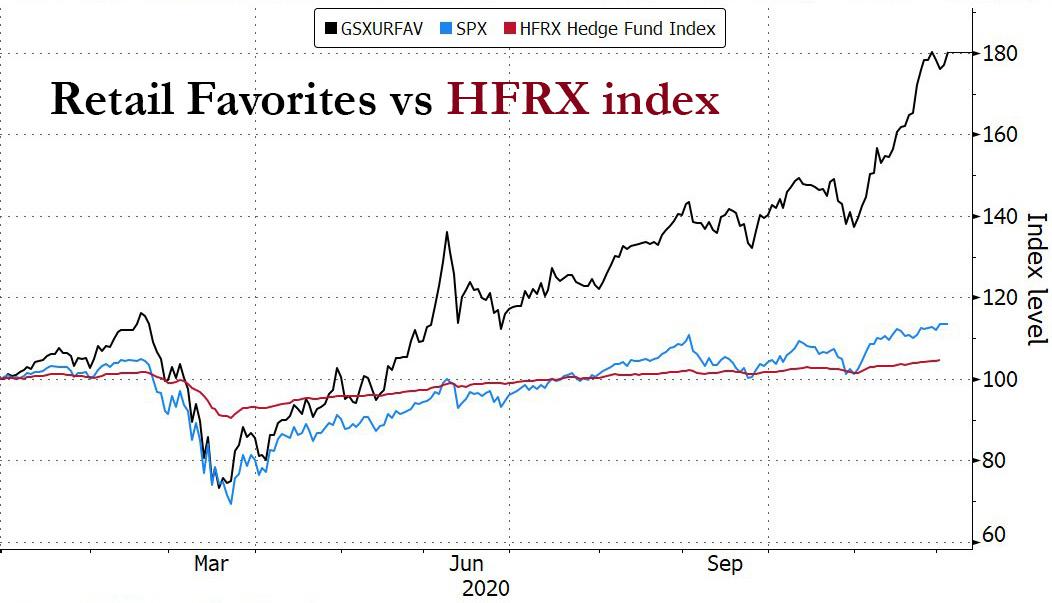

By now it is well-known that most hedge funds have a dismal 2020, outperformed not only by the S&P500 but also by retail investors, whose basket of 50 favorite stocks is up 80% YTD, versus the HFRX hedge fund index which is barely green on the year.

Of course, that doesn’t mean that every hedge fund had a terrible year, in fact as Bloomberg notes, some of the industry’s marquee names are proving why they deserve 2 and 20, racking up double-digit returns this year.

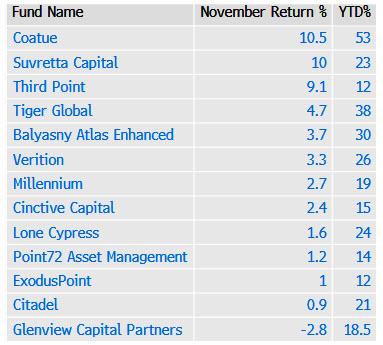

One fund racking up impressive YTD returns is Balyasny Asset Management is up 30% through the end of November, beating most of its multi-stra, pod-based peers. Citadel’s Wellington fund was also up in the double digits, returning a solid 21.2%, including a gain of 0.9% last month. The fund saw positive returns for both periods across its core strategies: equities, fixed income macro, credit, commodities and quant.

Some other equity-focused funds with stellar (at least in the context of the generally dismal industry) returns in 2020 are Lone Pine Capital whose Lone Cypress flagship fund is up 24%. Lone Pine’s long-only Lone Cascade fund was in line with the broader market last month, gaining 11% and bringing returns for 2020 to 39%, people said. Lone Pine benefited from a bullish bet on Shopify which was the firm’s largest publicly disclosed long wager as of Sept. 30. The stock is up almost 170% this year as online shopping surges in the pandemic.

One of the year’s best performers is

‘s Coatue Management which is up more than 50% thanks to its long position in Tesla – the hedge fund held 3.1 million shares at the end of the third quarter, which would now be worth $1.3bn – as well as its Wirecard short, the fraudulent German payments group, making it one of the best-performing big hedge funds in the world in 2020. Coatue also benefited from its investments in PayPal which is up nearly 100 per cent this year, and in the video conferencing business Zoom as well as solar-panel maker Sunrun, which also appear in its recent regulatory disclosures. Meanwhile, a large stake in Disney has been a drag on its performance.

As the FT reports, in a rare appearance at an industry conference in 2018, Laffont – who is one of the most prominent “Tiger cubs” or investors who learned the tools of the trade under Julian Robertson’s hedge fund Tiger Management – said: “I truly believe that in every portfolio you need to ask yourself what is going to be more relevant five to 10 years versus today.

“The most interesting trend is that technology, which used to be mostly software and semiconductors and obscure things, it’s coming everywhere, it’s the future of cars and the future of transportation and every sector.”

In addition to its flagship hedge fund, Coatue manages other investment vehicles in areas such as private equity and venture capital, and its overall assets under management are $25bn.

Coatue’s main fund which manages more than $11 billion returned 53% net of fees through the end of November, the FT and Bloomberg reported.

These funds are largely outliers: the average hedge fund lost 4.5% in the year up to the end of October, according to HFR, and equity-focused hedge funds have only returned 3%, dramatically underperforming stock markets which are up more than 10%. Even tech-focused hedge funds, which have enjoyed a solid year, have returned about 17%, according to HFR, less than half the YTD return of the Nasdaq which doesn’t charge any fees.

As a result of another year of dismal performance, the hedge fund industry suffered net investor redemptions of more than $100bn in the first 10 months of the year, according to Eurekahedge, a data provider, about half of which was yanked out of long-short funds.

A list of some other outperformers is below:

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com