Airbnb Joins DoorDash By Boosting IPO Price Amid Year-End Deal Frenzy

Tyler Durden

Mon, 12/07/2020 – 06:08

As tourism and hospitality-related industries tumble into bankruptcy one after the other as the government money runs out and revenues dry up thanks to the pandemic, Airbnb – the sharing economy pioneer that has managed to shift its focus to offering ‘staycation’-type arrangements for high-strung professionals looking to take a little break from city life – is reportedly raising its IPO price range by more than $10, the latest sign of just how unabashedly frothy markets are heading into the close of a year without equal in modern history.

According to media reports, Airbnb is boosting its price range to between $56 and $60 a share, from $44 to $50. The new range would give the vacation rental company a valuation of as much as $42 billion on a fully diluted basis (including proceeds from the offering).

DoorDash, the food delivery stalwart that’s expected to go public on Wednesday (one day before Airbnb), revealed late last week that it had also raised its IPO price in anticipation of excessive demand.At the top of the current range, Airbnb could be worht as much as $42BN, while DoorDash could be worth as much as $36BN.

Even with the global economy partially shut down, deal flow has continued at a breakneck pace in 2020 as the new ‘SPAC’ craze, which has helped to raise billions of dollars. Moreover, so far this year, more than $140BN has been raised in via IPOs on US exchanges, a number that far exceeds the previous full-year record high set at the height of the dot-com boom in 1999, according to Dealogic data that dates back to 1995.

According to WSJ, these price hikes for some of the year’s hottest IPOs are just a sign that a gangbusters year for deals is going out with a bang, even though December is typically a quiet time in the IPO market. With COVID making the traditional IPO ‘roadshow’ unworkable, investment bankers have been marketing their offerings to mutual funds, hedge funds and other clients via Zoom meetings, rather than the typical cross-country tour.

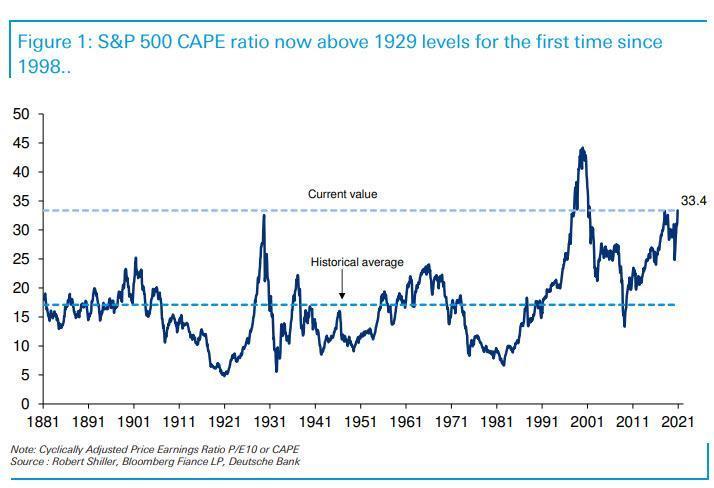

In addition to the intense deal flow that is expected to keep investment banking analysts busy through the Christmas holiday, US equity valuations haven’t been this stretched since 1929 (per Professor Robert Shiller’s CAPE ratio).

As November’s payrolls report reminds America just how dire the economic situation truly is, we must ask: what’s wrong with this picture?

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com