2020 Default Tsunami: Pandemic Sparks Most US Bankruptcies Since 2009

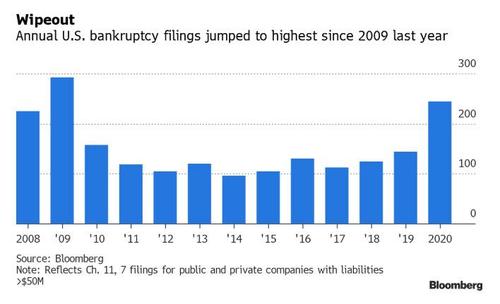

While it will hardly come as a surprise to anyone, at least the data is now official: more large US companies filed for bankruptcy in 2020 than in any year since the global financial crisis, after the covid pandemic locked down the US economy and tipped swaths of the economy into distress. The hardest hit sectors were energy, retail and consumer services, with a total of 244 bankruptcy filings according to data compiled by Bloomberg. That was the most since 2009, when 293 U.S. companies sought protection from creditors.

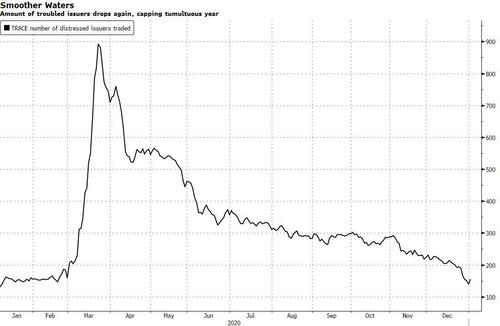

The flipside is that since the March crash, when capital markets froze, credit markets have rallied, lifting many borrowers out of distress, and yet bankruptcy experts predict another wave of filings that could start in the second quarter of 2021 as the stimulus cash runs out. Energy, retail, consumer and travel companies remain especially vulnerable – even after vaccines are distributed – following lasting damage inflicted by the virus.

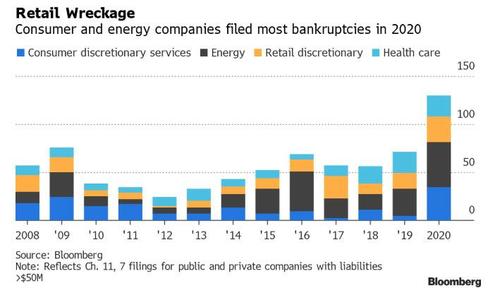

Digging into the data we find that the 27 bankruptcy filings from retailers marked the worst run for that sector since at least 2008, according to Bloomberg data. Such retail icons as JCPenney and Stein Mart fell into bankruptcy court protection as the pandemic raged, as did higher-end names like Brooks Brothers Group Inc. and Neiman Marcus Group.

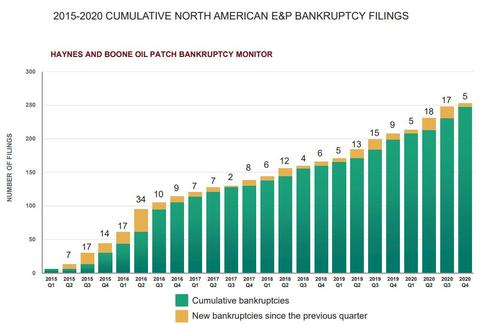

Additionally, at least 47 energy companies with liabilities of at least $50 million went bankrupt last year, the most since at least 2008. The turmoil began in earnest in April, when oil prices plunged and futures briefly traded below zero, derailing planned ongoing restructurings and kick-starting new ones.

Health-care companies were also hit hard, with 22 large firms seeking court protection. Hospital systems including Quorum Health Corp. and Thomas Health System Inc. went bankrupt, as the pandemic punished an already-struggling industry.

That said, after an early burst of defaults following the shutdowns, the year ended relatively slowly, with just 45 big corporate bankruptcies across all sectors since Oct. 1 — the slowest quarter of 2020 largely thanks to the massive fiscal stimulus package which eventually “trickled down.” Even so, that still marked the busiest last three months of any year since 2009.

What is more concerning, is that this may be just the eye of the hurricane for bankruptcy filings: as Bloomberg reports, more bankruptcy filings are expected this year as struggling retail firms including gyms and movie theaters finally succumb, according to Andrew Little, research analyst at Global X, a New York-based provider of global exchange-traded funds. Last year’s filings included 24 Hour Fitness Worldwide Inc., Town Sports International Holdings Inc. and VIP Cinema Holdings Inc.

“We are having multiple years of disruption in the retail sector occur within months,” Little said in an interview. “E-commerce is here to stay, we will continue to see expansion and continue to see it capture retail sales.”

Another sector that showed major cracks was real estate, with 22 large firms filing for bankruptcy, the most since 2011. Bankruptcy courts witnessed a double-whammy in November when mall landlords CBL & Associates and Pennsylvania Real Estate Investment Trust filed for bankruptcy within hours of each other.

According to Cynthia Romano, global director of CohnReznick’s restructuring and dispute resolution practice, the real estate pain is also expected to spread as landlord concessions like rent abatements run out in 2021.

Ironically, as fundamentals deteriorate, prices rise: according to Bloomberg calculations, the total amount of traded distressed bonds and loans shrank to about $149 billion as of Dec. 31, down 8.3% week-on-week and a fraction of the $935 billion peak in March.

Troubled bonds and loans declined 7.7% and 10%, respectively, in the last week of the year. There were 290 distressed bonds from 154 issuers trading as of Monday, down from 377 and 199, respectively, two weeks ago. That’s significantly less than the 1,896 credits from 892 companies at the March 23 high.

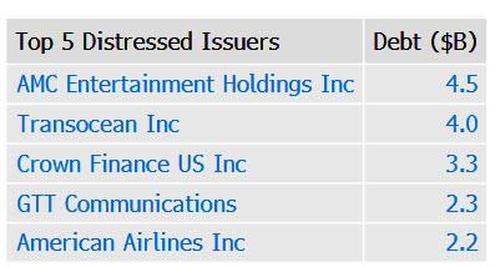

According to Bloomberg, theater chain AMC Entertainment had the most distressed debt of issuers that hadn’t filed for bankruptcy as of Dec. 31. That will likely change soon.

Looking ahead, several distressed companies have potentially significant dates approaching. Peabody Energy Corp. has an early tender deadline on Jan. 8, Community Health Systems Inc. wraps up a tender offer Jan. 11, while Party City Holdco Inc. has a bond payment due Jan. 15.

Tyler Durden

Tue, 01/05/2021 – 12:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com