Crypto & Small Caps Surge, Dollar Shrugs Ahead Of Biden’s Budget Bonanza

When the headline hit last night – from a Biden aide – that Biden’s stimulus spendfest was $2 trillion (or some suggested $3 trillion), markets lurched – bond yields spiked, small caps surged, tech tumbled, the dollar rallied, gold dumped, and crypto rebounded further.

By the end of the day session, gold and the dollar had retraced their moves while stocks, bonds, and crypto extended their trend.

Then late on stocks took a brief dive after NYTimes dropped a headline outlining Biden’s $1.9 trillion stimulus plan…

One thing that markets may not like is that contrary to previous expectations that the “stimmy” check will be $2,000, Biden will instead propose additional $1,400 stimulus checks, “topping up the $600 checks that Congress approved in December.”

Which apparently disappointed stocks… Still, the US equity markets massively diverged with Small Caps exploding higher as Big-Tech and the Dow and S&P drifted down, accelerating late on…

Today was the biggest short-squeeze since April 2020!!

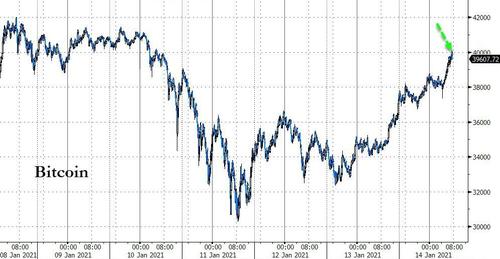

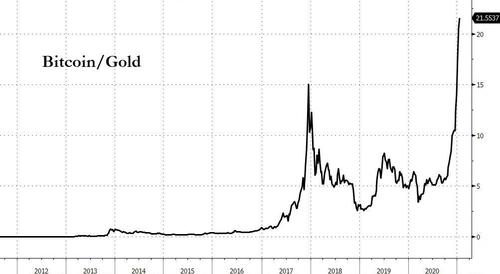

Bitcoin pushed back up above $40,000 as perhaps the cleanest signal left of the inflationary impulse…

Source: Bloomberg

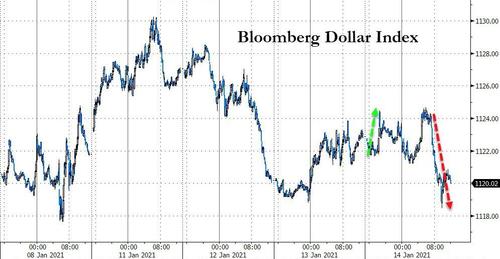

The dollar reversed hard and ended down…

Source: Bloomberg

And while gold ended lower it bounced hard off the spike lows overnight…

As, we suspect the world is coming to recognize that the Treasury/Fed axis is “meddling with the primary force of nature… money!!”

The Russell 2000 / Nasdaq 100 ratio soared to their highest since early March…

Small Caps are now up almost 10% YTD with Nasdaq barely above unch…

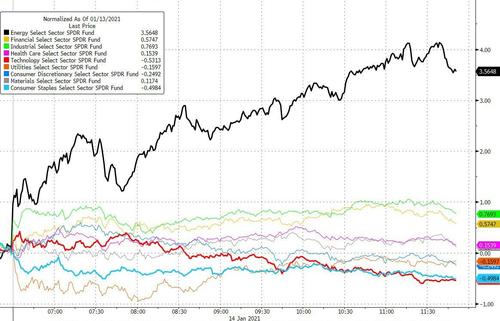

Energy stocks exploded higher once again today as Tech and Staples lagged…

Source: Bloomberg

Value was well bid as growth stocks were dumped…

Source: Bloomberg

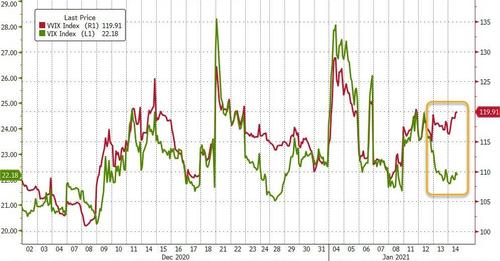

VIX remains awkwardly high relative to stocks…

Source: Bloomberg

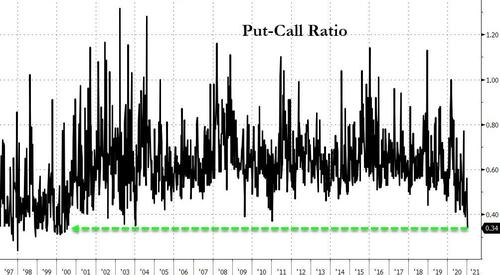

But with demand for calls so high (at 21 year highs relative to puts), this measure of ‘fear’ could have switched to a measure of ‘greed’ once again…

Source: Bloomberg

As we are seeing insane levels of call-buying in XLE and more idioyncratically XOM…

Source: Bloomberg

But vol of vol (VVIX) is notably decoupling…

Source: Bloomberg

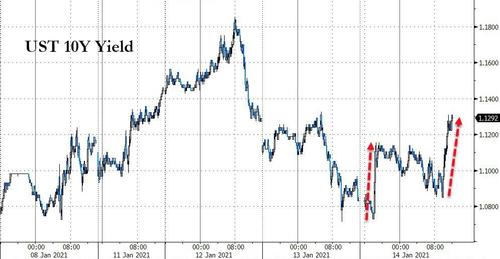

Treasury yields also extended their overnight spike on the reflation theme after Jay Powell failed to calm the taper rhetoric…pushing 30Y back to unch on the week…

Source: Bloomberg

10Y yields pushed back above 1.10%…

Source: Bloomberg

USTs are at their highest to Bunds in over 10 months and at a critical technical level…

Source: Bloomberg

Oil surged back above $53…

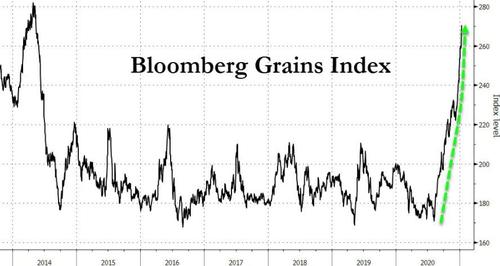

Grains continue to soar…

Source: Bloomberg

Today’s rebound in Bitcoin combined with gold’s recent relative weakness has sent the cryptocurrency to a record 21.5x the price of the precious metal…

Source: Bloomberg

And finally as US economic data continues to serially disappoint…

Source: Bloomberg

It has never been more expensive for the ‘average joe’ to buy stocks…

Source: Bloomberg

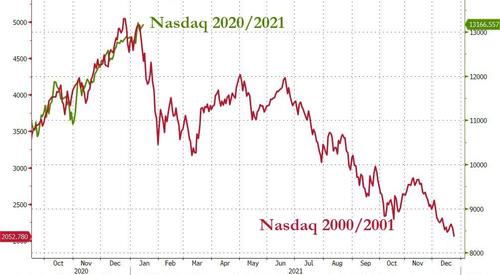

And the last time the put-call ratio collapsed to these levels of complacency… it did not end well…

Source: Bloomberg

Tyler Durden

Thu, 01/14/2021 – 16:01

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com