Home Prices Soar At 4.5 Times The Fed’s Inflation Target In All US Cities

The Fed’s most frequent lament is that no matter how many trillions in bonds (and stocks and ETFs) it buys or how much liquidity it forehoses into the market, it just can’t push inflation higher.

Well, here’s an idea: maybe all the central-planning megabrains at the Marriner Eccles building and 33 Liberty Street can take a break from whatever circle jerk they are engaged in right now, and look at the latest Case Shiller numbers which showed not only that home prices surged at the fastest pace in seven years, rising more than 9% compared to a year ago…

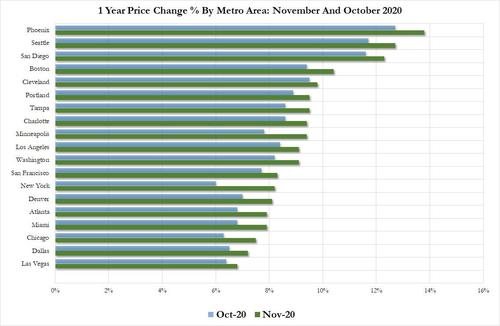

… but that for the first time since the financial crisis, the annual price increase in every major US MSA (and according to Case Shiller there are 20 of them) rose by at least 6.8% Y/Y (in the case of Las Vegas) and as much as 13.8% in Phoenix, meaning that the average home prices across all of the US is now rising at 4.5 times the Fed’s own inflation target, and even the cheapest US MSA is rising at more than 3 times the Fed’s inflation goal.

Why does this matter? Simple: Because if – as Joseph Carson mused last month – CPI measured actual house prices, inflation would be above 3% right now.

For those who missed it, here again is the explanation:

“Actual” consumer price inflation is rising during the recession. That runs counter to the normal recessionary pattern when the combination of weak demand and excess capacity works to lessen inflationary pressures.

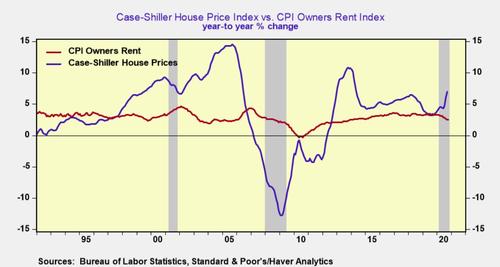

The main source of faster consumer price inflation is centered in the housing market. The Case-Shiller Home Price Index posted a 7% increase the last year, more than twice the gain of one-year ago.

The sharp acceleration in house price inflation represents the fastest increase since 2014 and runs counter to the patterns of the past two recessions. During the 2001 recession house price inflation slowed by one-third, while in the Great Financial Recession housing prices posted their largest decline in the post-war period, falling over 12% nationwide.

The consumer price index (CPI) does not show in house price inflation because it uses a non-market rent index to capture the trends in housing inflation. The Bureau of Labor Statistics (BLS) estimates that the non-market rent index has increased 2.5% in the past 12 months, or 450 basis points below the rise in house prices.

If actual house prices were used in place of rents core CPI would have registered a 3% gain in the past year, nearly twice the reported gain of 1.6%.

If aggregate price measures did not exist house prices would be one of the most important measures to gauge inflation and the proper setting of official interest rates. That’s because house price cycles include easy credit/financial conditions, excess demand, and inflation expectations, three key ingredients of inflation cycles.

Rising consumer price inflation is added to the list of unique features of the 2020 recession. Others include an increase in corporate debt levels instead of debt-liquidation and rising equity prices instead of share price declines.

If the 2020 recession has economic and financial features that normally appear during economic recovery what does that imply for the next growth cycle? The debt overhang at the corporate and federal debt should impede the next growth cycle. And if the cyclical rise in housing demand is occurring in recession it can’t be repeated during recovery.

The next economic cycle will be filled with unique tipping points, and no one should assume that policymakers can control or offset them.

Tyler Durden

Tue, 01/26/2021 – 11:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com