Make Standard Oil Great Again: Exxon, Chevron Have Discussed A Merger

Just this past Friday, we lamented that amid the marketwide meltup, one of the very few companies that actually deserves to be higher with or without the help of WSB, oil giant Exxon, simply refuses to do so, and so we begged Melvin Capital to short it (although it now appears that Gabe Plotkin is busy razing a 1930s house to build a tennis court on his Miami mansion).

Can Melvin Capital please short XOM

— zerohedge (@zerohedge) January 29, 2021

That was, of course a joke, but what isn’t a joke is that the two largest US oil companies clearly believe they are undervalued because as the WSJ reported on Sunday afternoon, the CEOs of Exxon and Chevron “spoke about combining the oil giants after the pandemic shook the world last year, according to people familiar with the talks, testing the waters for what could be one of the largest corporate mergers ever.”

The discussions – which took place after the plunge in oil prices last year – between the Exxon CEO Darren Woods and Cheveron CEO Mike Wirth, “were described as preliminary and aren’t ongoing but could come back in the future” according to the WSJ sources.

And with XOM’s market cap of $190BN and Chevron’s $164BN, a combination would result in a $350BN E&P behemoth, which would be the world’s second largest oil company by market capitalization and production, producing about 7 million barrels of oil and gas a day, based on pre-pandemic levels, second only in both measures to Saudi Aramco.

Such a deal would significantly surpass in size the mega-oil-mergers of the late 1990s and early 2000s, which included the combination of Exxon and Mobil and Chevron and Texaco Inc.

It also could be the largest corporate tie-up ever, depending on its structure. That distinction currently belongs to the roughly $181 billion purchase of German conglomerate Mannesmann AG by Vodafone AirTouch PLC in 2000, according to Dealogic.

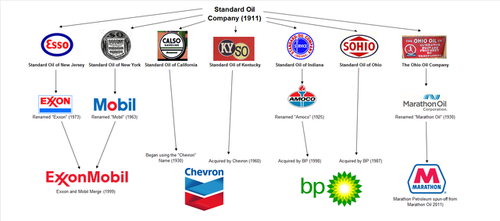

If it proceeds, a deal would also reunite the two largest descendants of John D. Rockefeller’s Standard Oil monopoly, which was broken up by U.S. regulators in 1911, and reshape the oil industry. In other words, if this deal happened, it would go a long way to making Standard Oil Great Again:

Which is also why such a merger would likely encounter regulatory and antitrust challenges under the Biden administration. President Biden has said climate change is one of the biggest crises the country faces. In October, he said he would push the country to “transition away from the oil industry” whatever that means (conventional energy is responsible for about 90% of US energy production); Still, a deal is not impossible: Biden hasn’t been as vocal about antitrust matters, and the administration has yet to nominate the Justice Department’s head of that division.

As the Journal adds, in an interview discussing Chevron’s earnings Friday, Wirth, who like his Exxon’s Woods also serves as his company’s board chairman, said that consolidation could make the industry more efficient. He was speaking generally and not about a possible Exxon-Chevron merger.

“As for larger scale things, it’s happened before,” Wirth said, referring to the 1990s and early-2000s megamergers. “Time will tell.”

It now appears that he was explicitly envisioning a merger with Exxon.

According to energy analyst Paul Sankey, who first floated the idea of a merger between Chevron and Exxon last October, a combined company would have a market capitalization of about $300 billion and $100 billion in debt. A merger would allow them to cut a combined $15 billion in administrative expenses and $10 billion in annual capital expenditures, he wrote.

As for the stock price of XOM and CVX, they certainly wouldn’t need a massive short squeeze to soar, which would be welcome news to the activists who have recently circled around Exxon.

Some investors have grown increasingly concerned about Exxon’s direction under Mr. Woods as the company faces a rapidly changing energy industry and growing global consciousness about climate change. Some are also worried that Exxon may have to cut its hefty dividend, which costs it about $15 billion annually, due to its high debt levels. Many individual investors count on the payments as a source of income.

The company’s woes have helped draw the attention of activist investors. One of them, Engine No. 1 LLC, has argued that the company should focus more on investments in clean energy while cutting costs elsewhere to preserve its dividend. The firm nominated four directors to Exxon’s board Wednesday and called for it to make strategic changes to its business plan. Last month it also emerged that Exxon had been in talks with activist hedge fund D.E. Shaw and is preparing to announce one or more new board members, additional spending cuts and investments in new technologies to help it reduce its carbon emissions.

Unlike virtue signaling European peers BP and Shell, both of which would love to be included in some ESG basket, Exxon and Chevron have had the intellectual honesty of staying the course and haven’t invested substantially in renewables, instead choosing to double down on oil and gas. Both companies have argued that the world will need vast amounts of fossil fuels for decades to come, and that they can capitalize on current underinvestment in oil production.

They are of course right, and after the next crash, when the faddish ESG idiocy is long forgotten, shareholders will reward the two companies handsomely for having been honest in a time when every company lies.

Tyler Durden

Sun, 01/31/2021 – 19:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com