The Semi Chip Shortage Is Turning Into A Crisis

For the better part of the last month we have been writing about how the shortage in semiconductors has wreaked havoc on the auto industry.

Now, it looks as though the shortage is going from being a nagging pain in the auto industry, to a full scale crisis that is also affecting consumer electronics like phones and gaming consoles.

It is now being referred to as the “most serious shortage in years”, with Qualcomm’s CEO saying last week that there were now shortages “across the board”, according to Bloomberg.

But it isn’t just Qualcomm executives speaking out: other industry leaders have warned in recent weeks that they are susceptible to the shortages. Apple said recently that its new high end iPhones were on hold due to a shortage of components. NXP Semiconductors has also warned that the problems are no longer just confined to the auto industry. Sony also said last week it may not be able to to fully meet demand for its new gaming console in 2021 due to the shortage. Companies like Lenovo have also been feeling the crunch.

Neil Mawston, an analyst with Strategy Analytics, said: “The virus pandemic, social distancing in factories, and soaring competition from tablets, laptops and electric cars are causing some of the toughest conditions for smartphone component supply in many years.”

Mawston says that prices for some smartphone components are up as much as 15% the last 6 months.

At the center of the shortage is Taiwan and its largest company Taiwan Semiconductor Manufacturing Co. The company now sits astride a larger political crisis between China and Taiwan while Biden officials in the U.S. work to find solutions, not only for the semiconductor issues, but for the larger conflict developing between the two nations.

To make matters worse, Huawei is being blamed for hoarding components in 2020 (almost as if they knew this was going to happen). This set off other manufacturers to do the same. According to the report:

Industry executives also blame excessive stockpiling, which began over the summer when Huawei Technologies Co. — a major smartphone and networking gear maker — began hoarding components to ensure its survival from crippling U.S. sanctions. Led by Huawei, Chinese imports of chips of all kinds climbed to almost $380 billion in 2020 –– making up almost a fifth of the country’s overall imports for the year.

Rivals including Apple, worried about their own caches, responded in kind. At the same time, the stay-at-home era spurred sales of home appliances from the costliest TVs to the lowliest air purifiers, all of which now come with smart, customized chips. TSMC executives said on its two most recent earnings calls that customers have been accumulating more inventory than normal to hedge against uncertainties, a maneuver they see persisting for some time.

“There’s a chip stockpiling arms race,” said Will Bright, co-founder and chief product officer at Drop. Analyst Mario Morales of IDC said: “A lot of it can be traced back to the second quarter of last year, when the whole world basically shut down. Many auto companies shut down manufacturing and their suppliers re-prioritized. Not until the second half will we see relief for some of these markets.

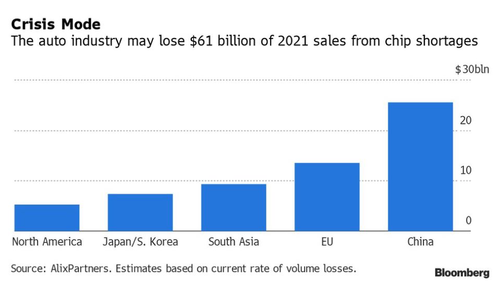

While the extent of the damage on consumer electronics remains to be seen, the shortages are expected to cost $61 billion worth of sales in the auto industry. Recall, we noted just days ago that GM and Ford had joined Nissan in cutting production due to the shortage.

Mid-day on Wednesday the U.S. automaker announced that the shortage would “impact production in 2021”, according to StreetInsider. The company said in a statement that “semiconductor supply for the global auto industry remains very fluid”.

It continued: “Our supply chain organization is working closely with our supply base to find solutions for our suppliers’ semiconductor requirements and to mitigate impacts on GM. Despite our mitigation efforts, the semiconductor shortage will impact GM production in 2021.”

The automaker said it is “currently assessing the overall impact, but our focus is to keep producing our most in-demand products – including full-size trucks and SUVs and Corvettes – for our customers.”

Nissan also announced Wednesday that it had fallen victim to the shortage. As a result, Nissan said it would suspend some truck production at its Mississippi plant due to the shortage of chips. Nissan is struggling to make “short term production adjustments”, according to Yahoo Finance, at its plants in North America.

The stoppage is starting with three non-production days at the Canton, Mississippi plant. Further delays could continue if the semi shortage continues to negatively affect business.

We also noted just hours ago that Ford had also announced it was making more production cuts and temporary layoffs at its Chicago Assembly Plant. The most recent round of layoffs is also being attributed to the supply chain disruptions in semiconductors, according to The Pantagraph.

Tyler Durden

Sun, 02/07/2021 – 21:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com