Goldman Tells Clients To Buy Exxon Calls Ahead Of Analyst Day

To think it was just two months ago that Goldman upgraded energy giant Exxon to Buy for the first time in four years (after having a Sell rating as recently as October).

In retrospect, this proved to be one of Goldman’s best recommendations in the recent past, and while the bank had since lifted its PT to $55, it also advised its clients to put on a call spread for some levered upside.

Well, no more. As of today, Goldman has closed its recommendation to buy XOM call spreads, and instead has gone balls to the wall bullish, by initiating a new recommendation to buy calls outright ahead of the Mar 3rd analyst day:

On Dec 15th, we recommended buying the XOM Apr-21 $45/$50 call spreads, driven by our bullish view ahead of multiple catalysts. On 20-Jan we rolled the recommendation to a higher strike at a gain. Today, with increased clarity on the company’s dividend payment, and solid earnings on 02-Feb, we recommend closing the call spreads at a gain, and buying the XOM Mar-21 $52.50 calls, recently offered at $2.56 (4.8%, stock $52.85).

Why is the upcoming analyst day a catalyst? Because according to Goldman, “XOM analyst days have historically been an important catalyst, with the stock averaging +/-1.6% on the day of the event, nearly in-line with the average earnings-day move in past years.” And with one month implied volatility declining 10 points since earnings, Goldman believes “option prices are low, and recommend investors buy calls ahead of the analyst day.”

For those who care more about the fundamentals, Goldman Energy analyst Neil Mehta is Buy rated on XOM, with his bullish near-term view driven by:

- Significant upside to 2021-22 Visible Alpha consensus earnings

- Outlook for improving oil prices, particularly relative to the forward curve

- Leverage to continued chemicals strength

- Improving natural gas price fundamentals

- A view that refined product demand will sharply accelerate as jet and road travel rebound

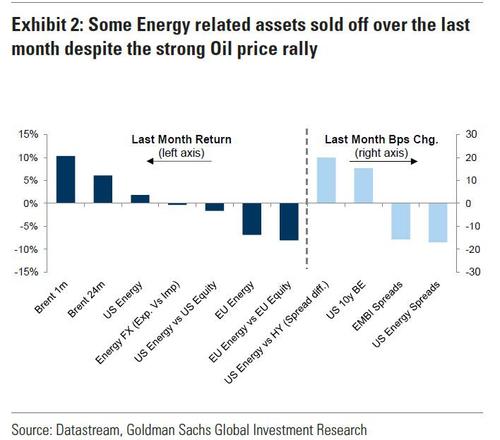

Yet while the biggest risk – the Exxon dividend – now appears safe, why has the stock failed to keep up with oil, and is still well below year-ago levels even as Brent has reversed all post-covid losses? As a reminder, this is a point we discussed earlier this week, when we showed that Goldman recommended adding energy equity exposure since the “US energy equity sector is almost unchanged since mid January” while oil has surged.

According to Goldman’s Neil, despite recent investor conversations highlighting improving sentiment around XOM and the sustainability of its dividends, mutual funds remain underweight the stock, potentially a bullish positioning indicator.

As a result, he too sees positive risk-reward heading into the March 3rd analyst day, where management is likely to discuss improving capital intensity, and defend the dividend. He also sees the event as an opportunity to unpack differentiated assets in their portfolio, particularly Guyana, Brazil and the chemicals portfolio.

Tyler Durden

Thu, 02/18/2021 – 21:56![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com