Morgan Stanley: This Cycle Will Burn “Hotter And Shorter” So Start Thinking About Rotating Out Of Early-Cycle Winners

By Andrew Sheets, Chief Cross-Asset Strategist for Morgan Stanley

A Shorter Cycle

Our experience informs our beliefs. The last four US economic expansions have been unusually long, ranked by the NBER as the first, second, third and sixth longest among 34 business cycles over the last 164 years. We think that the current cycle could burn hotter and shorter, with important implications for investment strategy.

This discussion needs to start with an obvious question: Is this even a ‘new’ cycle? COVID-19 brought the global economy to a sudden stop, while an aggressive policy response drove a rapid recovery. Some investors argue that both were so fast that conditions never ‘reset’ in the way they usually do during recessions.

All cycles have their quirks. The last three US recessions were adjacent to: 1) The largest equity bubble in history; 2) The largest financial crisis since the Great Depression; and 3) A global pandemic. If you’re looking for a ‘normal’ recession, good luck!

Surprisingly, as different as these three recessions were, they were all preceded by similar phenomena. All three saw an inverted yield curve within ~6 months before they started. All three followed a Fed hiking cycle and core CPI above 2.4%Y. All three were preceded by high consumer confidence, low unemployment and declining equity market breadth.

Those are an awful lot of similarities. And they carry through to the recovery. Since the lows of activity in April 2020, ‘normal’ early-cycle investment strategies have worked very well. Corporate default rates have been similar to other recessions when measured on a rolling two-year basis. If it walks like a new cycle and talks like a new cycle, we think that investors should treat it like a new cycle.

Yet while this cycle has so far followed many ‘normal’ patterns, its evolution could be unique. For several reasons, in the US and globally, this cycle could burn unusually hot.

-

The first is stimulus. The global economy is seeing record levels of fiscal and monetary stimulus at the same time. ‘Unprecedented’ is an overused word in our business, but this cycle qualifies and is unique among other post-recessionary periods.

-

The second is savings. Savings rates stand at historical highs in the US, Europe and China. While the distribution of these savings is uneven, they provide substantial fuel for consumption. Corporate cash balances are also elevated, a buffer against COVID-19 uncertainty that could find its way into spending as confidence returns.

-

Third is the labor market. Our economists note that the majority of recent job losses were in COVID-19-related sectors. If the economy can reopen safely, it seems reasonable that we could see an unusually fast labour normalization as these sectors come back.

-

Finally, there is the future path of policy. Global central banks are signalling a strong commitment to supporting growth and returning inflation to more normal levels. Governments are showing little desire to eventually raise taxes or cut spending. Both stances suggest a hotter cycle, less likely to be restrained by policy tightening than the previous expansions.

For all these reasons, our economists think that growth and inflation will exceed expectations over the next two years. But just like in the cosmos, what burns hotter may also burn shorter. Unlike the long expansions that defined the last 40 years, this one might look more similar to the late 1940s or 1950s.

Short cycles can still mean good growth and multi-year expansions. The Roaring Twenties saw recessions in 1920, 1923 and 1926 (and, of course, 1929). The US economy grew at an enviable 4% rate between 1947 and 1960, despite recessions in 1948, 1953, 1957 and 1960. Each expansion lasted at least three years.

But this does mean that investors need to be more nimble. Different investments work in different parts of the economic cycle. If this cycle burns hotter and shorter, we need to start thinking about rotating out of early-cycle winners.

Where should we look? US small-cap versus large-cap equities, copper versus gold and corporate credit are all strategies that we’ve liked given historically strong performance following recessions. But all do less well as the cycle extends. My colleague Michael Wilson recently downgraded US small caps (see US Equity Strategy: Weekly Warm-up: The Cycle vs Liquidity; Downgrading Small Caps; Earnings > Multiple, March 15, 2021), an example of how we are looking to exit some early-cycle strategies.

Sector and regional leadership can also vary significantly as the cycle progresses. Emerging market equities historically do best following a recession, but then lag. Stocks in Europe and Japan have done better as the economy matures.

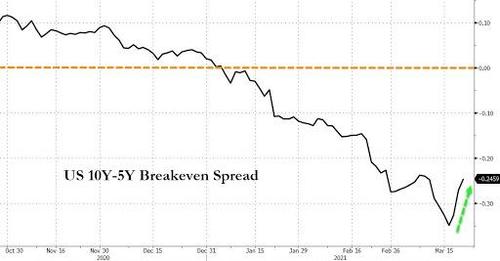

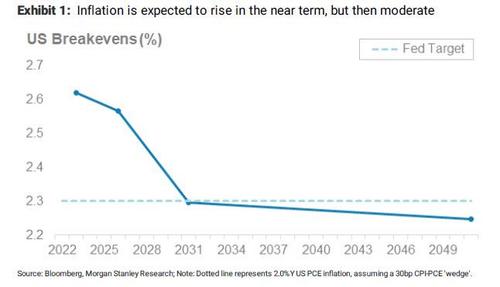

Will conditions run too hot? One metric I’m following closely is the US breakeven expectations curve. At the moment, it is reflecting a modest overshoot of inflation over the next 2-5 years…

… followed by lower levels of inflation thereafter. That would appear to be exactly what the Fed hopes to deliver, wrapped up neatly with a nice little bow.

As long as that curve remains inverted, the market is signalling that inflationary pressure will be transitory, and there is little need for central banks to sharply change tack. Maybe this is correct. Maybe it is an example of expectations being driven by recent experience. Either way, it’s an important dynamic to watch.

Tyler Durden

Sun, 03/21/2021 – 19:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com