Average Wall Street Bonus Rises 10% To $184,000 Thanks To 2020 Recession

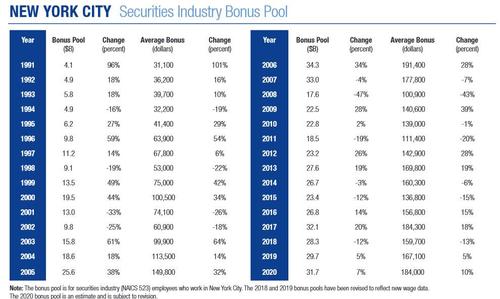

The average Wall Street bonus rose by 10% in 2020 to $184,000 as the total bonus pool increased by 7% to $31.7 billion, according to annual estimates released today by New York State Comptroller Thomas P. DiNapoli as soaring market volatility and a surge in underwriting generated a record bonanza for US banks. The jump, which was in line with the city’s most recent 9.9% projection, will allow the city to meet or exceed its income tax revenue projections in FY2021.

The New York Comtroller estimated that the 2020 Wall Street bonus pool increased by 6.8 percent to $31.7 billion during the traditional December-March bonus season, up from $29.7 billion in 2019. The report noted that “the growth of the bonus pool is unique after a recessionary event.” Bonuses fell by 33% in 2001 after 9/11 and by 47% in 2008 after the Great Recession. Bonuses have fallen four times since 2008, with an average decline of 12 percent.

Pretax profits in 2020 for the broker/dealer operations of New York Stock Exchange member firms (the traditional measure of securities industry profits) increased by 81 percent to $50.9 billion. It was the fifth consecutive year of growth in profits, which are up 256 percent since 2015. Profitability in 2020 was the second highest on record, trailing $61.4 billion recorded in 2009.

In 2020, profits rose because of an increase in trading and underwriting activity, along with lower interest rates. Market conditions experienced significant upheaval beginning in late February due to the pandemic and related public health and fiscal responses, resulting in a flurry of trading activity, creating higher commissions and trading income. THe Fed must also be thanked: low rates also encouraged borrowing, generating fees and interest expense savings.

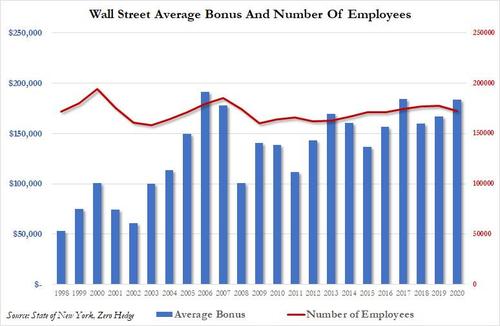

Despite the record year, Wall Street bonuses were the same as 2017’s $184,300 while the total bonus pool was lower compared to that year for traders, when it hit a record $32.1 billion. The record for Wall Street comp remains 2006 when the average bonus hit $191,400 with a record bonus pool of $34.3 billion.

“Wall Street’s near-record year shattered all expectations. The early forecast of a disastrous year for financial markets was sharply reversed by a boom in underwriting activity, historically low interest rates, and surges in trading spurred by volatile markets,” DiNapoli said. “Income tax revenue from New York City’s securities industry will help shore up state and city budgets that are strained by steep declines in other industries, but it comes with a caution. New York benefits when Wall Street succeeds, but our economy won’t fully recover until other sectors can reopen and all New Yorkers have a chance to share in economic success.”

The securities industry accounts for 20% of private sector wages in New York City, even though it is less than 5% of private sector employment. DiNapoli estimates that nearly 1 in 10 jobs in the city are either directly or indirectly associated with the securities industry.

In 2020, employment in New York City’s securities industry was 179,900, 5% smaller than 2007 and 11 percent below its peak in 2000. While New York remains the center of the nation’s securities industry, the total share of jobs has declined from 33 percent in 1990 to 19 percent in 2020. During the pandemic, securities firms swiftly enabled employees to work remotely and some opened trading operations in other parts of the country. It remains to be seen if these relocations are temporary. The industry lost 3,600 jobs, 1.9 percent of employment, in 2020.

As a major source of revenue, DiNapoli estimates that the securities industry accounted for 18 percent ($15.1 billion) of state tax collections in state fiscal year (SFY) 2020 and 6 percent ($3.9 billion) of city tax collections in city fiscal year (CFY) 2020.

“New York benefits when Wall Street succeeds,” DiNapoli said, “but our economy won’t fully recover until other sectors can reopen and all New Yorkers have a chance to share in economic success.”

The Comptroller’s estimate is based on personal income tax withholding trends and includes cash bonuses for the current year and bonuses deferred from prior years that have been cashed in. The estimate does not include stock options or other forms of deferred compensation for which taxes have not been withheld.

Tyler Durden

Sun, 03/28/2021 – 12:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com