Amazon, Stock Compensation & Equity Valuation

Submitted by Jim Rocchio of Kailash Concepts

Bloomberg News recently published an article, Amazon Fights Union Drive With Fact-Free Bombast, discussing Amazon’s alleged use of misinformation to prevent employees from unionizing. In the same manner Kailash recused itself from having a “bull” or “bear” thesis on Bitcoin, we will recuse ourselves from any discussion of unions. What we would like to draw our readers’ attention to however is the method by which Amazon pays many senior executives. In the Bloomberg article it noted that the former head of Amazon’s logistics business was awarded stock compensation worth $160 million dollars.

In the wake of the scandals that occurred during the financially profligate dot.com bubble, rule FAS123 was passed requiring stock compensation be expensed in a company’s income statement. In papers written both in the professional and academic worlds, Kailash has used Amazon as an example of how cash flow accounting contradicts the intent of FAS123. The Kailash note found here showed how Amazon’s well explained and GAAP compliant use of lease and stock comp accounting could potentially cause confusion among analysts. Kailash’s academic expert on stock compensation put his work, Stock Compensation Expense, Cash Flows and Inflated Valuations through peer review. His work made it painfully clear that this GAAP compliant accounting method diminished the information value of traditional calculations of free cash flows.

Our views are obviously shared by many including Jamie Powell at the FT who noted the issue with stock compensation accounting in a 2018 article here. When it comes to accounting Kailash believes the headlines do plenty to explain the dubious nature of many practices common in today’s markets. Our views in both the professional and academic spheres express a belief that the regulators will either make a gentle amendment today or will be chasing the issue after an explosion of investor outrage in the wake of losses. While things like prudence and transparency have been slaughtered at the trough of improvident financial practices today, we believe that overstating profitability by billions is worth the attention of investors.

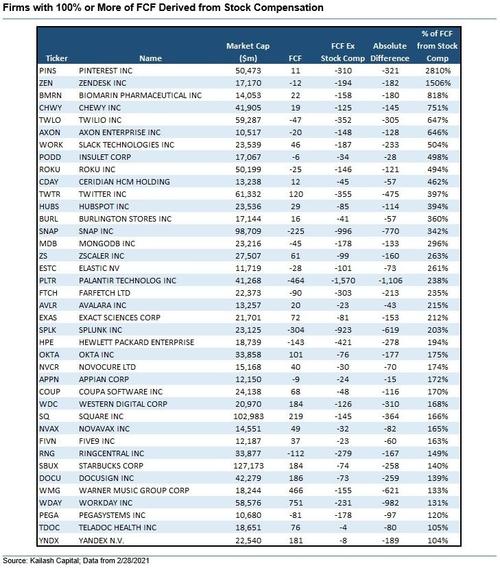

Kailash would like to note that Amazon is by no means the most aggressive user of stock compensation. We highlight them in our work due to the exemplary clarity of their footnotes and disclosures. In effect, the clarity of Amazon’s reporting makes understanding the magnitude of the issue easy. For copies of our research on this accounting chimera please click here. Below we have provided a list of firms that derive over 100% of their their free cash flows from stock compensation.

We would like to note that many of the firms on this list are already at elevated valuations and this is merely another risk factor if the recent pullback in growth persists.

If you would like to see how companies outside those listed below are impacted by stock compensation please just email [email protected].

Tyler Durden

Thu, 04/01/2021 – 12:20![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com