Stellar 10Y Auction: Foreign Demand Surges; Biggest Stop Through In 12 Months

One day after a blockbuster 3Y auction, moments ago the US Treasury sold $27 billion in 10Y paper in what was a stellar auction of US benchmark paper.

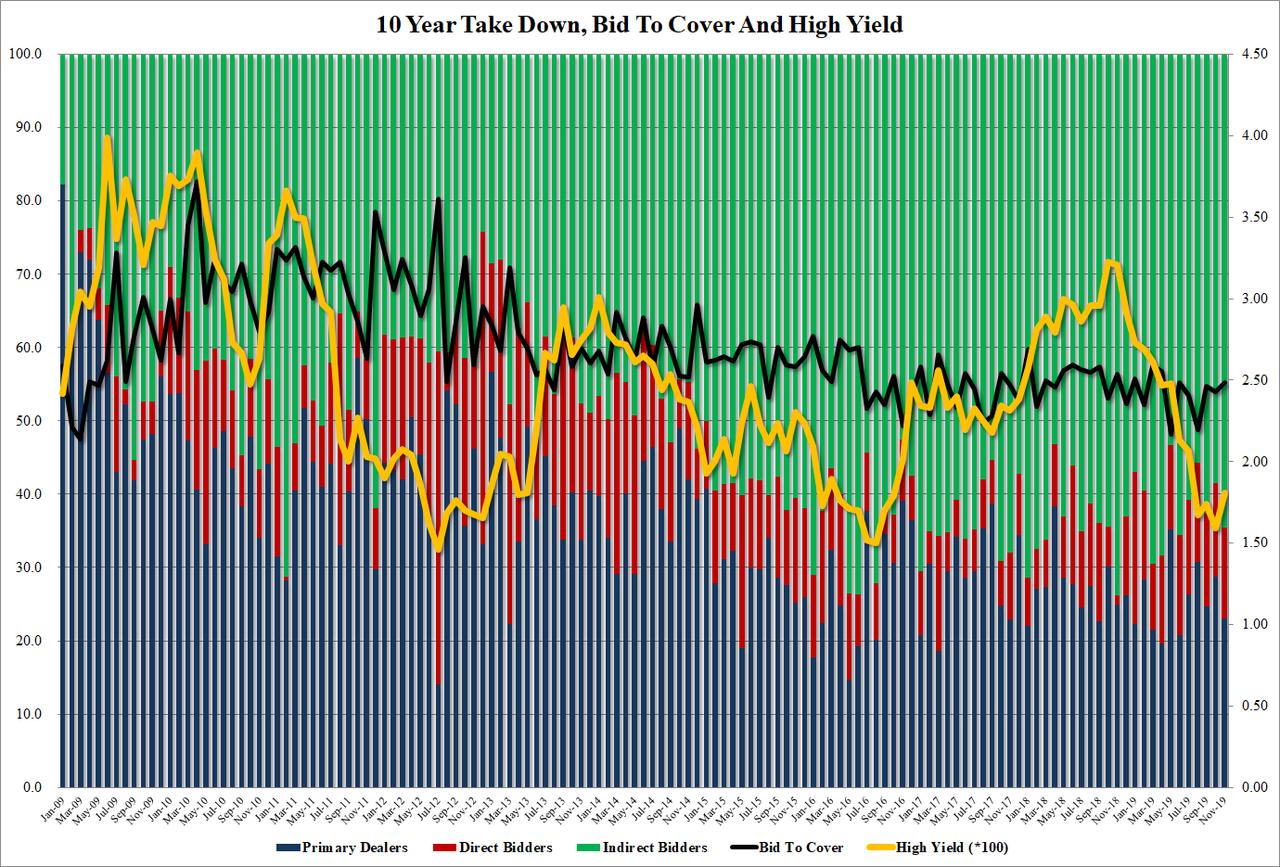

Starting at the top, the high yield of 1.809%, while notably above October’s 1.5900% following the sharp selloff in the past few days, stopped through the 1.8200% When Issued by 1.1bps, the biggest “stop through” in one year, since November 2018.

The Bid to Cover also was a notable improvement, rising from 2.43 to 2.49, far above the 2.36 six auction average, and the highest bid to cover since April.

Finally, the internals were the piece de resistance, with the Indirect takedown surging from 58.5% to 64.5%, the highest since June, and leaving Directs holding on to 12.4%, the lowest since May, while Dealers were left holding 23.1% of the paper, the lowest since June.

Overall, a stellar auction, and one which pushed intraday 10Y yields to session lows, now that the selloff across the curve appears to be over, with the yield on the benchmark US Treasury sliding from 1.86% to 1.81% after the auction.

Tyler Durden

Wed, 11/06/2019 – 13:14

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com