Morgan Stanley Is Planning Ahead For A “Harder Summer”

By Andrew Sheets, chief cross-asset strategist at Morgan Stanley

The weather in London has been unseasonably good and, together with the easing of some local restrictions, this opens the door to that most elusive of feelings: normality. Our economists forecast a strong rebound in UK GDP for 2Q, and when navigating the crowds that have now appeared, this feels about right.

The catch, however, is that more normality also portends a more difficult summer for the markets. Some of the problem is fundamental, some psychological, and some a function of what’s now in the price.

Let’s start with the three fundamental challenges.

- First, our global economics team has consistently argued that this will be a strong, ‘V-shaped’ recovery, a view that underpinned our strategy preference for early-cycle winners. But following the arrival of better data, not to mention the US$1.9 trillion American Rescue Plan, better growth is now more widely expected. Meanwhile, the rate of change for that growth will soon peak, given that we’re passing the one-year anniversary of the largest global economic drawdown on record.

- The second fundamental challenge lies in inflation. Our economists forecast US core PCE to hit ~2.5%Y next month, and stay at 2.0%Y or higher for the rest of the year. If that’s correct, inflation will switch from being a far-off concept to something appearing regularly in the monthly data. While we don’t think we’re on the verge of runaway prices, markets are forward-looking, and cyclical, early-cycle winners historically underperform when inflation moves back above trend. My colleague Mike Wilson has been vocal about starting this shift out of early-cycle cyclicality, and increasing quality in the portfolio.

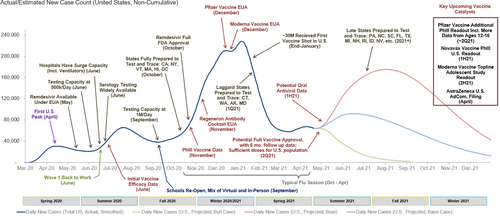

- Then there is the virus. My colleague Matthew Harrison thinks that vaccinations will allow the US to achieve herd immunity by summer, maybe as early as June. While this is clearly a public health milestone to be celebrated, the implications for markets could be more complicated.

Low inflation and a terrible pandemic gave the Federal Reserve two powerful arguments to keep accommodation flowing even as financial conditions improved. Can the Fed sustain this accommodation if the US hits herd immunity and realized inflation is above 2.0%Y this summer? Certainly, and this remains our expectation. But is that a trickier message for the Fed to manage? It sure seems that way.

There are also some softer, market psychology risks that may be relevant.

Seasonality is good in April but gets worse in May through September, offering a convenient excuse to reduce exposure. Then there’s the unprecedented build-up of unused time off and desire to take advantage of it. This is not a cry for sympathy; our industry is well compensated and has been able to work remotely more easily than many others. But with only slight exaggeration, one of the bigger risk-management challenges this summer might be keeping desks properly staffed.

The real crux of the issue, however, is what’s in the price. The year-to-date rally has increasingly eliminated upside to our targets.

Across four major global equity markets (the US, Europe, Japan and emerging markets), only Japan is currently below our end-2021 strategy forecast. In bond markets, US 10-year rates are near the year-end expectations of my colleague Guneet Dhingra, who also thinks that US inflation breakevens now price in the rise of inflation our economists forecast. Oil and credit spreads are also near our year-end targets, and mortgage valuations have compressed so much that, as my colleague Jay Bacow notes, shorting MBS against US 5-year Treasuries is a positive carry, positively convex trade.

We’ll be sitting down soon for our semi-annual outlook process, so it’s possible that these longer-term forecasts will change. But based on our current expectations, there just isn’t much milk left in the carton.

There are a few exceptions. EM local bonds have been big underperformers this year, and James Lord and our emerging market strategy team are out with a recommendation to buy them (FX-hedged). Their underperformance relative to other assets, our expectation for more stability in US yields and a historically low cost of removing currency risk all make a compelling case.

Like EM local bonds, CLOs are a less liquid corner of the market that has lagged the rally, and thus still offer value. With confidence in the global recovery, my colleagues Charlie Wu and Vasundhara Goel like taking default risk in US CLOs at current prices, and see good returns in junior parts of the capital structure in EU CLOs, respectively.

Growth is still improving and liquidity is still abundant. The bull market remains intact, and I struggle to see the type of calamity that defined the summers of 2010, 2011, 2012 and 2015. But a harder, choppier, more range-bound summer does seem likely. Increase quality within equity portfolios, trim CCCs and long-dated corporates, sell MBS against Treasuries, and buy a few EM local bonds.

Tyler Durden

Sun, 04/25/2021 – 17:50![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com