Ethereum Surges Above $3,000; Now Bigger Than BofA & Disney

In the immortal words of Ron Burgundy, “that escalated quickly.”

In 15 calendar days, Ethereum has gone from sub-$2000 puke to being over $3000 ($3028 highs)…

Source: Bloomberg

Ether has quadrupled year-to-date (dramatically outperforming bitcoin, which itself has put in a none-too-shabby double YTD)…

Source: Bloomberg

ETH is now at its strongest relative to BTC since Aug 2018…

Source: Bloomberg

As CoinTelegraph notes, the remarkable run has even prompted renewed speculation that Ethereum could “flippen” Bitcoin, overtaking BTC as the largest digital currency in the world.

The first time we detailed Ethereum’s potential was in February 2017 (when ETH was at around $13)…

“Because of its capacity for smart contracts — and other complicated computing capacities — Ethereum is viewed as more agile and adaptable than Bitcoin.”

Ethereum is now bigger than Bank of America, Disney, and Home Depot:

There are multiple catalysts behind Ethereum’s rise, as CoinTelegraph details:

The first is an ongoing surge in activity on the chain, including from institutional entities: earlier in the week the European Investment Bank announced it would be issuing a two-year digital bond worth $121 million in collaboration with banking entities such as Goldman Sachs.

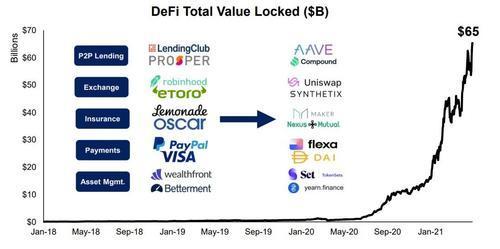

Retail interest in DeFi has also been rising as of late, with total value locked numbers reaching astonishing highs above $100 billion.

However, the “London” hardfork, which includes the EIP-1559 overhaul of Ethereum’s fee structure, as well as the subsequent looming ETH 2.0 transition to a proof-of-stake consensus model, may be the prime events investors are anticipating. These upgrades to the network are expected to significantly decrease fees, as well as reduce the amount of ETH rewarded to miners – which in turn is expected to decrease sell-side pressure on the asset.

Between the enormous amount of activity on Ethereum, the economic improvements to Ether, and the promise of increased scalability with Ethereum 2.0, there is a lot for the Ethereum community to be excited about.

Finally, we note that FundStrat’s Tom Lee maintains his $10,500 target for Ethereum as we detailed here (and suggests the possibility of a $35k target).

Tyler Durden

Sun, 05/02/2021 – 22:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com