Morgan Stanley Says “Rather Than Getting Excited, It’s Getting More Concerned”

By Michael Wilson, Morgan Stanley chief equity strategist

The Mid-Cycle Transition

Over the past month, we’ve taken a different path than most equity strategists. Rather than getting excited about the reopening, we are getting more concerned about (1) execution risk and (2) what’s already priced in.

First, on the execution front, there’s growing evidence that supply remains a problem for many companies, just as demand is picking up. These issues have been particularly acute in certain materials and components, and now it’s becoming more apparent that we have labor shortages as well. In addition to numerous surveys and company commentary, Friday’s very disappointing employment report suggests labor availability may be a gating factor on the speed of the reopening. Furthermore, while these problems haven’t broadly affected margins yet, stocks are discounting machines and don’t always wait for an engraved invitation. To prepare for this execution risk, we downgraded small caps and early-cycle stocks like consumer discretionary while upgrading consumer staples and suggesting a move up the quality curve. At the same time, we have maintained our reflationary bias, with overweights in financials, materials and industrials.

We first highlighted these concerns in mid-March and are now even more convinced that they are warranted. On valuation, the risk is elevated too. But, with liquidity still flush and the S&P 500 making new highs every day, few seem worried. For many, the weak payroll number just means more accommodation from the Fed, or at least not a withdrawal any time soon. From our vantage point, the equity risk premium is underpricing these cost/supply issues as well as the other risks we have discussed over the past month. Most notable are the peak rate of change in economic and earnings data, as well as in policy and liquidity; extreme equity supply; and investor leverage. To be fair, the market isn’t completely ignoring these risks. Since mid-February, many stocks and indices have traded lower, some as much as 30-40%, and they aren’t recovering. Longer-duration stocks have been hit the hardest, as back-end interest rates moved higher than most expected this year. Lower-quality stocks have underperformed, too. More recently, the vaunted FAANMG stocks sold off on terrific 1Q earnings results after an outsized run into the event. This was in line with our call for a rotation towards high quality but also a reminder that stocks often peak on good news. From here, it will be important to see which ones can make new highs on the weak payroll report and subsequent lower yields and greater perceived Fed accommodation. We’ve placed our bet on Alphabet.

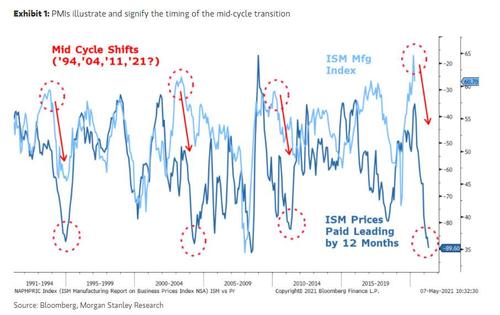

To be clear, this peak rate of change and execution risk are normal as we exit the early stages of a recovery and enter what we call the mid-cycle transition. Perhaps the best way to visualize this is to look at the headline Manufacturing Purchasing Managers Index and Prices Paid component.

In past cycles, 1994, 2004 and 2011 were comparable years. We think that 2021 will be similar for investors – flattish returns for the year with a 10-20%+ correction along the way. During such periods, the game is to be more selective with one’s investments and even more tactical with the rotations under the surface. The first quarter saw full-on cyclical rotation, with both reflation and reopening stocks leading. That is starting to morph now with reflation plays still working well while reopening stocks take a breather on execution risk.

Finally, remember that we’re still only a year from the trough in the recession, and new bull markets tend to last for years. So, whatever correction the market experiences this year, we are likely to make higher highs next year. The goal as an investor is to navigate the mid-cycle transition, avoid the stocks with the biggest drawdowns and be in position to capture the next leg. The first stage of that transition seems to be well along – i.e., taking out the most egregiously valued stocks as rates moved higher. Small caps, early-cycle stocks like semiconductors and lower-quality stocks are now underperforming, along with some reopening plays that got too extended. It’s likely that the S&P 500 will eventually feel it too before the transition is complete.

Bottom line, dreaming about a reopening is likely much easier than doing it. Given that stocks are discounting mechanisms, it’s often better to travel than arrive from an investment perspective. As a result, we think it’s time to be more selective and a tad more defensive until these risks are better reflected in margins/earnings expectations, price, or both. Welcome to the mid-cycle transition!

Tyler Durden

Sun, 05/09/2021 – 14:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com