UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

It looks like the hiring (and retention) shortage isn’t just for rank-and-file minimum wage jobs.

UBS has now said that, amidst historic competition and a “retention crisis” in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted. This is double what some of the bank’s competitors are offering.

It’s part of a push for lenders “to reward and retain younger employees weighed down by a surge in business and a prolonged work-from-home grind,” according to BNN Bloomberg.

The bank is planning on paying the bonus to analysts who are promoted to associates, on top of regular salary increases. It marks a bonus that is about 30% of the base pay of a newly promoted associate.

Recall, last month, junior bankers at Goldman Sachs spoke out about long hours worked during the SPAC boom. Their public outcry catalyzed a trend of other banks and employers rushing to kiss the ass of their respective employees to avoid turnover, and (likely more important) a PR crisis.

Weeks later, we profiled how the world’s top professional service firms and banks were showering their employees with luxury gifts and bonuses to try and prevent them from moving on to other opportunities. Even law firms were feeling the crunch; Financial Times reported last month that Davis Polk & Wardwell and Simpson Thacher & Bartlett, two elite law firms, gave one time bonuses between $12,000 and $64,000 to their employees for their “hard work during the pandemic”.

Latham & Watkins and Goodwin Procter also followed suit. Goodwin’s employees will be paid in two tranches, one in July and another in October.

Investment bank Jefferies gave its employees a choice of a Peloton, a Mirror or various Apple products. David Polk offered its employees wine packages, gift cards and shopping sprees. Credit Suisse – who has larger, Archegos-sized problems on its hands right now – said it would pay its junior staff $20,000 in bonuses.

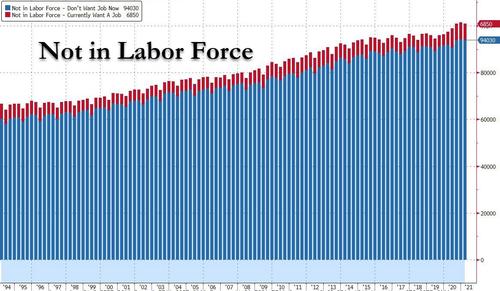

We have also noted at length the ongoing labor shortage that has developed as a result of the government paying the unemployed more to stay home than they would make in the labor force.

Trillions in Biden stimulus has incentivized workers to not seek gainful employment, but rather to sit back and collect the next stimmy check for doing absolutely nothing in what is becoming the world’s greatest “under the radar” experiment in Universal Basic Income.

Even more amazing: a stunning 91% of small businesses surveyed by the NFIB said they had few or no qualified applicants for job openings in the past three months, tied for the third highest since that question was added to the NFIB survey in 1993.

Tyler Durden

Tue, 05/11/2021 – 05:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com