Europe Leads In EV Sales, But For How Long?

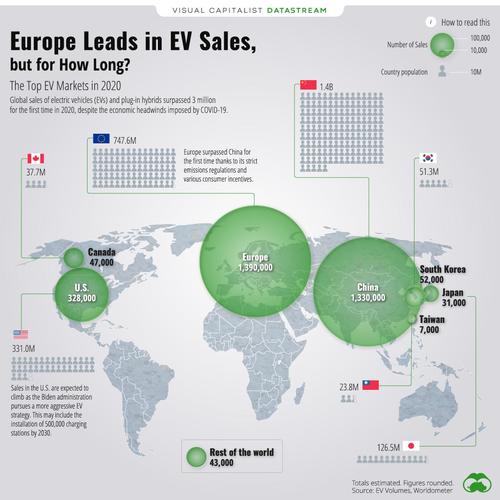

Despite the economic headwinds imposed by COVID-19, Visual Capitalist’s Marcus Lu reports that global sales of electric vehicles (EVs) and plug-in hybrids (PHEV) surpassed 3 million for the first time in 2020.

This visualization presents a geographical breakdown of these sales, revealing that over 80% were made in either Europe or China.

The EU was the largest market by a margin of 60,000 cars, but given China’s larger population, it’s likely the two will switch places in the near future.

Government Incentives Play a Key Role

Government incentives have boosted the transition to battery power in recent years. For example, many countries offer a buyer rebate, which effectively reduces the price a consumer pays for an EV or PHEV.

In Germany, buyers can receive a subsidy of $10,800 when purchasing an EV with a list price of less than $48,000. China also offers a rebate program, where buyers of an EV with a travel range of at least 186 miles can receive a subsidy of $2,500.

Consumers should be aware that these incentives are likely to diminish over time, especially as EVs become more mainstream. In January 2021, the Chinese government announced it would reduce its existing subsidies by 20%.

Will EV Sales in America Catch Up?

In a 2020 survey, 71% of U.S. drivers said they were interested in getting an EV—so why are sales so far behind Europe and China?

In that same survey, 50% of drivers cited a lack of public charging stations as the main factor for preventing them from buying an EV. Concerns like these have led the Biden administration to propose a more aggressive EV strategy, which includes the installation of at least 500,000 charging stations by 2030.

* * *

If you found this post interesting, you might enjoy this graphic that compares electric vehicle highway ranges

Tyler Durden

Sun, 05/16/2021 – 07:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com