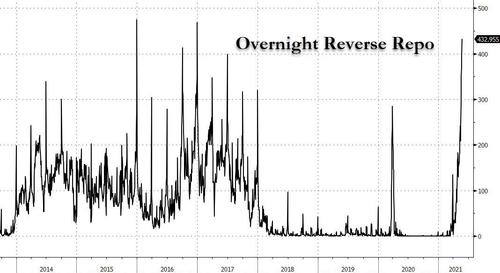

“RRP Explosion”: Fed Reverse Repo Soars To Third Highest With “Incredible Amount Of Cash”

Ahead of today’s 1:15pm overnight Reverse Repo deadline we asked (for the second day in a row) if today was the day the repo market finally cracks, pushing the amount of reserves parked at the Fed to a new record above $500 billion.

$500BN in reverse repo today?

— zerohedge (@zerohedge) May 25, 2021

And for the second day in a row, we were off, but we are getting warmed by the day: on Tuesday, the Fed revealed that the amount of overnight reserves parked at the Fed rose by another $38BN to $433BN (with 48 counteparties, down from 54 yesterday) from $394.9BN on Monday, which was the 3rd highest in history, up a whopping $190 billion in one week and the highest non-quarter end reverse repo usage ever!

Why does this matter? Three reasons, all of which we explained in extensive detail in “Fed Alert: Overnight Reverse Repo Usage Soars Above Covid Crisis Highs“, Repo Crisis Looms: Fed’s Reverse Repo Usage Soars To $351BN, Fifth Highest Ever, and Zoltan On The Coming QE Endgame: “Banks Have No More Space For Reserves“,

- The Fed is taking Treasurys out of the market through QE purchases and putting them right back in via the RRP

- The heavy use of the o/n RRP facility tells us that foreign banks too are now chock-full of reserves.

- Banks don’t have the balance sheet to warehouse any more reserves at current spread levels.

As for the immediate market implications they are even more ominous: either the Fed will have to hike the IOER or rates will soon go negative. Worse, with the Fed still planning to do at least $1 trillion in QE even assuming a December taper, and potentially as much as $2 trillion based on the latest just released Fed “forecast”, there is simply no place to park all of these reserves.

It’s not just us concerned about how clogged up the market plumbing has become: in his daily Repo Market Commentary note from Monday, Curvature’s repo market guru Scott Skyrm wrote the following:

RRP Explosion

On March 17, a little over two months ago, there was no volume at the Fed’s RRP window. Nothing. Today, it was almost $400 billion! How do you go from zero to $400 billion in two months? Not only was today’s activity at the RRP one of the largest ever, it was also THE largest non-quarter-end, non-year-end print. There’s an incredible amount of cash in the Repo market right now! Clearly, the Fed took too much collateral out of the market – or – added too much cash.

The market is distorted from too much QE and hopefully QE tapering will be announced in June.

And while Powell & Co pretend that they can continue business as usual for years to come, the repo market is not only cracking but banks, full to the gills with inert reserves and which increase by $30 billion every week, are on the verge of pulling a Mr Creosote…

… and balking at even a penny of additional liquidity. How the Fed will continue to monetize debt then, when the repo system is now out of collateral, is anyone’s guess.

Tyler Durden

Tue, 05/25/2021 – 13:41![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com