Markets Have Never Had It So Good

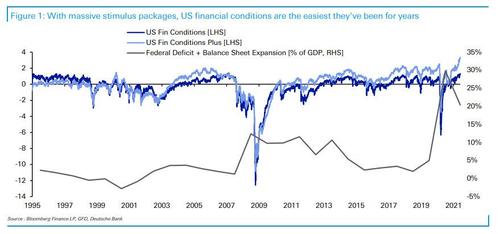

As Deutsche Bank’s Jim Reid points out in his latest “Chart of the day”, Bloomberg’s US financial conditions index has eased to fresh 14-plus year highs. This index looks at money markets, various credit spreads and equity markets.

However Bloomberg also compiles a financial conditions “plus” index where they include indicators of asset-price bubbles incorporating tech shares, housing markets and additional yield deviations from the mean.

As Reid notes, this “plus” index has really exploded higher over the last few weeks to comfortably be at record highs. When we add in combined fiscal deficits and Fed balance sheet expansion as a % of GDP one can easily see why financial conditions are so loose and bubbles have appeared in various places over the last few months.

So, yes, markets have never had it so good, but what comes next? As the DB credit strategist rhetorically concludes, “will policymakers regret such extreme stimulus in the quarters ahead? Much will depend on whether inflation comes roaring back as a result of the trends seen in the graph.”

Tyler Durden

Wed, 06/02/2021 – 12:19![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com