Futures Near Record High Shake Off Yellen Comments, Brace For Inflation Data

US equity futures rebounded from a mild dip in the overnight session, rising back to just shy of all time high at 4,228 as of 7:45 am on Monday, shaking off Yellen’s Sunday comments that the US Tsy Secretary welcomes higher rates (i.e., inflation) which would be “good for the Fed and US society.” World shares were range bound on Monday as markets digested Friday’s disappointing yet “Goldilock” jobs report and a global tax deal between the G7 group of countries, while also looking ahead to critical CPI data due Thursday. The dollar was steady while the 10-year rate added two basis points after Janet Yellen said on Sunday a slightly higher interest-rate environment would be “a plus” for society. WTI slipped after rising to $70 per barrel as short-term demand worries continued.

Yellen set the stage for Monday trading on Sunday when she said Biden should push forward with his spending plans even if they spark inflation that persists into next year. Meanwhile, the Group of Seven rich nations secured a landmark deal that could help countries collect more taxes from big firms and enable governments to impose levies on U.S. giants such as Amazon.com Inc. and Facebook Inc.

Investors were wary how shares of major tech firms would react to the G7’s agreement on a minimum global corporate tax rate of at least 15%, although securing approval not to mention enforcement from the whole G20 could be a tall order. So far, the reaction was muted with Nasdaq futures down 0.4%, highlighting investor concern that a pure growth narrative may no longer be enough to support stocks. Technology shares underperformed in Europe as well, with the benchmark gauge for the sector falling from the highest level since April.

“I would assume that it (the tax deal) is not helping the market in the sense that these Internet giants are going to be taxed more….it has an impact on sentiment in equity markets, but the reality is it has already been priced in,” said Sebastien Galy, senior macro strategist at Nordea Asset Management. “So even though equity markets in the U.S. are under pressure on the futures side, I’d expect it not to last till the end of the day.”

Here are some of the biggest U.S. movers today:

- Tesla shares fall 1.3% after the electric-vehicle maker called off plans to build a Model S Plaid+

- AMC Entertainment (AMC) gained as much as 3.5% in premarket trading, halting two days of declines for the money-losing movie theater chain that’s become the new favorite of meme-stock investors.

- Cryptocurrency-related stocks like Marathon Digital (MARA) and Riot Blockchain (RIOT) edge lower in U.S. premarkettrading following a dip for Bitcoin and other tokens over the weekend.

- Evofem Biosciences (EVFM) shares rise 10% in premarket trading after Morgan Stanley reported a stake in the biotech and amid touts for the stock on Reddit

- Liminal BioSciences (LMNL) soars 44%, extending a postmarket rally on Friday, after the U.S. FDA approved Ryplazim for the treatment of patients with plasminogen deficiency type 1 (hypoplasminogenia).

- Meme stocks including Sundial (SNDL) and Naked Brand (NAKD) advance in premarket, while AMC shares edge higher, reversing earlier drop

While resurgent inflation has sparked a debate about when the Fed will start tapering monetary accommodation, Bloomberg notes that recent data including the May nonfarm payrolls report on Friday seemed to vindicate the central bank’s dovish stance. Investors are trying to strike a balance between preparing for higher rates and riding a risk-on rally supported by Fed stimulus and a $4 trillion spending plan by President Joe Biden, which however is facing significant headwinds and may end up being substantially diluted before it passes. Traders await the U.S. consumer-price index report Thursday for more clues.

“The slightly softer-than-expected rise in U.S. payroll employment in May probably won’t change the Fed’s thinking, but another pickup in CPI inflation likely to be reported on Thursday will further spur the taper talk,” Shane Oliver, head of investment strategy and chief economist at AMP Capital, wrote in a note.

MSCI’s All-Country World index traded just below record highs and was flat on the day after the start of European trading.

European shares opened lower, easing from all-time highs with commodity shares leading declines as sentiment soured after weaker-than-expected China trade data and worries about inflation. Autos was the best performing sub-group in Stoxx 600 benchmark YTD, along with banks (+31%). The Stoxx 600 Automobiles & Parts index was poised to hit a record high, rising as much as 0.9% on Monday and with the sub-index up 31% YTD. So far in 2021, German automaker Volkswagen (+57%) and its controlling shareholder Porsche SE (+78%), and Daimler (+38%) are the top performers in the index.

Here are some of the biggest European movers today:

- Tessi SA shares rose as much as 35%, biggest intraday increase ever, after the business services company’s main shareholder said it planned an offer for the remaining stock at EU172 a share.

- Edenred gained as much as 3.5% in Paris after Deutsche Bank upgraded the stock, saying the French employee voucher company’s earnings may be surprisingly strong as economies reopen.

- S4 Capital jumped as much as 6.5% to a record after an AGM statement with Jefferies noting that the company raised its guidance again given accelerating growth so far in the second quarter.

- UniCredit advanced as much as 3% after Jefferies upgraded the stock to buy from hold and said brighter loan volume trends can support revenue at southern European banks, as the Italian lender has stronger gearing to a lending recovery.

- Elekta AB gained as much as 3.1% to the highest since November 2019 after the firm and Royal Philips agreed to deepen a strategic partnership.

- IWG slumped as much as 18% to the lowest since late January after the company warned 2021 earnings would be “well below” the previous year’s.

- Argenx fell as much as 9% after a Johnson & Johnson unit ended its collaboration and returned the rights to the anti-CD70 antibody cusatuzumab. The setback could shift sentiment on Argenx’s perfect track record of execution, KBC said in a note.

- Kinnevik dropped as much as 5.7% after Pareto downgraded to sell from buy, saying a strong performance made the stock expensive.

Asian equities swung between gains and losses as Hong Kong’s Hang Seng Index slid on the first day of trading following the start of its biggest-ever overhaul, while stocks in Singapore climbed. MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.05% and risked a fourth session of losses. Japan’s Nikkei edged up 0.3% and touched its highest in almost a month. Taiwan stocks lost 0.4% as a spike in COVID-19 cases hit three tech companies in northern Taiwan, including chip packager King Yuan Electronics.

Financials and internet giant Tencent were among the biggest drags on the MSCI Asia Pacific Index, while advances in consumer staples and healthcare shares cushioned the downside. The regional benchmark has traded sideways for the past few sessions after recovering back above its 100-day moving average. Traders continue to speculate that the U.S. recovery will be strong enough to prompt the Federal Reserve to taper asset purchases. Still, a weaker-than-expected American jobs report eased fears about the economy running too hot and lifted U.S. stocks Friday. “Last time the Fed decided to taper, in 2013, markets priced in tapering before it was certain,” SMBC Nikko strategists led by Masashi Akutsu wrote in a note. “Even if markets correct, we would not expect a sharp pullback since the May jobs report was not sufficient to force the Fed to pull future rate hikes forward.” Vietnam’s main equity benchmark tumbled more than 1%, as traders pointed to profit-taking after a recent strong rally. Markets in New Zealand and Malaysia were closed for holidays.

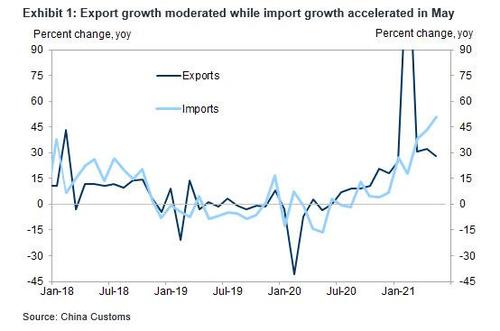

In key Asian eco data, China’s imports grew at their fastest pace in 10 years, although export growth missed expectations, customs data showed. China’s exports rose 27.9% yoy in May, slightly below expectations. This implies a sequential decline of 6.4% in May vs. +9.4% in April. Imports rose 51.1% yoy in May, also a slight miss to expectations, though sequentially, it fell 6.8% sa non-annualized in May (vs. +2.0% in April). Monthly trade surplus edged up to $45.5bn in May.

In FX, the greenback was still trading in follow through of Friday’s poor jobs report. While the 559,000 rise in May U.S. jobs missed forecasts it was still a relief after April’s shockingly weak report. The jobless rate at 5.8% showed there was a long way to go to reach the Federal Reserve’s goal of full employment. After Friday’s dollar tumble, the Bloomberg dollar index was steady and most Group-of-10 currencies traded in tight ranges against the greenback.

“The data was perfect for a goldilocks type outlook for risk: not too hot to bring in fears of a faster Fed taper, and not too cold to worry about the outlook for the recovery,” said NatWest Markets strategist John Briggs. “This caused a weaker USD, better stocks, reinforced the earlier bid in commodities, and boosted emerging markets.” Briggs suspected Fed officials might open the door to talking about tapering at the June policy meeting, with the start coming in early 2022 and a rate hike not until 2024.

Elsewhere, the pound led declines among Group of 10 currencies as concerns over whether the U.K. will be able to fully reopen the economy weighed on sterling. U.K. Health Secretary Matt Hancock has said it’s too early to say whether a planned easing of coronavirus restrictions on June 21 can go ahead, as ministers continue to weigh the threat of a potential fresh wave of the pandemic. The Aussie was little changed while Australian sovereign bonds traded higher, tracking gains in Treasuries on Friday after U.S. payrolls data missed estimates; S&P Global Ratings raised the nation’s rating outlook to neutral from negative. The yen kept consolidating versus the dollar while Japan’s 30-year government bonds erased gains ahead of an auction on Tuesday; benchmark 10- year bonds weren’t traded.

In rates, Yields on U.S. 10-year notes were a fraction higher at 1.58%, after diving 7 basis points on Friday and back to the bottom of the trading range of the last three months. Treasuries futures were near lows of the day as U.S. session begins, amid focus on this week’s Treasury supply following Friday’s squeeze higher after jobs report. Treasury yields are cheaper by 2bp-3bp across long-end of the curve — 10-year by 2.5bp at ~1.58% — with 20-year sector underperforming; long-end-led losses steepen 5s30s by ~1bp. Both bunds and gilts outperform Treasuries slightly over early European session. IG credit issuance is expected to be heavy this week, adding to cheapening pressure on Treasury yields. May CPI report is ahead on June 10, and no Fed speakers are slated ahead of June 16 FOMC meeting.

In commodities, the pullback in the dollar helped gold steady at $1,885 an ounce, up from a low of $1,855 on Friday. Oil prices ran into profit-taking after Brent topped $72 a barrel for the first time since 2019 last week as OPEC+ supply discipline and recovering demand countered concerns about a patchy global COVID-19 vaccination rollout. Brent slipped 0.4% to $71.61 a barrel, while WTI eased 0.4% to $69.31 after rising above $70 for the first time since October 2018. Bitcoin rebounded above $36,000 after a roller-coaster ride over the weekend.

On today’s calendar there are no major events until 3pm ET when we get the April Consumer Credit report, est. $20.5b, prior $25.8bn. Attention will then turn to the U.S. consumer price report on Thursday where the risk is of another high number, though the Fed still argues the spike is transitory. Investors are also watching the tussle over U.S. President Joe Biden’s proposed $1.7 trillion infrastructure plan with the White House rejecting the latest Republican offer. The European Central Bank will hold its policy meeting on Thursday and is widely expected to maintain its stimulus measures with tapering a distant prospect.

Market Snapshot

- S&P 500 futures down 0.15% to 4,221.75

- STOXX Europe 600 little changed at 452.96

- MXAP little changed at 210.16

- MXAPJ little changed at 704.68

- Nikkei up 0.3% to 29,019.24

- Topix little changed at 1,960.85

- Hang Seng Index down 0.5% to 28,787.28

- Shanghai Composite up 0.2% to 3,599.54

- Sensex up 0.3% to 52,282.40

- Australia S&P/ASX 200 down 0.2% to 7,281.89

- Kospi up 0.4% to 3,252.12

- Brent Futures down 0.82% to $71.30/bbl

- Gold spot down 0.34% to $1,885.11

- U.S. Dollar Index little changed at 90.173

- German 10Y yield rose 1.3 bps to -0.200%

- Euro down 0.06% to $1.2160

Top Overnight News from Bloomberg

- Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates

- Armin Laschet boosted his chances of succeeding Angela Merkelas German chancellor by helping secure a decisive victory for his Christian Democratic Union in the country’s poorest state

- China’s exports continued to surge in May, although at a slower pace than the previous month, fueled by strong global demand as more economies around the world opened up. Imports soared, boosted by rising commodity prices.

- German manufacturers unexpectedly saw demand decline in April, signaling that supply shortages and higher prices are undercutting the country’s economic recovery

Quick look at global markets courtesy of Newsquawk

Asian equity markets traded cautiously as the initial tailwinds from last week’s US jobs report eventually faded amid softer than expected Chinese trade data. ASX 200 (-0.2%) was choppy as the strength in tech and mining names was offset by underperformance in financials and with NAB among the worst performers as it faces an anti-money laundering investigation by AUSTRAC for potential serious and ongoing breaches. Nikkei 225 (+0.3%) rallied at the open and reclaimed the 29k level but then wiped out most of the gains amid the recent counterproductive moves in the local currency and broad cautious tone. Hang Seng (-0.5%) and Shanghai Comp. (+0.2%) were lacklustre as participants digested the latest Chinese trade data which mostly missed expectations and following punchy rhetoric from US officials on China including Secretary of State Blinken who said the Biden administration will get to the bottom regarding the origins of COVID-19 and that the US will hold China accountable, while US Trade Representative Tai commented that the US-China trade relationship has “significant imbalance” and that the Biden administration is committed to levelling it. The declines in Hong Kong were led by casino names after reports that Macau is to block non-residents entering from Guangdong beginning June 8th, although the world’s largest pork producer WH Group is at the other end of the spectrum with firm gains following the announcement of a USD 1.93bln share buyback. Finally, 10yr JGBs held on to Friday’s after-hour gains amid a surge in T-notes following the NFP miss but with further upside in Japanese bonds capped as Japanese stocks just about remained afloat and with the absence of the BoJ’s Rinban operations today, while the Aussie 10yr yield was lower by about 6bps after it tracked recent downside in global peers and with the RBA also conducting its regular QE operations.

Top Asian News

- Flipkart Is Said in Talks for $3 Billion From SoftBank, Others

- Thailand Ramps Up Vaccine Rollout as Phuket Reopening Nears

- Evergrande Slumps to One-Year Low as Regulators Tighten Grip

- Saudi Wealth Fund, Early Alibaba Investor Back Jordanian Startup

European equities trade with no firm direction (Euro Stoxx 50 Unch.) having experienced a mild downside bias at the cash open, whilst APAC markets closed mixed after the broader NFP-induced optimism waned. US equity futures are also trundling lower with the YM (-0.1%) faring slightly better than its ES (-0.2%), NQ (-0.4%) and RTY (-0.4%) counterparts, whilst US Treasury Secretary Yellen over the weekend sounded more comfortable with the prospect of higher rates, stating that it would be a “positive” for the country. Nonetheless, the overall tone of the market is similar to tentativeness last week heading into the US open, with news flow also on the quiet side. Sectors in Europe are now mixed after opening largely in the red. Basic Resources are weighed on by the subdued base metal prices after Chinese trade data missed the mark. Autos and Banks are among the top performers whilst Tech resides among the laggards alongside Healthcare. Sectors overall do not portray a clear overarching theme. In terms of individual movers, Royal Mail (+2.6%) sits as one of the Stoxx 600 winners as the Co. takes steps to fend off competition by offering timed delivery slots from next year. Reckitt (-0.1%) failed to garner much traction despite reports that it entered an agreement to sell its infant formula and child nutrition businesses to Primavera Capital Group for an enterprise value of USD 2.2bln. IWG (-16%) meanwhile plumbs the depths after a downbeat trading update in which it now sees underlying EBITDA to be well below 2020 levels.

Top European News

- Tesco and Carrefour to End Buying Alliance and Go It Alone

- Merkel’s Heir Bolsters Bid for Chancellorship With State Win

- Oman Hires Advisers Including Citi, HSBC for Islamic Bond Sale

- Bankers Demand Clarity as Sweden Watchdog Balks at ESG Rules

In FX, a choppy start to the week for the broader Dollar and index, with the latter managing to remain above its 21 DMA (90.108) vs the 90.023 post-NFP low print. The index notched a current intraday high at 90.302, but news flow and catalysts have remained light as traders set sights on this week’s ECB and US CPI. On that note, ECB and Fed speakers also remain scarce for the week as officials observe their respective pre-meeting blackout periods.

- AUD, NZD, CAD – All vary vs the Greenbank but with the breadth narrow. The Aussie narrowly outperforms amid a rise in Chinese imports and S&P affirming its rating but upgrading the Aussie outlook. Some tailwinds could also be derived from technical factors as the pair topped its 50 and 100 DMAs (0.7723 and 0.7726 respectively) as it eyes the 0.7750 marks, coinciding with the 21DMA. NZD/USD meanwhile probes 0.7200 having had traded on either side of the mark, but with upside contained as the AUD/NZD cross eyes 1.0750 to the upside. The Loonie, meanwhile, lags as oil prices pull back after WTI briefly notched USD 70/bbl.

- EUR, GBP – Sterling sees slightly more pressure vs the EUR – possibly technical as EUR/GBP tops 0.8600, but with some tailwinds emanating from more noise surrounding the Northern Irish protocol between Britain and the EU bloc, with weekend reports suggesting that Brexit European leaders are drawing up plans to impose trade sanctions on Britain and accused UK PM Johnson of “taking them for fools” over the Northern Ireland protocol. Cable has dipped back below its 21 DMA (1.4141) from a high of 1.4170 with no follow-through from a slight beat in May Halifax House Prices, whilst EUR/USD trades on either side of 1.2150 after testing but failing to breach its 21 DMA at 1.2173.

- JPY – USD/JPY remains caged on both sides of 109.50 but still north of its 21 and 50DMA at 109.28 and 109.19 respectively, with the pair also eyeing several sizeable OpEx north of 109.50, with USD 1.25bln rolling off at the half-number.

In commodities, WTI and Brent front month futures are subdued as sentiment remains indecisive after the post-NFP optimism seen on Wall Street on Friday waned. WTI Jul however printed USD 70/bbl for the first time since 2018 before giving up gains and some more as it trades around USD 69/bbl at the time of writing. Brent Aug meanwhile resides in the low-USD 71/bbl levels after hitting a session high of USD 72.27/bbl. Oil-specific news flow has been quiet, although this week sees the trio of monthly oil market reports – with focus likely to fall on the demand picture heading into summer and risks surrounding Iranian oil returning to the market. OPEC-related commentary (i.e. production figures) will likely be stale given the monthly meetings and set quotas through July. Elsewhere, precious metals are subdued but holding onto a lion’s share of its post-NFP gains, with spot gold in a USD 10/oz range around USD 1,880/oz and spot silver just north of USD 27.50/oz as yields and the Buck dictate price action, although the former sees its 21 DMA (1,873/oz) in the vicinity. Turning to base metals, LME copper remains sub-10,00/t as China’s unwrought copper imports fell M/M in May on record-high prices, whilst BHP kicks off labour talks with workers from its largest Chilean mine, Escondida, with initial proposals for a new contract submitted on Friday – the Co. has 10 days from the receipt date to respond to the union.

US Event Calendar

- 3pm: April Consumer Credit, est. $20.5b, prior $25.8b

DB’s Jim Reid concludes the overnight wrap

The big event this week is undoubtedly Thursday’s US CPI release. Consensus estimates for May currently expect both the headline and core rate to rise +0.4% month-on-month which would lift the YoY rate to 4.7% and 3.4% respectively which will be the highest since late 2008 and 1993 which would be a pretty impressive feat especially on the core. This will undoubtedly be the most watched data release this year so far.

We will also pay close attention to the inflation expectations data in Friday’s University of Michigan consumer sentiment survey (89.0 vs 82.9). To beat a well worn drum, our rates strategists feel that expectations are heading back to their 1998-2014 regime after 7 years of rock bottom levels likely due to the slump in the oil price around that time. In turn this should be worth 3% on 10 year Treasuries. Their 2.25% YE forecast reflects a probability, rather than certainty, of this happening. Last month the 5-10 year expectation rose to a revised 3.0% with the 1yr at 4.6%.

This follows May’s employment report missing expectations. The 559k gain headline payrolls (496k private) was characterised by Cleveland Fed President Mester as “solid” but still short of “substantial further progress”. She also noted that the data are “not anywhere near a wage-price spiral”. While there was some evidence in the report that labour shortages are resulting in upward pressure on wages – high demand in the leisure & hospitality sector being the most obvious – we are clearly along way from normality in the US labour market. However things might change very quickly as the economy fully opens up this year.

Note that our US economists will be hosting a webinar with William English, Professor in the Practice, Yale School of Management and former Director of the Division of Monetary Affairs at the Federal Reserve Board, tomorrow at 09:00 EST / 14:00 BST / 15:00 CET to discuss the outlook for Fed policy (See “The outlook for Fed policy: Taper timeline and beyond” to register for the event). This is all ahead of next week’s FOMC.

Outside of US CPI the other main event of the week will be Thursday’s ECB meeting, where much attention will be on what sort of pace the Governing Council decides on for the bank’s PEPP purchases. Given the dovish tilt in the Council’s latest commentary, our economists expect the ECB to maintain the faster pace of PEPP purchases for the time being. However, they expect that after June the market focus will be on PEPP exit, as it is a pandemic policy and we expect exit to be confirmed in September or December. See here for their full note. Otherwise, the other G20 central bank policy decisions will come from Canada on Wednesday and Russia on Friday. There are no Fed governors set to speak this week as Saturday marked the start of their blackout period ahead of next week’s FOMC meeting. The rest of the data week is in the day by day calendar at the end.

In Asia, markets have started the week on a mixed footing with the Nikkei (+0.32%) and Kospi (+0.36%) up while the Hang Seng (-0.77%) and Shanghai Comp (-0.21%) are down. Meanwhile, futures on the S&P 500 are down -0.10% while those on the Stoxx 50 are also down -0.07%. In terms of overnight data releases, China’s May exports came in at +27.9% yoy (vs. +32.1% yoy expected) while imports came in at +51.1% yoy (vs. +53.5% yoy expected).

In other interesting overnight news, US treasury secretary Janet Yellen said that President Joe Biden should push forward with his $4tn spending plans and added that “If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view.” She also said that Biden’s packages would add up to roughly $400bn in spending per year and contended that it’s not enough to cause an inflation over-run. Yields on 10y USTs are up +1.6bps this morning to 1.571%.

Ahead of this weekend’s G-7 meeting we saw an agreement in principle from the same seven countries for a minimum global corporation tax of “at least 15%” on overseas earnings. The focus will now shift to a meeting of G20 finance minister in July to see if we can get wider agreement and on long-running talks between about 140 countries at the OECD. Overall it’s been clear for the last couple of years, even before the pandemic, that a 40-year race to the bottom for corporate tax rates was coming to an end and was likely to reverse. The pandemic has accelerated this.

Turning to Germany’s state election now where Angela Merkel’s Christian Democrats are most likely to win in Saxony-Anhalt and fend off the AfD. According to projections from public broadcaster ARD, the CDU is on course to win 37%, an improvement over the 30% it received in 2016 in the state, while the far-right AfD, which was pushing for the lead in recent polls, is likely to be well back in second with 22% (24% five years ago). This was the final electoral contest before the national vote in September and will be a boost to the CDU’s Armin Laschet as he bids to succeed Merkel in the Chancellorship.

Now finally to review last week. Risk assets performed well for a second straight week with equities advancing to new highs in Europe, with the STOXX 600 up +0.80% to a new record. The S&P 500 was up +0.61% to close less than 0.1% away from its record closing high from early May. Large-cap tech did particularly well with the NYFANG index posting its third straight weekly gain (+0.99%) after falling for the previous four weeks.

With inflation expectations abating, sovereign bonds gained again last week, with yields on 10yr Treasuries down -4.1bps to 1.553%, with much of that drop coming on Friday (-7.2bps) following the weaker payrolls data. This was the 7th weekly decline in yields in the last 9 weeks. The decline on Friday was driven by lower real rates (-6.1bps) however the weekly drop in yields was more driven by the drop in inflation expectations (-2.7bps). In Europe, sovereign debt also performed well, with yields on 10yr bunds seeing a -3.0bps decline. Lastly, commodity prices rose to a new high as the Bloomberg commodity spot index rose +2.00%, led in part by oil prices reaching two year highs with Brent Crude (+3.25%) and WTI (+4.98%) seeing a strong week even as copper prices (-3.17%) sagged.

On the data front, the US job report showed +559k new jobs, less than the 675k expected, with no significant upward revision to last month’s historic miss.

Tyler Durden

Mon, 06/07/2021 – 07:58![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com