Fed Blinks!

Since the April 28th FOMC meeting, gold is the strong outperformer while the dollar is unchanged. Bonds and stocks are up about the same (1.5-2%)…

Source: Bloomberg

At the March meeting, only 4 FOMC members saw a rate hike in 2022…

Source: Bloomberg

The market is about 50-50 in its guess for a 2022 rate-hike (notably less than at the last April 28th FOMC meeting)…

Source: Bloomberg

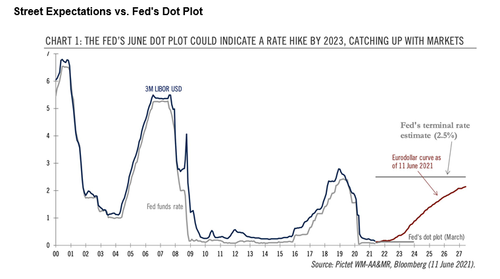

Finally, we note that the longer-term expectations of the market are significantly divergent (and more hawkish) from The Fed’s…

So what will The Fed do?

The big question is the 2023 Fed Funds dot plot (and whether it will be adjusted enough to shift the median expectation to a rate-hike).

The other thing to focus on – frankly ignoring the words of the statement – is whether the 2023 PCE projection is increased from March’s 2.1% forecast, which could spook the market’s faith in The Fed’s view that the inflation spike is transitory.

And what will Powell say about the stagflationary onset that is cornering him?

Source: Bloomberg

We do note that stocks were at the lows of the day ahead of the statement…

And here’s what happened:

The Fed keeps benchmark rates and the pace of bond-buying unchanged but the biggest shift is a hawkish tilt to its rate forecasts as Fed median projections show 2 rate-hikes by end-2023 and 7 FOMC members see a hike in 2022…

Additionally, given the massive excess in The Fed’s RRP facility, it hiked IOER by 5 bps to 0.15% from 0.10%

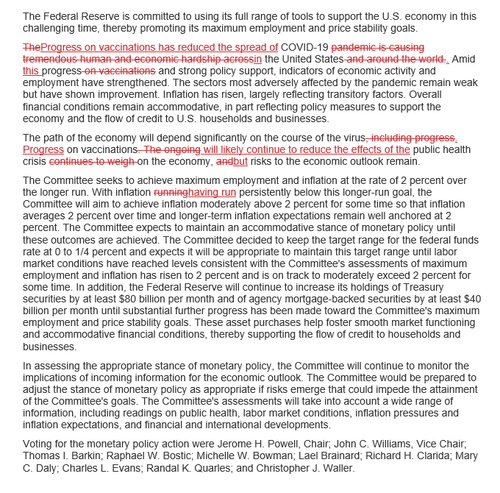

Full redline blow:

What happens next?

Tyler Durden

Wed, 06/16/2021 – 14:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com