Major Banks Raise Dividend, Boost Buybacks As Expected After Stress Test Results

After getting the (completely expected) green light from the Fed last week to resume dividend and buyback increases, guess what all the major banks just did…

- *MORGAN STANLEY DOUBLES QTR DIV TO 70C, TO BUY BACK UP TO $12BN

- *JPMORGAN TO BOOST QTR DIV TO $1.00/SHR; TO CONTINUE BUYBACK

- *STATE STREET TO BOOST QTRLY STOCK DIV TO $0.57/SHR, CONTINUE SHARE REPURCHASES IN UPCOMING QUARTERS

- *BANK OF AMERICA PLANS 17% DIV BOOST

- *GOLDMAN SACHS PLANS DIV BOOST FROM $1.25 TO $2.00/SHR

- *CITI SEES CONTINUING DIVIDENDS OF AT LEAST $0.51/SHR, BUYBACKS

- *U.S. BANCORP PLANS 9.5% DIVIDEND INCREASE TO 46C/SHARE IN 3Q, EXISTING SHARE BUYBACK PROGRAM STAYS IN EFFECT

Naturally, the CEOs who are also substantial shareholders, were delighted by the outcome:

“We are encouraged by the progress in reducing the capital intensity of our business as reflected in the recent stress test results,” said Chairman and CEO David Solomon

“Morgan Stanley has accumulated significant excess capital over the past several years and now has one of the largest capital buffers in the industry,” Chief Executive Officer James Gorman said Monday in a statement.

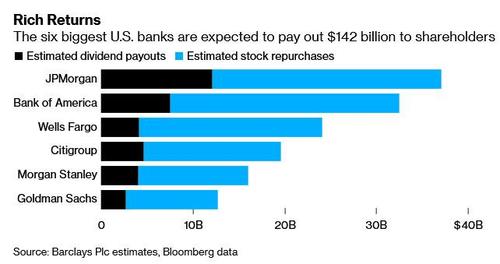

While we await the final number of bubacks to be tallied, we remind readers that expectations were that the six biggest banks would boost buybacks to repurchase up to $142 billion in shares.

For some reason, investors are surprised (to the upside) by this event which was telegraphed before last week’s results and even more telegraphed before today’s actions…

Source: Bloomberg

We look forward to what Senator Elizabeth Warren has to say about this Fed-enabled “enrichment of executives.”

And while all of the above was largely as expected, last week Credit Suisse repo guru Zoltan Poszar warned of a potentially troubling twist.

In his latest Global Money Dispatch, Pozsar noted that among other things, today’s stress test results will determine the stress capital buffers (SCB) large banks will have to hold in 2022, which will affect their CET1 minimums. Naturally, lower SCBs allow the largest U.S. banks to run with higher G-SIB surcharges, and this trade-off is particularly important for J.P. Morgan. According to Pozsar, the bank will be more willing to let its G-SIB surcharge climb to 5% this year from 4% last year if its SCB comes in around 2.5%, down from 3.3% currently. As a result, today’s release may have “a big impact on the pricing of the year-end turn in FX swaps: if J.P. Morgan’s SCB drops a lot, year-end premia might shrink a lot from here.”

There’s more: looking ahead to the June 30 expiration of stock buyback limitations, the Hungarian repo guru writes that the upcoming wave of buybacks “destroy balance sheet capacity in the banking system” as banks that return capital to shareholders have less capital to leverage up.

Here’s the math: with a 5% Supplemental Liquidity Ratio minimum at the holdco level, banks run 20-times leverage, which means that $10 billion in stock buybacks means $200 billion less of banks’ demand for reserves, Treasuries, MBS, and deposits.

This means that as banks rush to handout cash to shareholders, they will be forced to park even more reserves elsewhere… like for example the Fed’s reverse repo facility. This “push” by banks to shed capacity and potentially some deposits will meet the “sucking sound” of the RRP facility in coming weeks. It comes as usage of the Fed’s reverse repo facility has been rising by tens of billions daily and on Monday rose to just north of $800 billion.

Now imagine what will happen to the RRP facility if banks indeed proceed to repurchase $142BN in stock; applying Pozsar’s 20x leverage multiple, this means that bank balance sheets will shrink by just under $3 trillion, including trillions in reserves which will have to be parked at the Fed, which also means that in the coming weeks usage on the Fed’s reserve facility is set to explode to unprecedented levels. This in turn will only accelerate the next funding crisis (now that the banking system has shifted from being asset constrained (deposits flooding in, but nowhere to lend them but to the Fed), to being liability constrained (deposits slipping away and nowhere to replace them but in the money market) thanks to the Fed’s IOER/RRP rate hike), as we described in “Powell Just Launched $2 Trillion In “Heat-Seeking Missiles”: Zoltan Explains How The Fed Started The Next Repo Crisis.”

One final technical consideration from Zoltan is that the flattening of the yield curve in recent days hit bank stocks, so banks may start buybacks on July 1st, which means banks might choose to stay liquid around quarter-end. This will be an extra factor to consider in pricing the June quarter-end turn.

As Pozsar concluded, “ample liquidity is ample only if banks are willing to trade it, and trading liquidity means giving it up, which large banks might not want to do when the “pull” of the o/n RRP facility can complicate re-starting buybacks as early as July 1st.“

Tyler Durden

Mon, 06/28/2021 – 17:14![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com