Global Stocks Rise To New Record High As US Futures Drift In Muted Holiday Session

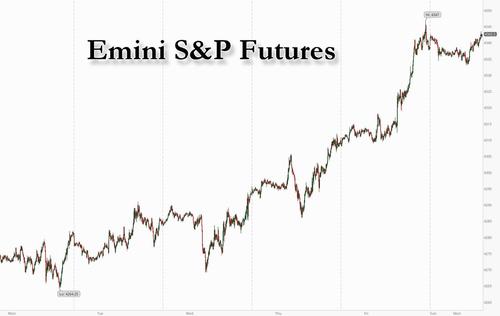

After 7 consecutive days of gains propelling US stocks to fresh all time highs, a feat last achieved in 1997, US equity futures were flat during Monday’s subdued holiday session…

… as WTI crude rose for a fourth day in five as the UAE held out against an extension of output increase by the OPEC+ alliance, threatening a collapse of the oil cartel which is meeting later today in what may be a decisive meeting for oil. The dollar dropped for a second day.

“Today’s public holiday suggests trading will be quiet, although the Fed story will very much re-emerge on Wednesday evening when investors pore through the minutes of the pivotal June 16th FOMC meeting,” ING Groep strategists including Chris Turner wrote in a note. “Before then, we expect much focus on the commodity complex.”

“Markets in general are still trying to find their feet,” said James Athey, investment director, Aberdeen Standard Investments. “Equities, of course, continue to shrug off or ignore anything that might be considered remotely negative as they continue their merry and complacent dance towards an inevitable reckoning.”

The S&P closed 0.8% at a new all-time high for a seventh straight day on Friday as data showed U.S. job growth surged the most in 10 months, although below the surface it was weaker than expected prompting some to question the Fed’s commitment to tapering as soon as later this month. Investors will watch Didi Global when U.S. markets reopen after China accelerated in crackdown on the ridehailing company.

“The goldilocks print suggests there is no need to accelerate the tapering timeline or the implied rate hike profile,” Tapas Strickland, an analyst at National Australia Bank, wrote in a client note. “Overall the level of payrolls is still 6.8 million below pre-pandemic February 2020 levels and is still below the level of substantial progress needed by the Fed. As such there is nothing in this report for the Fed to become hawkish about.”

While markets are closed here are some names that are in the news this morning, courtesy of Bloomberg

- Affiliated Managers Group (AMG): The asset management company agreed to buy ESG-focused investment management firm Parnassus for $600 million, Barron’s reported Sunday, citing a person knowledgeable about the transaction.

- Amazon.com (AMZN): The company will give incoming CEO Andy Jassy 61,000 shares of stock — currently valued at more than $214 million — that will vest over the next 10 years, according to a filing.

- Booking Holdings (BKNG): The travel platform, which gets the majority of its profits from Europe, is one way to invest in the continent’s travel recovery from a U.S. listing.

- Comcast (CMCSA): Universal Pictures dominated the top three spots in box office during the July 4th holiday as audiences poured in to see its returning action flick “F9” and two new releases.

- Didi Chuxing (DIDI): China’s cyberspace regulator ordered app stores to remove Didi Chuxing, citing serious violations on collection and usage of personal information, without elaborating.

- Genesco (GCO): Institutional Shareholder Services urged investors in Genesco to support board candidates proposed by managers at the upcoming AGM. Legion’s nominees “do not appear demonstrably superior” to the directors whom they would replace, it said.

- Johnson Controls (JCI): The heat wave in the U.S. could benefit the company, which offers products on cooling, heating, and ventilation products, Barron’s says.

- Johnson & Johnson (JNJ): Some people who received the Johnson & Johnson Covid-19 shot in the U.S. are seeking out added doses of a messenger-RNA vaccine, fearing their initial inoculation won’t protect them from the virus.

- Mirati Therapeutics (MRTX): The company registers $500 million shares for potential sale.

- NCR (NCR): The company, which produces cash registers and ATMs, may be one of the best ways to play a post-Covid rebound in the consumer economy, Barron’s writes

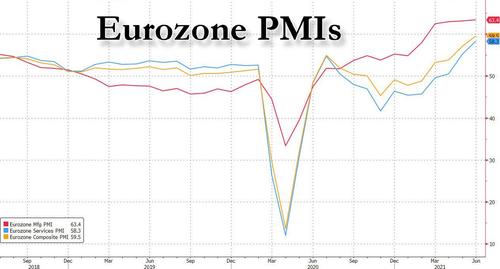

The MSCI All Country World index closed at a record 724.66 last week, and was 0.1% higher on Monday. Europe’s STOXX 600 index rose 0.2%, reversing earlier losses after data showed euro zone businesses expanded activity at the fastest rate in 15 years in June. Activity for British services firms also soared in June, albeit at a slightly slower rate.

Wm Morrison shares rose as much as 12% to the highest since 2018 after Apollo Global Management said it’s considering an offer, heating up a takeover battle for the U.K. grocer which over the weekend agreed to a 6.3 billion-pound bid from a consortium led by Fortress Investment Group. Peers also rose: Sainsbury +2.1%, Tesco 1.8%, Marks & Spencer 3.7%

In France, stocks slipped 0.4% as Health Minister Olivier Veran warned France could be heading for a fourth wave of the pandemic due to the highly transmissible Delta variant.

Here are some of the biggest European movers today:

- European mining stocks gained, with the Stoxx Europe 600 Basic Resources Index rising as much as 1.4%, as base metals gain on Chinese demand.

- Diversified miners advance: BHP +1.5%, Anglo American +1.4%, Rio Tinto +1.5%, Glencore +1.5% after naming new chairman and completing leadership overhaul.

- Landis+Gyr shares jumped as much as 11%, their biggest intraday increase on record, after the Swiss smart-meter maker signs a 20-year pact with National Grid in the U.S. for a grid modernization project.

- Altri shares gained as much as 3.3%, highest intraday price since June 18. Some investors are buying shares to receive Greenvolt stock in the upcoming IPO, according to Antonio Pedro Fonseca, head of trading at Banco Invest.

- Electricite de France shares fall as much as 4.9% after French Finance Minister Bruno Le Maire said it will be difficult for the country to accept the European Commission’s requests regarding a proposed reorganization of the company tied to regulatory reform.

- Naspers and Prosus shares fell following weakness in Tencent stock after China expanded a cybersecurity probe beyond Didi Global. Naspers declined as much as 4.5%, unit Prosus slides as much as 5%.

- Nobina shares extended its losing streak to a second day, dropping as much as 7% after Nordea downgraded to hold from buy post earnings.

Earlier in the session, MSCI’s broadest index of Asia-Pacific shares outside Japan, was flat as gains in technology-hardware stocks were offset by declines in Chinese internet giants. Chipmakers TSMC and Samsung were among the biggest boosts to the MSCI Asia Pacific Index. Tencent and Alibaba took a beating after local regulators moved to block Didi Chuxing from app stores just days after the ride-hailing firm’s U.S. listing. Tencent fell as much as 4.2%.

“The near-term focus for markets will be the Fed/U.S. monetary policy outlook, Delta variant and the earnings season,” Nomura strategists led by Chetan Seth wrote in a note. “Overall, we maintain our view that any weakness in Asian equities stemming from potentially tighter U.S. monetary policy outlook will likely be short-lived and less disruptive (vs 2013) and eventually an opportunity for investors to raise allocations.”

Taiwan led advances around Asia Pacific on Monday, with its benchmark rising more than 1%, while Hong Kong led decliners. Japanese equities fell following a drop in U.S. Treasury yields and mixed local-election results. China’s CSI 300 Index fluctuated after plunging 2.8% on Friday. China’s blue chip stock index recovered from earlier losses to close 0.1% higher as pledges by Beijing to continue policy support for its tech sector helped counter worries about a crackdown on ride-hailing giant Didi Global and scrutiny of other platform companies in the country.

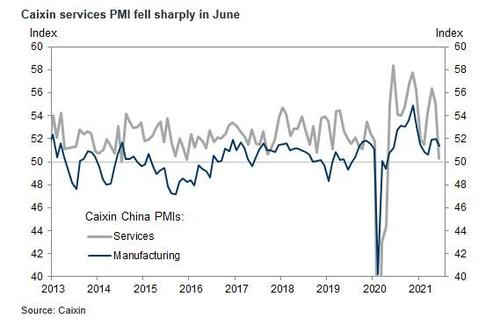

Meanwhile, on the economic front an index of China’s services industry slowed sharply in June following virus outbreaks in some parts of the country and weaker new orders. The survey showed a deeper downturn in services than the official non-manufacturing gauge released last week.

COVID-19 angst also weighed on Japan shares, with the Nikkei falling 0.6%, to a two-week low, following a surge in infections in Tokyo, just weeks before the city hosts the Olympics.

In rates, Treasury cash trading was closed while eurozone government bond yields nudged higher but analysts expect the recent downward trajectory to resume after the U.S. payrolls data. Germany’s 10-year Bund yield was up by half a basis point at -0.231%.

In FX, the dollar was mostly flat on Monday after dropping from a three-month high at the end of last week, pressured by the weaker details of the U.S. payrolls report. The greenback climbed by about 0.2% to $1.1859 per euro and traded flat at 111.05 yen.

In commodities, crude oil was rangebound as OPEC+ talks dragged on. Saudi Arabia’s energy minister pushed back on Sunday against opposition by fellow Gulf producer the United Arab Emirates to a proposed OPEC+ deal and called for “compromise and rationality” to secure agreement when the group reconvenes on Monday. Brent crude added 0.1% $76.21 a barrel, and U.S. crude gained 0.1% to $75.25 a barrel. Gold was up 0.3% to $1,792.30 an ounce.

Later this week, attention will turn to the minutes of the Federal Open Markets Committee meeting from last month, when policymakers surprised markets by signalling two rate hikes by the end of 2023. Commentary by Fed officials since then has been more balanced, particularly from Chair Jerome Powell, and investors parse Wednesday’s release for further clues on the timing of policy tightening.

DB’s Jim Reid concludes the overnight wrap

A happy Independence Day for yesterday, and holiday today, to all our US readers. Why you all wanted to leave the union with the U.K. some 245 years ago I’ll never know. If you’d have stayed you could have won Euro 2020 as England have marched into the semi-final after a 4-0 win on Saturday. I annoyingly missed the first three goals as we had a water emergency. To prepare for the football we had the kids’ dinner done early and just as we were about to put them to bed we noticed we had no water from the taps. After an initial check around ourselves we tried to call a plumber. As you can imagine trying to find a plumber within one hour of a major national football match was impossible. Not one person picked up the phone. The water company told us to turn off the stopcock in case of a leak and as the first goal went in I was at the road side with a wrench lifting up a big manhole cover and turning off the supplies. I heard the neighbours celebrate that gave me a clue to the first early goal. I juggled my wrench in joy. At half time the kids were in bed and my wife went to try to make some toast. The toaster wasn’t working which given it was new (see Friday’s EMR), led us to check the electricity circuit. Basically one ring of appliances had tripped without us knowing and it then dawned on us that the water pump we had installed to ensure we always get full pressure had also tripped. So we wondered whether the water was fine after all. I went outside again with my big wrench and turned the water back on. Bingo! It worked. However another two cheers from my neighbours whilst I was doing that indicated we were 3-0 up. So England march on to a Wednesday night semi against Denmark. Given that me not watching is a lucky omen if you need any plumbing done in the south east of England on Wednesday night give me a shout. I’ll come with my wrench.

Turning ourselves away from football, normally the week after payrolls is relatively quiet for fresh schedule data/newsflow but given the first Friday of the month was so early we still have PMIs/ISM from the service sector to look forward to today and tomorrow (US). Outside of that the main event of the week will be the release of the last FOMC minutes (Wednesday) given the surprise move at the meeting. Elsewhere a gathering of G20 finance ministers and central bank governors (Friday) will be interesting, especially after the news that 130 countries had signed up to the minimum tax agreement last week. Finally the development of the delta variant is never going to be too far from the top of the headlines. It has certainly put a dampener on the reopening trade for now. The U.K. is at the top of the global charts for new cases again, yet it seems to be powering ahead towards a full reopening two weeks today. So this is going to be an enormous test case as to whether heavily vaccinated countries can live with the virus.

Going through the main highlights to look forward to this week in more detail now. Firstly we have the release of the global services and composite PMIs today and tomorrow. The flash readings we’ve already had were pretty strong, with the Euro Area composite PMI at a 15-year high of 59.2, while the US number came in at 63.9. Overnight, China’s Caixin June services PMI came in at 50.3 (vs. 54.9 expected and 55.1 last month), the lowest level since April 2020. On prices, the statement along with the release added that “Prices in the service sector were stable, as inflationary pressure eased. High commodity and labor prices continued to push up costs for services companies, but the growth of input prices slowed.” Japan’s final services PMI came in at 48.0 vs. 47.2 in flash.

Back to week ahead and also in focus will be the ISM Services index from the US, after the ISM manufacturing reading last Thursday saw the employment index move below 50 for the first time since November. And on top of that, the prices paid measure hit its highest since 1979, so we can expect there to be continued focus on signs of inflationary pressures. On employment, it’ll be worth looking out for the latest US JOLTS data for May on Wednesday will also be closely watched as this has shown a much healthier labour market than payrolls of late.

The main highlight outside of data will probably be the release of the FOMC minutes from their June meeting on Wednesday. That has the potential to shed further light on the hawkish shift that saw the median dot move to project two rate hikes in 2023, up from zero back in March. All signs of how the committee felt about the taper will also be devoured but we have heard from several members on this topic since the FOMC. Otherwise, there’ll be a few speakers to look forward to, including ECB President Lagarde and Bank of England Governor Bailey. In terms of monetary policy decisions however, the only G20 decision scheduled for this week is from the Reserve Bank of Australia (Tuesday), where the consensus expectation is that they’ll keep their cash rate target unchanged at 0.10%.

The G20 finance ministers and central bank governors meeting on Friday, which is taking place in Venice, will be interesting to see if there’s any discussion on the ongoing OECD negotiations on reforming the global corporate tax system, which, it was announced, 130 countries and jurisdictions have now signed on to. The main changes would see companies pay more taxes in the jurisdictions they operate in, including digital companies, and also a global minimum corporate tax rate.

Asian markets are a bit directionless this morning ahead of the US holiday with the Nikkei (-0.60%) and Hang Seng (-0.45%) down while the Kospi (+0.42%) and Shanghai Comp (+0.16%) are up. Futures on the S&P 500 are down -0.12% while those on US treasuries are broadly flat. In FX, the US dollar index is up +0.13% recouping part of Friday’s -0.40% decline.

In terms of the latest on the OPEC+ meeting, the stalemate in talks have continued as the UAE has still not stepped into line with the next meeting to break the deadlock scheduled for today (c. 2pm BST). As things stand, all the members of OPEC+ including Russia have agreed that the group should increase production over the next few months, but also extend its broader agreement until the end of 2022 for the sake of stability while, the UAE is against the extension of the deal, supporting only a short-term increase and demanding better terms for itself for 2022. Saudi Arabia’s Prince Abdulaziz has said that without the extension of the agreement, there’s a fall-back deal in place, under which oil output doesn’t increase in August and for the rest of the year. This could of course risk a spike up in oil. However this could break the OPEC+ alliance under a more extreme scenario which could lead to a production free for all and a price slump. So lots to play for and one for the game theorists.

In other news, the ECB executive board member Isabel Schnabel said that she sees “growing evidence” inflation expectations are finally starting to align with the ECB’s target of just-under 2%, but that continued monetary and fiscal stimulus is needed to ensure that happens. She added that it is “necessary and proportionate” that inflation overshoots the institution’s goal for a while as the economy recovers. The comments come as the ECB prepares for a special meeting this week to debate changing its price-stability strategy.

Turning to the pandemic, French Health Minister Olivier said in a tweet over the weekend that a wave of infections may hit France by the end of July because of the delta variant, based on what’s happening in the UK. Meanwhile across the other side of the Atlantic, a Washington Post/ABC News poll showed that more than a quarter of people in the country are unlikely to get a Covid-19 shot, with 20% saying they definitely won’t and 9% saying they probably won’t. So it looks as though the US will struggle in the last mile of the vaccination campaign which of course has implications.

Recapping last week now, it was a fairly divergent performance for financial markets, with the US seeing a strong performance, whereas other regions were relatively weaker. By the end of the week, the S&P 500 had risen +1.67% (+0.75% Friday) to hit yet another fresh all-time high, whilst the VIX index of volatility was down -0.55pts (-0.41pts Friday) to hit a post-pandemic low. Sentiment in the US was supported by what can only be described as a goldilocks jobs report from markets, as it was sufficiently strong to reassure investors about the recovery, but also not so strong that it triggered worries that the Fed would pare back their stimulus more rapidly than expected. The headline number for nonfarm payrolls was up +850k (vs. +720k expected), marking the strongest job growth in 10 months. However, the unemployment rate unexpectedly ticked up a tenth to 5.9% (vs. 5.6% expected). US Treasuries similarly had a decent performance, with 10yr yields down -10.0bps (-3.4bps Friday), as strong technicals, delta, and faith in the Fed dominated.

Over in Europe last week saw a more subdued performance, with the STOXX 600 falling -0.18% (+0.26% Friday), whilst rising geopolitical tensions in Asia saw the Nikkei fall -0.97% (+0.27% Friday) and the Shanghai Composite fall -2.46% (-1.95% Friday). Covid-sensitive assets were another group to struggle amidst the continued spread of the delta variant, with the STOXX Travel & Leisure index down -1.01% (+0.57% Friday) in its 3rd successive weekly decline, whilst the S&P 500 airlines index fell -1.85% (-0.38% Friday) in its 5th successive weekly decline. On the other hand, commodities continued to recover from their losses after the Fed meeting, with WTI oil prices up +1.50% (-0.09% Friday) in its 6th successive weekly advance. Agricultural prices also performed strongly after weather-related disruption and weaker-than expected supply data, with corn prices up +9.54% (-3.13% Friday), and soybeans up +9.17% (+0.35% Friday).

Tyler Durden

Mon, 07/05/2021 – 07:59![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com