Here’s Why The Rally Is Seen Going On For A While

By Kit Rees, Bloomberg reporter and commentator

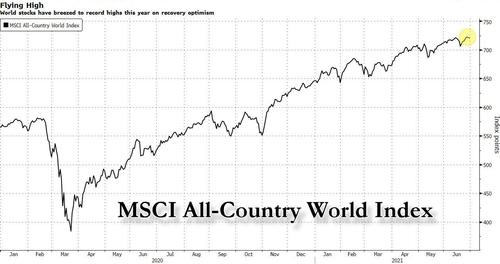

Stocks around the world continue to smash one record after another, and some of the world’s biggest money managers have a simple message: Get used to it.

The likes of BlackRock Inc., State Street Global Markets, UBS Asset Management and JPMorgan Asset Management expect equity markets to keep rising in the second half of the year, with many investors increasingly looking outside the U.S. for more returns. They cite reasons such as the economic recovery, continuing central-bank accommodation and a lack of alternatives amid low rates and the tightest credit spreads in a decade.

“Many indicators suggest there is still overwhelming liquidity in the system that is looking for a home,” says Carsten Roemheld, capital markets strategist at Fidelity International. Flows will continue to go into equities, though return expectations should be much lower from here, he says.

One reason behind the rally in equities is that there is still nothing as attractive as stocks out there, given that developed-market government bond yields remain lackluster and credit spreads have tightened to their lowest levels in over a decade. Goldman Sachs strategists recently flagged that U.S. money-market fund assets have ballooned to a record $5.5 trillion during the pandemic, showing that there is a lot of cash on the sidelines.

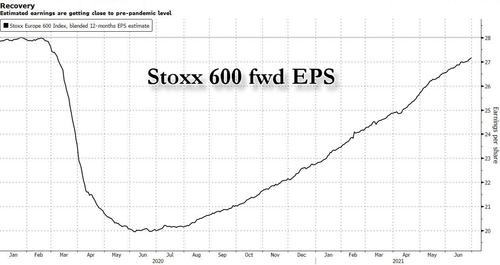

Recovery in earnings growth will also be key to sustaining gains. Globally, profit expectations have bounced back to pre-pandemic levels, and nearly 50% of S&P 500 companies have raised their full-year outlook over the past three months, one of the highest percentage levels since 2010.

“We are slowly looking to position back into value as we expect a solid second half for corporate earnings and the economy,” says Maarten Geerdink, the head of European equities at NN Investment Partners. But that fall short of estimates could be punished.

“Within equities, cyclicals and value should continue to benefit from the likely surge in consumer spending, but investors should also consider secular growth stocks, such as mega-cap technology,” says Seema Shah, the chief global strategist at Principal Global Investors.

Still, an extended rally is not a given, considering much of the reopening optimism is already priced in. Some investors are even turning to more defensive sectors. “Quality at a value price is key at this juncture and we are positioning our portfolio in between the barbell of growth tech stocks and the deep cyclical value trades,” says Eric Lynch, managing director at Scharf Investments. “We currently like health care, as it is the only sector where the long term average is still cheap.”

One could argue that the set-up for equities is simply too good, with economic indicators in both the euro area and US running red hot. But even this isn’t necessarily seen as a problem, according to Claudia Panseri, a global equity strategist at UBS Global Wealth Management, who says that historically, peaking leading indicators doesn’t always mean markets will fall.

“Hardly anything has the potential to make you look more foolish as a market participant than to predict a market correction,” says DWS Chief Investment Officer Stefan Kreuzkamp. “The trigger of a correction is unlikely to be one of the many talked about risks, but something that will happen in some niche corner of the market that no one expects.”

Tyler Durden

Tue, 07/06/2021 – 06:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com