Goldman: Here’s Why The Shorts Will Have To Cover This Week

Last weekend, before the S&P broke out into a series of new all time highs despite Thursday’s “harrowing” 1% dip, we shared Goldman’s observations on why the market was entering the best 2-week seasonal period of the year. Since then, the SPX has hit new all time highs 3 out of the past 5 trading days, and on 9 out of the last 11 even as sentiment substantially declined this week in global equities. For context, on Thursday we observed that the TICK Index logged one of the largest (top 4) selling pressure on the open on record.

For those asking what was behind Thursday’s wobble, we mentioned previously listed the reason for the selloff, none of which were new. The general feeling was that equities needed to catch down to other asset classes.

But, as Goldman flow trader Scott Rubner correctly predicted on Friday, when he said that “I think local shorts will need to cover this am” only to see a new all time high in the Dow, S&P and Nasdaq, the selling is pretty much over “as long dealer gamma muted a larger potential drawdown.” Another reason why Goldman expects stocks to keep rising: JPM kicks off the defacto new buyback window on Tuesday.

With that in mind, here is a mini thread from Rubner on “where we came from” and where we are going next.

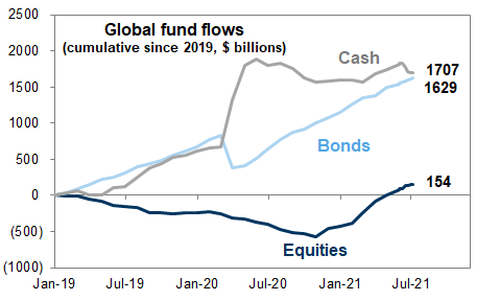

1. GS Wedge: Since January 2019, Money Markets have seen +$1.707 Trillion inflows and Global Bonds have seen +$1.629 Trillion inflows, while Global Equities just +$154 Billion worth of inflows. GS wedge stands at $3.2 Trillion ~ aka the defensive buffer.

2. Cash on the sidelines is waiting for a dip and bought the Thursday dip.

3. 1H 2021 actually logged the 2nd largest money market inflows on record. 1H 2020 was the largest.

4. The cash pile from 2021 has not been reduced.

5. 1H 2021 Bond inflows seem significant? On pace for best year in a decade.

6. Q1 2021 saw the 3rd largest quarterly inflow on record, Q2 2021 saw the 7th largest on record.

7. Global Equity inflows are the biggest story of the year, but do not seem extreme at all when I zoom out.

Goldman’s bottom Line: “We are still in the best two week period of the year, equity inflows are large, 401k are going back into stocks at a record pace. I think local shorts will need to cover.”

Tyler Durden

Sat, 07/10/2021 – 16:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com