“Fear” Nears 2020 Highs As Stocks, Bond Yields, & Crude Crash

After having the boot of fiscal and monetary repression firmly placed on the throat of uncertainty for months (if not years), today was a refreshing slap in the face for many ‘experienced’ traders who have been buying with both hands and feet since last March’s stimmies arrived as possibilities of an imminent taper and Biden’s big spending plan starting to stall raised the specter of reality peeking out from behind the Oz-ian curtain.

I don’t like the way this whole stock market system is set up #DDTG pic.twitter.com/pGRkp5bdWi

— Dave Portnoy (@stoolpresidente) July 19, 2021

With the S&P 500 around 3.5% off its record highs, we note that fear has exploded. The last time fear was this high, the S&P was down 40%!…

Source: CNN

Well done Jay Powell, you’ve enabled the most fragile market in history.

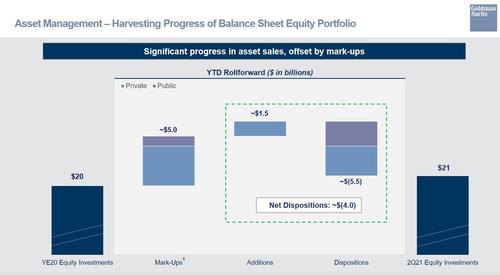

And just a quick reminder before we glimpse at today’s chaos, Goldman dumped a whopping $5.5 billion of its equity assets so far (excluding a modest $1.5BN in purchases) or more than a quarter of its entire portfolio in the last quarter.

The last time Goldman was “aggressively” selling into a “supportive” market? Well, we have to go back all the way to 2007 and 2008 when Goldman was busy creating the very CDOs which its prop desk would then “aggressively” short.

We all remember how prophetic that particular move turned out to be…

Remember that whole May/June rebound in the bubble assets? Well it’s rapidly evaporating….

Source: Bloomberg

Amid anxiety over Delta variant spread (demand fears), OPEC+’s decision (supply increase), and a more general macro ‘risk-off’ sentiment that crushed levered longs, crude collapsed today to a $65 handle

That crash didn’t help bond shorts at all (that are still heavy) and Treasury yields plunged by the most since November today, with the 10Y below 1.20%, at its lowest since February…

Source: Bloomberg

Real yields crashed back near record lows, around -1.08%…

Source: Bloomberg

Today was The Dow’s worst day since October and the broad NYSE Composite’s worst day of the year as every bounce was sold into. Of course, as always there was a completely random buying panic across all the indivces

With breadth stinky…

Source: Bloomberg

NOTE that the late bounce occurred around the ledge levels before The PPT was invited to The White House…

The early rebound, most exuberantly seen above in Small Caps, was all short-squeeze driven as “most shorted” stocks exploded off early lows…

Source: Bloomberg

The S&P 500 broke down quickly to its 50DMA…

The S&P broke a key uptrend today…

The Dow broke down to its 100DMA…

All sectors were lower today with Energy and Financials clubbed like a baby seal…

Source: Bloomberg

After Friday’s OPEX erased a f**kton of gamma, vol was unleashed today with VIX topping 25 intraday…

The entire yield curve crashed today with the long-end down 11bps. NOTE the bond buying started as Europe opened…

Source: Bloomberg

The yield curve flattened dramatically…

Source: Bloomberg

Is it time for stocks to catch down to bonds’ reality once again?

Source: Bloomberg

Not what we were told was going to happen…

Source: Bloomberg

Like they did last year?

Source: Bloomberg

Cryptos were also hit hard today but Bitcoin outperformed (relatively)…

Source: Bloomberg

The dollar ended the day higher after some volatility, back near its YTD highs…

Source: Bloomberg

Which pushed gold lower, but once again found support at $1800…

Delta, Schmelta!! Oh and by the way, this is what the ‘market’ is apparently panicking about… absolutely NO rise in deaths at all…

Source: Bloomberg

Oh, and don’t forget, the NBER said the recession ended last April… so what the f**k are you whining about?

Source: Bloomberg

Tyler Durden

Mon, 07/19/2021 – 16:02![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com