Netflix Slides After Subscriber Guidance Misses Estimates

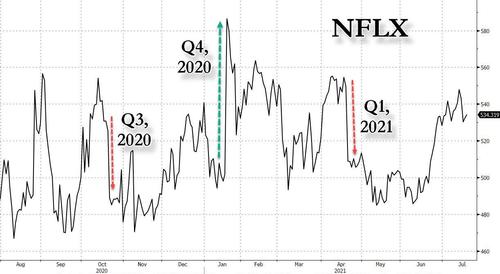

Recent earnings reports from streaming giant Netflix have been a mixed bag: the stock tumbled three quarters ago when the company reported earnings for its first full “post Corona” quarter and warned that “growth is slowing”, before again plunging three quarters ago when the company reported a huge miss in both EPS and new subs, which at 2.2 million was tied for the worst quarter in the past five years, while also reporting a worse than expected outlook for the current quarter. This reversed two quarters ago when Netflix reported a blowout subscriber beat and projected it would soon be cash flow positive, sending its stock soaring to an all time high – if only briefly before again reversing and then tumbling last quarter when Netflix again disappointed when it reported a huge subscriber miss and giving dismal guidance.

Which brings us to today, when investors are on edge today to find out not whether the company would beat or miss expectations, but rather if the slowdown CEO Reed Hastings warned about is for real and has pulled forward even more subscribers due to covid? After all, Netflix has been warning for months that growth would slow in 2021 compared to the phenomenal signup rate at the start of the pandemic lockdown last year. And yes, brace for a huge base effect hit: in the second quarter of 2020, the service added 10 million new customers, second only to the 15.77 million it added in the record first quarter of 2020.

To be sure, despite a series of hit or miss earnings, the company has been riding a wave of optimism, its stock soaring in early 2021. Still, after hitting to a record high in January, the stock has traded rangbeound, unable to break out to a new high, for the past seven months. And while there’s no doubt that viewership has surged during the Covid-19 lockdowns in the U.S. and much of the world, there are complications: the virus has brought TV and film production to a halt, a situation that may only get more dire for Netflix as the months wear on. But the biggest question remains how many future subs has covid brought to the present, and tied to that – will the panic over the Delta strain lead to another mini burst in subscribers in the coming quater(s)?

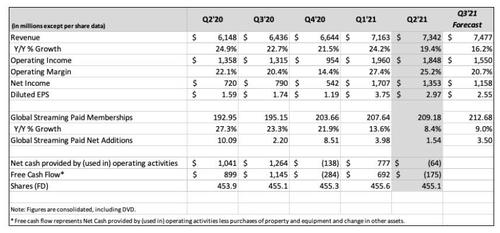

Indicatively, consensus expects just 1.12 million new subscribers to be added in the second quarter, just above the company’s own projection of 1 million new subs. Revenue are expected to come in at $7.32 billion, up from $7.16 billion last quarter, and resulting in EPS of $3.36, down slightly from last quarter’s $3.75. This, as streaming video remains on a hot streak since the pandemic struck.

Previewing the quarterly result, Bloomberg Intelligence analysts Geetha Ranganathan and Amine Bensaid cautioned that Netflix’s massive 2020 is leading to more muted subscriber gains this year: “Netflix will continue to feel the aftereffects of a super-charged 1H20, with a massive pull-forward of demand prompting tempered expectations for 1 million additions in 2Q, its lowest quarterly level since 4Q11. The pull-forward may have also been amplified by price increases and pent-up demand for outdoor entertainment leading to uncertainty in 3Q guidance, though the return of several high-profile titles (‘Witcher,’ ‘Cobra Kai,’ ‘You’ and ‘Money Heist’) will be a clear catalyst for normalizing subscriber gains from 4Q and into 2022.”

LightShed Partners media analyst Rich Greenfield published what he sees as the key questions Netflix investors should ask management after its earnings report. Among them are when Netflix’s subscriber growth will normalize, whether India can be a meaningful driver of profitability, and where the company sees opportunities in video games. Greenfield asks: “Is the goal to leverage IP you create for TV/film or create original video game IP that can be leveraged into TV/film production?”

Another thing to watch out for is how a slowdown in production last year is affecting the service. The filming of new shows and movies basically came to a standstill in early 2020, which curbed output in the following months.

* * *

So with all that in mind, was Q2 the quarter that would finally unleash another repricing higher for Netflix stock? Alas, it would again not be this time because despite beating on the top line, and adding more subscribers than expected, the company missed on EPS and again reported another dismal quarterly guidance which came in well below expectations (full letter to shareholders).

First, the good news:

- Q2 revenue $7.34B, beating Est. $7.32B

- Q2 Streaming Paid Net Change +1.54M, beating Est. +1.12M

- Operating margin of 25.2% came in on top of estiamtes of 25.2%

And then the bad news:

- Q2 EPS $2.97 missing consensus Est. $3.14

- Company sees Q3 Streaming Paid Net Change +3.50M, far below the Wall Street estimate of +5.86M

Just as bad, the company reported its first decline in US/Canada paid subscribers, which shrank by 430K to 73.95MM

In other words, while q2 revenue rose 19% and operating income rose 36%, shares tumbled after its third-quarter subscriber forecast missed estimates.

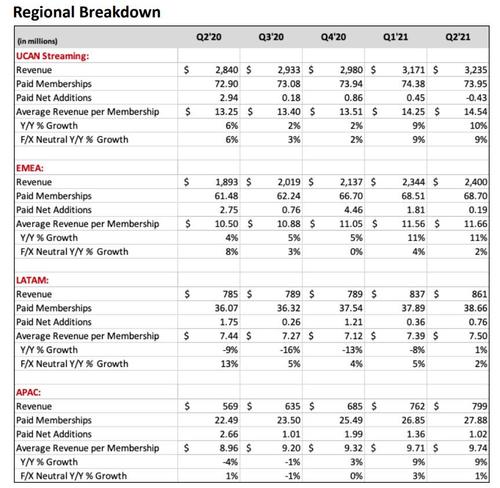

Here is the full breakdown of Q2 subs which saw a drop in US/Canada paid subs:

- UCAN streaming paid net change -430,000, estimate +52,190

- EMEA streaming paid net change +190,000, estimate +429,335

- LATAM streaming paid net change +760,000, estimate +128,719

- APAC streaming paid net change +1.02 million, estimate +524,900

- Total Streaming paid net change +1.54 million, estimate +1.12 million (Bloomberg Consensus)

And visually:

But what really hammered NFLX stock is the company’s guidance, where it now sees just 3.5 million new subs in Q3, far below the 5.86 million expected.

After initially plunging below $500 briefly, the stock has since stabilized down 3% around $515.

developing

Tyler Durden

Tue, 07/20/2021 – 16:16![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com