The Role Of Impaired Liquidity On The Recent Treasury Market Rollercoaster

Two weeks ago, on July 8 we summarized what Wall Street thought were the main reasons behind the sudden volatility observed in 10Y yields, when over the span of a few weeks, benchmark Treasury rates plunged from 1.70% to 1.30%, covering everything from fundamentals worries to technical positioning. However considering that just as volatile moves observed since then…

… one wonders if there isn’t a more basic, if ominous, reason behind the roller coaster observed in what once was the world’s deepest and most liquid market: lack of liquidity.

That’s the conclusion reached by JPMorgan quant Nick Panigirtzoglou, who writes that given the recent market moves, particularly in bond markets, it has raised the question of whether liquidity conditions have played an amplifying role. Reminding readers of the violent moves in rates earlier in the year, when following the catastrophic February 7Y auction the bond market suffered a historic breakdown and when a deterioration in market liquidity undoubtedly contributed to the bond market sell-off, the JPM strategist asks whether something similar could have exacerbated market moves more recently?

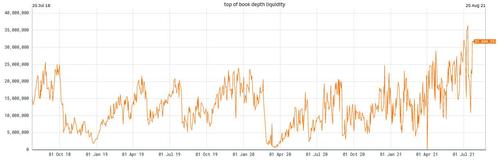

His answer is a decisive yes, and after pointing out the sharp decline in equity vol in recent weeks, something we highlighted last week when we showed the sudden drop (and subsequent rebound) in e-mini top of book depth liquidity…

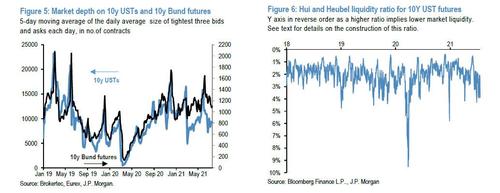

… Panigirtzoglou goes on to observe bond market liquidity and notes that after the bond market had recovered its early 2021 liquidity deterioration by mid-May, it has since deteriorated again to levels closer to the late February lows. By contrast, market depth in 10y Bund futures appears little changed (figure 5). Furthermore, JPM’s metric for market breadth, or the price impact of trading volumes, for 10y UST futures is also consistent with a deterioration in liquidity conditions to levels earlier in the year (Figure 6).

In other words, in contrast to equities where liquidity conditions show little sign of deterioration, in UST markets a deterioration in liquidity conditions has likely amplified market moves.

Finding no similar contraction in liquidity in commodities or credit, the JPM strategist concludes that “the deterioration in liquidity conditions in markets appears to have been mainly concentrated in UST markets and has very likely exacerbated the magnitude of those moves.” In equities, the deterioration in liquidity conditions appears relatively modest for US equities, though there is some evidence of deterioration in non-US markets.

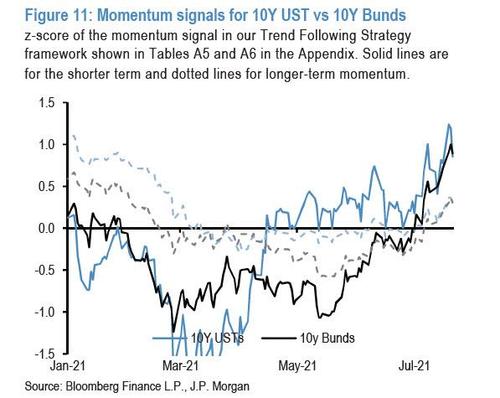

Of course, declining liquidity merely means that every sizable trade will have a far greater impact than otherwise, and in a world where momentum, trend-following managers and CTAs in general dominate (as most carbon-based traders are out on vacation), it pays to take a look at how CTAs are positioned. Well, according to JPMorgan, when 10y TSYs reached intra-day lows of around 1.13% on Tuesday, a move exacerbated by the deterioration in liquidity conditions noted above, some of these short-term overbought CTA signals have likely triggered mean reversion or profit taking.

And while Panigirtzoglou concedes that the longer-term signals are still some way from being triggered, but similar to signalling the oversold levels in March it is likely that shorter-term signals have a greater weight in the current conjuncture.

In other words, the CTAs are now done buying Treasurys and if anything, will seek to sell to book profits, and – eventually – short outright.

Tyler Durden

Sun, 07/25/2021 – 19:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com