Tesla Jumps After Beating On Top And Bottom Line

Heading into Tesla’s Q2 earnings, in our preview earlier we noted that sentiment is optimstic and the outlook for Q2 is pretty good because despite grappling with the chip shortage, a customer backlash in China, and the same shipping bottlenecks plaguing all global automakers right now, Tesla managed to set a record for vehicle deliveries in the second quarter: 201,250 cars.

As Bloomberg notes in its earnings preview, analysts have honed in on that bullish feat, and the idea that Tesla has been raising prices periodically throughout the year. Like the rest of its automotive peers, tight supply is giving Tesla some extra pricing power and the ability to pad margins amid costly supply chain headaches and raw material spikes.

On the bearish side, questions as usual will swirl about the source of Tesla’s profitability: as noted last quarter, virtuallyall of the company’s profits came from the sale of zero-emission regulatory credits which Tesla sells to other automakers (i.e., Jeep owner Stellantis). It basically equates to 100% margin and has been a significant contributor to net income. But, as Bloomberg notes, it can’t last forever.

For those who need a refresh, this is how much TSLA has sold in regulatory credits:

- 1Q 2020: $354M

- 2Q 2020: $428M

- 3Q 2020: $397M

- 4Q 2020: $401M

- 1Q 2021: $518M

And visually:

Also it’s worth recalling that this is Tesla’s first earnings call since Elon Musk feisty appearance earlier this month in Delaware Chancery Court over the automaker’s controversial 2016 acquisition of SolarCity. Musk contended that the acquisition was a sound decision — that it wasn’t done to benefit himself instead of shareholders.

In any case, as we enter Tesla’s earnings, we have record deliveries, rosy outlook on the quarter (albeit with questions about how the company generates its profit). And yet, Tesla’s stock is down 7.2% this year, while the S&P Index it belongs to is up nearly 18%. Clearly investors are a little concerned about the company’s long-term prospects at a time when virtually every OEM is coming up with numerous EV offerings and investing billions in future capacity.

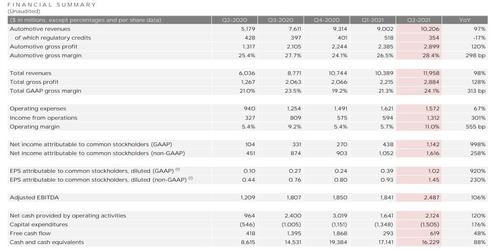

With that in mind, here is how Tesla did in the second quarter as per the just released investor letter:

- Revenue $11.96B, beating the est $11.36B

- Adjusted EPS $1.45, beating the est 97c

- Free Cash Flow $619M, beating the estimate of a Negative $319.1M

The result visually:

Of note, unlike previous quarter when virtually all the profit came from the sale of regulatory credits, in Q2 the situation normalized somewhat with $354MM in regulatory credits, which represents about 30% of the GAAP Net Income of $1142.

Other highlights: In Tesla’s comments on revenue, which rose 98% Y/Y, we find that the company’s average selling prices in Q2 declined by 2% Y/Y – which is odd at a time when car prices are exploding higher – which the company said was “due to the product updates and as lower ASP China-made vehicles became a larger percentage of our mix.” The full comment:

Total revenue grew 98% YoY in Q2. This was primarily achieved through substantial growth in vehicle deliveries, as well as growth in other parts of the business. At the same time, vehicle ASP1 declined by 2% YoY as Model S and Model X deliveries were reduced in Q2 due to the product updates and as lower ASP China-made vehicles became a larger percentage of our mix.

Looking at profitability next, we find that Tesla recorded another, if far more modest, $23MM impairment on its Bitcoin holdings. More from the report:

Our operating income improved in Q2 compared to the same period last year to $1.3B, resulting in an 11.0% operating margin. This profit level was reached while incurring SBC expense attributable to the 2018 CEO award of $176M in Q2, driven by a new operational milestone becoming probable.

Operating income increased YoY mainly due to volume growth and cost reduction. Positive impacts were partially offset by growth in operating expenses including increased SBC, Model S/X ramp (negative margin in Q2), additional supply chain costs, lower regulatory credit revenue, Bitcoin-related impairment of $23M and other items.

How aboput the balance sheet? Here Tesla reported $16.2BN in cash, which decreased mainly driven “by net debt and finance lease repayments of $1.6B, partially offset by free cash flow of $619M.”

In kneejerk reaction the stock jumped as much as 3% on what appears to be a solid beat on revenue, earnings and Free Cash Flow, however it has since faded much of the gains, giving a negative answer to those wondering if this earnings report will be the one that finally send TSLA stock green for the year.

Developing

Tyler Durden

Mon, 07/26/2021 – 16:17![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com