US Futures Breach New All-Time Highs As Global Stocks Approach Record On Unexpected Chinese Rate Cut

At this rate, rising by about 20 points er day, Trump will only be happy if the S&P hits 4,000 around the time of the 2020 election.

While US equity futures drifted ever higher into all time high territory, with S&P futures now above 3,120 on what many erroneously claim is trade deal optimism but in reality is the Fed and ECB’s injection of $80 billion in liquidity every month, world shares were also close to a record high on Monday, after Beijing surprised markets by trimming a key interest rate for the first time since 2015.

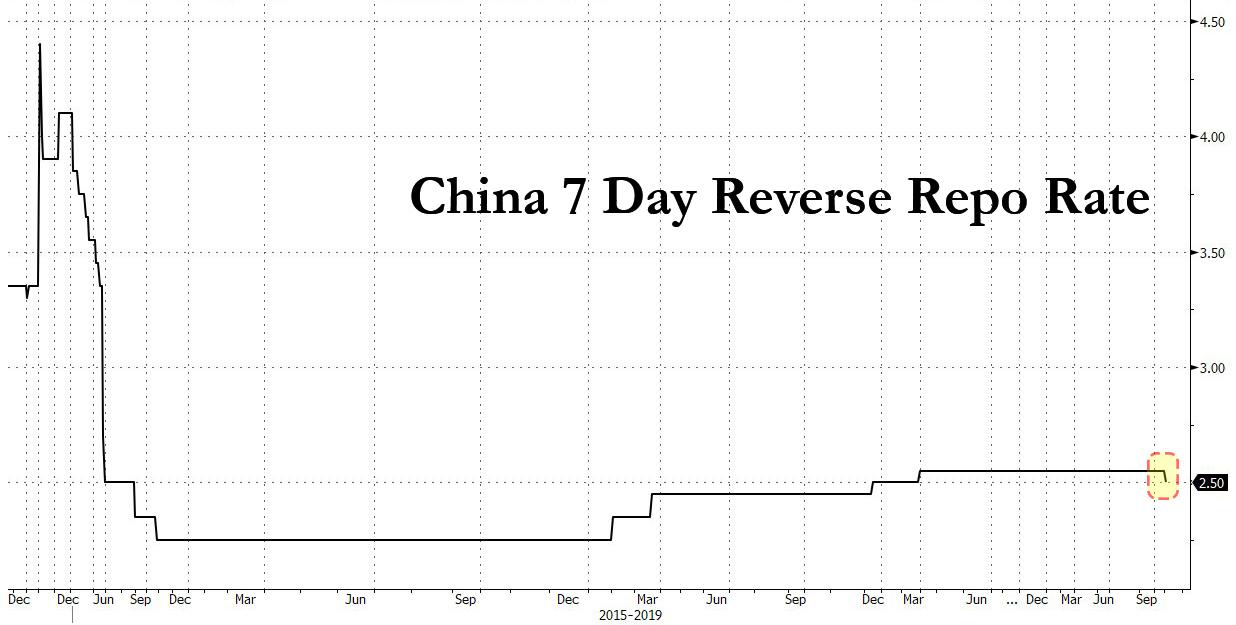

Confirming what we said just on Friday, that China has major structural problems that are far greater than just its GDP and slowing economy, and that the PBOC will be forced to step in with support, early on Monday, China’s central bank cut rates on seven-day reverse repurchase agreements by five basis points to 2.50% in its latest show of support for its economy.

The news helped Asia’s main markets close higher, surprising various experts who would not reconcile the war-like scenes out of Hong Kong and the jump in the Hang Seng and Shanghai Composite…

Why is Hang Seng +1.2% and the SHCOMP at session highs after war like scenes from Hong Kong? The PBOC injected a net CNY180 BN via reverse repo and cut the 7-day rev repo rate by 5bps to 2.50%.

All you need to know

— zerohedge (@zerohedge) November 18, 2019

https://platform.twitter.com/widgets.js

… and Europe followed suit, though early moves showed the initial reaction was cautious.

The Chinese intervention helped nudge MSCI’s 49-country world share index 0.12% higher to leave it less than 1% off the record high it set back in early 2018.

“It is a slow start to a slow week, but risk is marginally on,” said SocGen FX strategist Kit Juckes, who added it was now hard to avoid concluding that China was slowly easing monetary policy, having held off in recent months, wary of drawing fresh criticism from U.S. President Donald Trump during trade talks. “Maybe that’s what 5 basis points is all about. It’s not rocking the boat, but it’s a shift.”

As the region digested the unexpected cut in the PBoC’s 7-Day Reverse Repo rate, Asian markets resumed the momentum from last Friday’s record-setting performance in the US where all major indices notched all-time highs and the DJIA breached the 28,000-milestone for the first time. ASX 200 (-0.4%) and Nikkei 225 (+0.5%) were mixed with Australia dragged by broad weakness across its sectors including underperformance in gold miners and losses for the top-weighted financials, while the Japanese benchmark was relatively quiet with mild gains spurred on the back of a weaker currency. Shanghai Comp. (+0.6%) was initially choppy with markets somewhat desensitized by the latest trade headlines including reports of a constructive call between US-China top trade negotiators and recent comments from US Commerce Secretary Ross that the finish line is close regarding a phase one trade deal. However, Chinese stocks were eventually supported after the PBoC injected liquidity through reverse repos for the first time in 3 weeks and lowered the rate by 5bps to 2.50%, while the Hang Seng (+1.4%) was resilient despite continued Hong Kong unrest with the index lifted by outperformance in property names and on touted short-covering following last week’s 5% slump, as well as reports of government rescue for mid-sized lender Harbin Bank. Finally, 10yr JGBs traded choppy amid the somewhat indecisive risk sentiment and mixed results from the enhanced liquidity auction, although prices have eked mild gains as it continues its rebound from support at 153.00.

After a solid Asian session, the European STOXX 600 index fluctuated in early trading, initially trimming gains in Monday morning trading as construction materials and autos sectors decline, before extending its six-week winning streak as advances in Switzerland offset weakness in France and Germany. The index is only 8 points short of its own record high of 415.18 points hit in mid-April.

In the US, E-Mini futures pointed to S&P 500 adding to Friday’s record highs, with an open around 3,124. Just around 1am, S&P e-minis breached 3120 to the upside, triggering a raft of stop orders in a surge of volume but then faded from the highs.

Beijing’s latest easing bolstered to hopes it might also be more serious about making progress in trade talks with the United States. On Saturday, Chinese state media said the two sides had “constructive talks” on trade in a high-level phone call that included Vice Premier Liu He, U.S. trade representative Robert Lighthizer and Treasury Secretary Steven Mnuchin.

“More than in previous rounds, we see momentum toward reaching at least a limited trade deal, and certainly a mini-deal would remove some of the negative sentiment overhang for the real economy and markets,” said Patrik Schowitz, global multi-asset strategist at J.P. Morgan Asset Management.

“We have upgraded our outlook on equities as an asset class,” he added. “Emerging-market equities are now our most favoured region alongside U.S. large-cap equities.”

Emerging-market stocks and currencies advanced for a second day on the above-mentioned trade deal optimism and China’s easing: Turkey’s lira and South Korea’s won outperformed peers after U.S. and Chinese trade negotiators held “constructive discussions” in a phone call on Saturday to address each side’s core concerns of phase one of the trade deal. White House economic adviser Larry Kudlow’s comment late Thursday that U.S.-China talks were nearing the final stages helped to trim emerging-market losses last week. “It seems market reaction to trade discussions has been asymmetric recently, with a stronger reaction to any slightly positive news” said Credit Agricole strategist Guillaume Tresca, unwittingly hitting the nail on the head, that the market is not responding to trade news at all but to the Fed’s QE “The news flow on the global front is limited in the week ahead and barring any negative surprise, the positive momentum should continue.”

In rates, the 10Y TSY yield rose 2 bps from the Friday close, trading around 1.850%, while German Bunds also fell amid positive signals from “constructive discussions” in U.S. and China trade talks. The Bunds decline was led by the 5- to 10-year sectors as core bonds underperform semi-core peers. Italian BTPs were little changed as Greek bonds fare best among peripheral peers. Gilts slip led by the belly ahead of speeches by PM Johnson and opposition leader Corbyn at the Confederation of British Industry conference in London later Monday.

In FX, the dollar was little changed against other major currencies on Monday and within recent trading ranges. Volatility in the market has been the lowest in decades recently and shows no sign of shifting. The dollar rose against the safe-haven yen to 108.94. The Bloomberg Dollar Spot Index initially headed for its third day of losses before reversing back to unchanged as the pound rallied following a series of opinion polls that showed U.K. Prime Minister Boris Johnson’s party well ahead of the opposition.

A UK election Survation poll conducted November 14th-16th showed Conservatives at 42% (+7), Labour at 28% (-1), Lib Dems at 13% (-4) and Brexit Party at 5% (-5). (Twitter) UK election YouGov/Times poll conducted November 14th-15th showed Conservatives at 45% (+3), Labour at 28% (unch), Lib Dems at 15% (unch) and Brexit Party at 4% (unch). Mail on Sunday poll conducted November 14th-16th showed Conservatives 45% (+4), Labour 30% (+1), Lib Dems 11% (-5%), Brexit Party 6% (unch).

The dollar and bonds are likely to be sensitive to minutes of the Federal Reserve’s last policy meeting, set to be released on Wednesday. “The minutes are likely to reiterate that the U.S. economy is ‘solid’ and that current monetary policy settings are ‘appropriate’, which would support the dollar,” said Joseph Capurso, a currency analyst at Commonwealth Bank of Australia. However, he noted a report on October U.S. retail sales released on Friday suggested previously strong consumption might be slowing. “Any further weakness in consumption could warrant a material reassessment of the outlook by the FOMC. Under our baseline, the FOMC would most likely start cutting interest rates again in 2020,” said Capurso.

The yen is leading losses amid a thin data calendar and as investors await fresh developments on trade discussions. Sterling gains as investors add longs in the cash market on the back of low uncertainty over the U.K. election, while demand to hedge downside risks emerges through the options market, The pound strengthened against all its Group-of-10 peers after U.K. Prime Minister Boris Johnson said Conservative candidates pledged to vote for his Brexit deal if he wins the Dec. 12 election. GBPUSD gains a fourth day, up 0.5% to 1.2963 after high of 1.2985; stops triggered above 1.2930 and 1.2940, with some stop entries also going through, a Europe-based trader says. The pair was headed for its best run in a month as it touches its strongest level since Oct. 22; Johnson will try to win business leaders over to his side Monday, offering them tax cuts as an olive branch for the disruption caused by Brexit.

In commodities, spot gold fell to $1,459 per ounce; oil prices also fell, after Brent touched a seven-week high on Friday. Brent crude futures dropped 18 cents to $63.12 a barrel. WTI slipped by 4 cents to $57.69.

In overnight central bank comments, ECB’s de Guindos defended the central bank’s catastrophic NIRp policy, said the most significant vulnerabilities of euro area banks relates to their weak profitability prospects. Notes banking system is operating with significant overcapacity resulting in cost inefficiencies and competitive pressures; weaker cyclical momentum and associated low interest rates are weighing on bank profitability, although monetary policy accommodation has supported lending volumes.

In geopolitics, US Defence Secretary Esper met with Chinese Defence Minister Wei in Bangkok which experts described as significant in strengthening mutual military trust, while China was said to ask US to stop escalating the South China Sea situation. In related news, China’s Defence Ministry spokesman said China will not tolerate any Taiwan independence incidents and a China Navy spokesperson confirmed a Chinese carrier sailed through the Taiwan Straits but noted the passage is not directed at any target nor is it related to current situation.

Over the weekend, Iran experienced widespread protests in more than 100 cities and towns following a 50% gas price increase; separately, protestors are reportedly blocking the entrance to Iraq’s Umm Qasr port, operations are down by 50%., according to port sources

No major economic data is expected. Woodward is among companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.2% to 3,123.00

- STOXX Europe 600 up 0.02% to 406.14

- MXAP up 0.4% to 164.98

- MXAPJ up 0.5% to 528.02

- Nikkei up 0.5% to 23,416.76

- Topix up 0.2% to 1,700.72

- Hang Seng Index up 1.4% to 26,681.09

- Shanghai Composite up 0.6% to 2,909.20

- Sensex down 0.2% to 40,293.79

- Australia S&P/ASX 200 down 0.4% to 6,766.82

- Kospi down 0.07% to 2,160.69

- German 10Y yield rose 0.7 bps to -0.327%

- Euro up 0.1% to $1.1064

- Italian 10Y yield fell 9.1 bps to 0.886%

- Spanish 10Y yield fell 1.2 bps to 0.428%

- Brent futures little changed at $63.28/bbl

- Gold spot down 0.6% to $1,459.99

- U.S. Dollar Index down 0.1% to 97.90

Top Overnight News from Bloomberg

- Donald Trump used Twitter on Sunday to slam Jennifer Williams, an aide to Vice President Mike Pence, who’s due to testify in the public impeachment inquiry into the president’s actions with Ukraine

- The political peril for Trump, will be heightened as the House investigation accelerates with three days of public hearings starting Tuesday. Gordon Sondland, the U.S. Ambassador to the EU, a Trump donor and a confederate with Rudy Giuliani in back-channel diplomatic efforts for the president in Ukraine is scheduled to testify Wednesday

- Hong Kong police urged protesters to drop their weapons and leave a university campus in Kowloon, but many remained holed up after a weekend standoff led to dramatic scenes with smoke billowing from multiple fires at the campus as the work week kicked off

- Protesters called for rallies on Monday night near Hong Kong Polytechnic University, which is surrounded by police vowing to arrest hundreds of demonstrators who have taken over the campus. Clashes around Kowloon university has led to multiple arrests and injuries

- China lowered the cost it charges on short-term open-market operations for the first time since October 2015, a move aimed at shoring up confidence following a string of poor economic data

- British PM Johnson will try to win business leaders to his side with an offer of tax cuts at the start of a crucial week in the U.K. general election campaign. Britain goes to the polls on Dec. 12 and a slew of opinion polls in Sunday’s newspapers all put Johnson’s Conservatives well ahead of the opposition Labour Party

- U.S. and Chinese trade negotiators held “constructive discussions” in a phone call on Saturday to address each side’s core concerns of phase one of the trade deal. China’s Vice Premier Liu He, the country’s key negotiator in the trade talks with the U.S., spoke with Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer, according to the Chinese Commerce Ministry

- China lowered the cost it charges on short-term open-market operations for the first time since October 2015, a move aimed at shoring up confidence following a string of poor economic data

Asian equity markets partially resumed the momentum from last Friday’s record-setting performance on Wall St. where all major indices notched all-time highs and the DJIA breached the 28000-milestone for the first time. Furthermore, the region also digested a cut in the PBoC’s 7-Day Reverse Repo rate but with gains limited as participants await the next developments on the trade front. ASX 200 (-0.4%) and Nikkei 225 (+0.5%) were mixed with Australia dragged by broad weakness across its sectors including underperformance in gold miners and losses for the top-weighted financials, while the Japanese benchmark was relatively quiet with mild gains spurred on the back of a weaker currency. Shanghai Comp. (+0.6%) was initially choppy with markets somewhat desensitized by the latest trade headlines including reports of a constructive call between US-China top trade negotiators and recent comments from US Commerce Secretary Ross that the finish line is close regarding a phase one trade deal. However, Chinese stocks were eventually supported after the PBoC injected liquidity through reverse repos for the first time in 3 weeks and lowered the rate by 5bps to 2.50%, while the Hang Seng (+1.4%) was resilient despite continued Hong Kong unrest with the index lifted by outperformance in property names and on touted short-covering following last week’s 5% slump, as well as reports of government rescue for mid-sized lender Harbin Bank. Finally, 10yr JGBs traded choppy amid the somewhat indecisive risk sentiment and mixed results from the enhanced liquidity auction, although prices have eked mild gains as it continues its rebound from support at 153.00.

Top Asian News

- China Trims Market Borrowing Costs as Economic Outlook Dims

- China Bond Traders Still on Edge After Rate Cuts Spur Rally

- Malaysian Stocks Get Cheaper by the Day But Few Want to Buy

Major European bourses (Euro Stoxx 50 -0.2%) are choppy and mostly directionless thus far on the first trading session of the week, following a mostly positive APAC session where sentiment was supported by Wall Street’s Friday rally, seemingly positive US/China trade headlines and the latest cut to the PBoC’s 7-Day Reverse Repo rate. European bourses trade mostly within last week’s ranges, however, US indices futures made fresh ATHs again this morning, with ES Dec’ 19 futures reaching as high as 3127.50. Looking ahead, further impetus is most likely to come from further developments on the US/China trade front, with the data docket largely empty for the day, aside from Central Bank speak. Moving on to the sectors, the picture is mixed; Utilities (+0.1%), Financials (+0.3%) and Health Care (+0.6%) are on the front foot, while Tech (-0.3%) and Industrials (-0.3%) the slight laggards. In terms of the most notable individual movers; BME (+38.1%) shot higher on increased hopes for a bidding war between Euronext (+1.2%) and SIX Exchange, the former having confirmed it is in discussions for the Co. and the latter putting in a bid worth EUR 34.0/shr. Meanwhile, Qiagen (+12.1%) opened higher on the news that the Co. has received several conditional non-binding indications of interest and has decided to start discussions to examine potential strategic alternatives. In terms of the laggards, Aviva (-3.5%) shares were sent tumbling on the news that, after an options review for its Singapore business, the Co. had concluded that retaining the business will achieve the best shareholder value.

Top European News

- Bunds Caught in a Battle Between Sentiment and Fundamentals

- Qiagen Rises to Highest Level Since 2001 as Bidders Multiply

- Aviva Retains Singapore, China Ops After Review; Shares Fall

- Yandex Changes Ownership Structure as Kremlin Tightens Rules

In FX, another subdued day for the broad Dollar and Index with the latter losing further ground below the 98.00 figure amid Friday’s downbeat US IP figure coupled with strength in some G10 peers. DXY probes the 97.90 mark having dipped to 97.87 as European participants entered the market with the next level to the downside its 21 DMA at 97.83. Meanwhile, the Yuan is on a modestly softer footing after the PBoC cut its 7-day reverse repo rate by 5bps ahead of the Central Bank’s LPR decision later this week – with consensus pointing towards a maintained rate, but against growing views of a 5bps reduction. USD/CNH remains off highs after the pair rose to to almost 7.0200 post-PBoC ahead of its 100 DMA at 7.0381. Looking ahead, this week sees a mammoth USD 5bln in USD/CNH at strike 7.0000, with the largest chunk of USD 2.1bln for tomorrow.

- GBP, EUR – Sterling stands as the marked outperformer thus far amid tailwinds from weekend polls suggesting an uptrend in the Conservative’s lead over Labour, with the weekend polls showing a lead between 14-17 points across three surveys. Thus, Cable extends upside above 1.2900 to test 1.2950 in early EU trade before taking out resistance at 1.2972-5 (Oct31/Nov1 highs) and ahead of touted barriers at 1.3000. As a result, EUR/GBP continues to edge lower towards the 0.8500 mark (0.8535 intraday low) with bears’ targets now including the YTD low at 0.8456 ahead of the 55 MMA (0.8437). Meanwhile, the Single Currency sees little action and largely moves at the whim of the Buck having clocked in a 20 pip intraday parameter for now and with a few pertinent speakers on today’s docket and a lack of notable data points. EUR/USD meanders just above 1.1050 and with options expiries eyeing a hefty EUR 1.3bln at 1.1055 for today’s NY cut.

- JPY – Modestly softer start to the week with little by way of major weekend risk events to sway sentiment. USD/JPY tested 109.00 in early trade and has since meandered around the round figure where its 200 DMA also resides. Scheduled events today are unlikely to affect the market mood, but as always traders will be on the lookout for developments on the trade and Hong Kong front for catalysts.

In commodities, crude prices are flat to lower, as the market consolidates following last Friday’s healthy gains on the back of trade related optimism tailwinds. Both WTI and Brent front month contracts trade at the top of recent ranges, the former just below the USD 58.00/bbl mark and the latter comfortably above USD 63.00/bbl. Other geopolitical developments are focused over in East Asia; the US and South Korea postponed joint military drills to help provide an opportunity to bring North Korea back to negotiations, while US Defence Secretary Esper reportedly met with Chinese Defence Minister Wei in Bangkok which experts described as significant in strengthening mutual military trust and China was said to ask US to stop escalating the South China Sea situation. In terms of metals; Gold has been heading lower, breaking below resistance just above the USD 1460/oz level. Copper, meanwhile, has been moving sideways after making modest gains overnight on the back of PBoC liquidity injections at a lower RRR and trade hopes.

US Event Calendar

- 10am: NAHB Housing Market Index, est. 71, prior 71

- 4pm: Net Long- term TIC Flows, prior $41.1b deficit

- 4pm: Total Net TIC Flows, prior $70.5b

- 12pm: Fed’s Mester Speaks at University of Maryland

DB’s Jim Reid concludes the overnight wrap

Happy Monday. We discovered the first major design flaw in our new house yesterday as 2 year old twin Eddie locked himself in our downstairs toilet and was then so hysterical for 20 minutes that we couldn’t reason with him that it was just as easy to unlock as it was to lock. I must admit, I was mentally working out whether it was cheaper to call a locksmith or to try to bash the door down and get it repaired. In the end, he calmed down in time and managed to unlock the door and I saved myself some money and/or another injury.

We might find ourselves stuck a little this week as well as it isn’t the biggest for important data but there are still some key highlights for markets and the global economy to look forward to. We have to be patient for the main data release which comes in the form of the preliminary November PMIs on Friday. If global data is on the turn this will be a useful point for it to show itself. Ahead of that, both the Federal Reserve (Weds) and the ECB (Thurs) will be releasing accounts of their October monetary policy meetings. In politics, we’ll see the first televised debate for the UK general election (Tues) alongside further impeachment hearings in the US and a Democratic primary debate (Weds). Finally, we’ll hear from ECB President Lagarde on Friday, and earnings season will continue to draw to a close.

The preliminary November PMIs on Friday will be important as expectations have risen that the global economy has bottomed. Indeed, our economists put out a global piece on Friday suggesting such an outcome (albeit with event risks still there) in the US, Europe and in Asia. See here for their report. Back to PMIs, and consensus for the German composite currently stands at 49.2, above October’s 48.9 but still in contractionary territory. Meanwhile, the Euro Area composite PMI is seen rising to 50.8, having been 50.6 in October. A similar increase is expected in the US.

Elsewhere in the US, there aren’t a great deal of data releases out this week. We’ll get the final University of Michigan sentiment indicator for November on Friday, following the preliminary reading which saw a small increase to 95.7, a three-month high. On Wednesday, October’s building permits and housing starts data comes out, before Thursday sees the release of October’s existing homes sales, along with the Philadelphia Fed’s business outlook indicator for November.

The FOMC minutes on Wednesday will be interesting but with the Fed seemingly on hold until further notice it’ll be difficult to gain too much new insight into it. However our economists think that given the growing contingent of policymakers that have either voiced opposition to the latest rate cut or only supported it conditional on sending a hawkish signal with it, then the minutes could provide more intelligence as to the power of the different camps in the Fed at the moment.

Before we look at the rest of the weekly economic highlights, this morning in Asia the PBOC has cut the interest rate on its seven-day reverse repurchase agreements to 2.5% from 2.55% for the first time since October 2015. Along with the reduction in interest rates, the PBoC also added CNY 180bn of cash into the financial system via open market operations, helping to alleviate liquidity concerns. Meanwhile, over the weekend the PBOC’s quarterly report warned not only on growth risks but also on rising inflation, highlighting the limited room that monetary policy has to respond. The PBoC also said in the report that it will “increase counter-cyclical adjustment” to ward off downward pressure on the economy while adding that monetary policy will “properly handle the short-term pressure,” making sure not to offer excessive funding, while keeping an eye on the risk of expectations that inflation may spread.

We also saw new trade headlines over the weekend with the Chinese Commerce Ministry saying in a statement that the US and Chinese trade negotiators held “constructive discussions” in a phone call on Saturday to address each side’s core concerns ahead of “phase one“ of the trade deal. The talk was held between China’s Vice Premier Liu He and the US Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer. The report further added that the call was held at the request of the U.S. negotiators, and the two sides agreed to remain in close communication.

Asian markets are trading mixed this morning with the Nikkei (+0.22%), Hang Seng (+0.83%) and Shanghai Comp (+0.43%) all up while the Kospi (-0.29%) is trading down. Elsewhere, futures on the S&P 500 are trading flat.

Back to this week’s highlights and we have a number of central bank speakers over the week ahead, with ECB President Lagarde scheduled to speak on Friday. Her first speech at the start of the month didn’t feature monetary policy at all, so if her remarks do cover monetary policy issues, markets will be paying close attention in order to find out more about her views. Alongside Lagarde, we’ll hear from ECB Vice President de Guindos, along with Bundesbank President Weidmann. And from the US, this week’s Fed speakers include Cleveland Fed President Mester, New York Fed President Williams, and Minneapolis Fed President Kashkari.

Turning to politics, this week has two notable debates occurring on either side of the Atlantic. The first will be the televised head-to-head debate tomorrow between Prime Minister Johnson and Labour Party leader Corbyn, which comes ahead of the UK general election on 12 December. The polls this weekend showed the Conservatives anywhere from 8 to 16 percentage points in the lead with some evidence of Brexit Party votes slightly going their way this week relative to the week before. Elsewhere, Bloomberg reported that in a speech today at the CBI, PM Johnson will offer tax cuts to the business leaders for the disruption caused by Brexit. He will say a Conservative government victory at the December 12 election will lead to a “fundamental review” of business rates. On taxes, the U.K. and US elections over the next 12 months possibly bring the sharpest divide between cutting and raising taxes in living memory. A fascinating fork in the road moment for both countries. Staying with the U.K., over the weekend PM Johnson said that every Conservative candidate has signed a pledge to vote for his deal if elected, thereby giving credibility to his claim that he can break the Brexit deadlock. Sterling is up +0.20% this morning on the news.

Staying with politics, there’ll be another debate in the US between the Democratic primary candidates on Wednesday. Although the presidential election itself isn’t until November 2020, the first primaries and caucuses occur in February. Finally, we’ll see further impeachment hearings in the US over the week ahead.

On earnings, we’re nearing the end of this season, with 461 of the S&P 500 companies having reported. Of those that have, nearly 80% have reported a positive surprise on earnings, while just under 60% have reported a positive surprise on sales. Even if your view is that expectations were managed beforehand or that share buybacks continue to distort the picture, it’s hard not to be impressed with the resilience of US markets. Highlights to watch out for this week include Home Depot on Tuesday, Lowe’s and Target on Wednesday, and Thyssenkrupp and Macy’s on Thursday.

Reviewing last week briefly, equity markets staged a small rally with the S&P 500, NASDAQ, and DOW all nudging to fresh all-time highs. Those three US indexes gained +0.89%, +0.77%, and +1.17% on the week (+0.77%, +0.73%, and +0.80% and most of the week’s gains on Friday), respectively. The S&P 500 has now gone 27 session without consecutive down days, the longest streak since January 2012. In Europe, the STOXX 600 gained a more modest +0.15% (+0.44% Friday), with the IBEX (-1.41% on the week, +0.96% Friday) underperforming after the Socialist party partnered with a more left-wing group to form a new government after elections. EMs were also pressured, with an index of equities falling -1.26% (+0.79% Friday), and an index of EM currencies dipping -0.65% (flat Friday).

In fixed income, bond yields rallied, partially retracing the previous week’s selloff and partially a reflection of still-muted US inflation data. Ten-year yields in the US and Germany fell -11.1bps and -7.1bps (+1.2bps and +1.7bps Friday). The divergence helped the euro gain +0.30% versus the dollar (+0.26% Friday). Credit spreads widened, with high yield spreads +13bps and +9bps wider in the US and Europe (-2.6bps and +1.8bps Friday). Meanwhile, volatility remains low with the VIX at 12.1, flat on the week.

Tyler Durden

Mon, 11/18/2019 – 07:38

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com