Tracking China’s Regulatory Reset: Handy Cheat Sheet Of Beijing’s Regulatory Crackdown

With Beijing’s regulatory framework changing by the day – if not the hour – as part of the emerging “Paradigm Shift” in China, a popular question that has emerged is which sector’s shareholders does China plan on destroying today by publishing a harshly worded op-ed…

Which industry will China destroy tonight

— zerohedge (@zerohedge) August 4, 2021

… targeting capitalist virtues like profit and, well, capital.

Making matters worse, now that China’s crackdown is a daily event, it has become virtually impossible to keep track of all the latest developments.

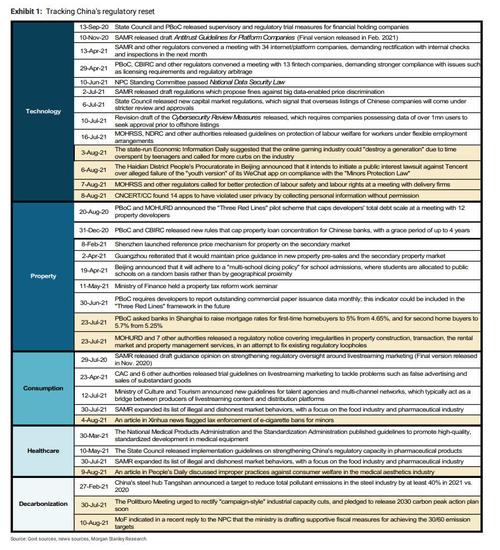

To make it a little easier, Morgan Stanley’s China economist Robin Xing has penned the following tracker of China’s “regulatory reset”, noting that regulatory issues linger in the healthcare and technology sectors, while policy support is skewed toward decarbonization. Further, the bank tracks regulatory developments in key sectors as follows:

1) Healthcare: An article in the People’s Daily on Aug 9 reported incidences of improper sales/marketing practices and safety concerns in the medical aesthetics sector, quoting expert views for stronger regulatory oversight on credentials, service quality and pricing.

Morgan Stanley analyst’s take: Sean Wu and Yolanda Hu believe that while this is a reiteration of previous guidance, the medical aesthetics sector, which has been a loosely regulated segment, could see tightened regulations over time to reduce accidents and penalize sales practices that promote unnecessary surgery procedures.

2) Technology: The Haidian District People’s Procuratorate in Beijing announced on Aug. 7 that it intends to initiate a public interest lawsuit against Tencent, due to alleged compliance issues with the “Minors Protection Law” in the “youth mode” of the company’s WeChat app.

Morgan Stanley analyst’s take: Gary Yu believes that the lawsuit reflects increased scrutiny to protect minors. Tencent proactively launched the “youth mode” on WeChat in Oct 2020 to align with regulatory focus,and has been fine-tuning the functions while conducting a series of self-rectifications across the ecosystem, including implementation of stricter curbs on minors’ access to mobile games and suspension of new user registration for WeChat.

3) Decarbonization: In a recent response to the NPC, the Ministry of Finance indicated that it is drafting supportive fiscal measures (covering fiscal and tax policies) in relation to the “30/60” carbon emission targets.

Morgan Stanley analyst’s take: Tim Chan believes the announcement of the Ministry of Finance reiterated the importance of green finance in achieving China’s carbon neutrality goal. These fiscal measures should support continued flow of capital to green projects. Moreover, Tim also thinks that potential auctioning of allowances in future in the China National Emissions Trading Scheme could become another major funding source for green projects.

Finally, here is a handy cheat sheet summary of all the recent regulatory developments across China’s economy:

Tyler Durden

Tue, 08/10/2021 – 20:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com