Consumer Confidence Crashes Amid Concerns About Delta Variant As Inflation Fear Soar

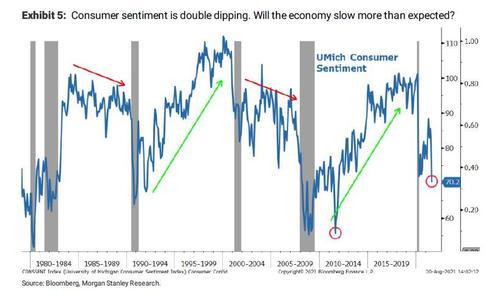

There was much confusion earlier this month when the University of Michigan consumer sentiment index even as the Conference Board Consumer Confidence printed at near post-covid high, forming a remarkable divergence and prompting question of which confidence indicator is right. We got the answer moments ago, when the Conference Board reported the number for August… and it was a doozy: coming in at 113.9, it was a plunge from last month’s 129.1 (revised down to 125.1), and missed not only the consensus estimate of 123.0 but also missed the lowest sellside forecast. That said, and as shown in the chart below, the Consumer Confidence index still has a long way to go before it catches down to its UMich peer.

Looking at the components, the Presentation Situation declined from 157.2 to 147.3, while Expectations slumped even more, from 103.8 to 91.4

“Consumer confidence retreated in August to its lowest level since February 2021 (95.2),” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board.

“Concerns about the Delta variant—and, to a lesser degree, rising gas and food prices—resulted in a less favorable view of current economic conditions and short-term growth prospects. Spending intentions for homes, autos, and major appliances all cooled somewhat; however, the percentage of consumers intending to take a vacation in the next six months continued to climb. While the resurgence of COVID-19 and inflation concerns have dampened confidence, it is too soon to conclude this decline will result in consumers significantly curtailing their spending in the months ahead.”

Some more details from the report on the Present Situation: Consumers’ appraisal of current business conditions declined in August.

- 19.9% of consumers said business conditions are “good,” down from 24.6%.

- 24.0% of consumers said business conditions are “bad,” up from 20.0%.

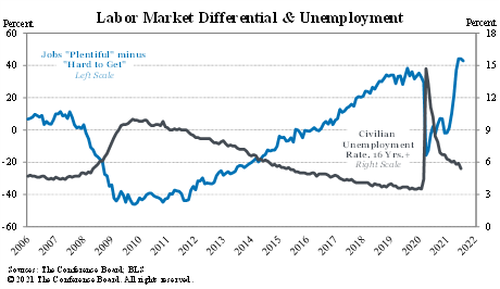

Consumers’ assessment of the labor market eased, indicating that we may have also peaked the record easy job market.

- 54.6% of consumers said jobs are “plentiful,” down from 55.2%.

- 11.8% of consumers said jobs are “hard to get,” up from 11.1%.

Drilling down into expectations 6 months from now, consumers’ optimism declined across the board, starting with short-term business conditions outlook which deteriorated in August.

- 22.9% of consumers expect business conditions will improve, down from 30.9%.

- 17.8% expect business conditions to worsen, up from 11.9%.

Consumers were somewhat less optimistic about the short-term labor market outlook.

- 23.0% of consumers expect more jobs to be available in the months ahead, down from 25.5%.

- 18.6% anticipate fewer jobs, up from 17.8%.

Consumers were less upbeat about their short-term financial prospects.

- 17.9% of consumers expect their incomes to increase, down from 20.0%.

- 10.1% expect their incomes will decrease, up from 8.8%.

All of this merely validated Michael Wilson’s recent observations that the collapse in sentiment, coupled with soaring prices and far less spending abilities (absent another stimmy), means that the US consumer is rapidly heading for a double-dip recession…

… which if Wilson is right, will translate into a 10% correction in the market in the coming months.

Tyler Durden

Tue, 08/31/2021 – 10:17![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com