Heads Of Major German Auto Manufacturers Say Semi Shortage “May Not Just Disappear” In 2022

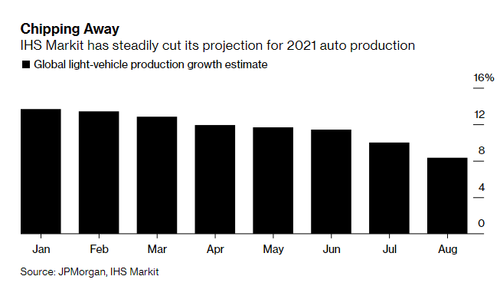

As if the auto industry needed more bad news about the ongoing semiconductor bottleneck, heads of major German automakers are speaking out and predicting that the shortage may not just disappear in 2022.

Volkswagen Chief Executive Officer Herbert Diess said on Bloomberg TV last week: “Probably we will remain in shortages for the next months or even years because semiconductors are in high demand. The internet of things is growing and the capacity ramp-up will take time. It will be probably a bottleneck for the next months and years to come.”

Ola Kallenius at Daimler and Oliver Zipse of BMW also added to the pessimism. Kallenius said that the shortage “may not entirely go away” in 2022, according to Bloomberg. Zipse said there could be another 6 to 12 months left in the shortage.

Kallenius noted that some are holding out hope for the shortage to let up in the fourth quarter. However, he also predicts that a “structural” demand issue will affect the industry in 2022.

Deiss said dealing with the Covid outbreak in Malaysia comes first, and that it may resolve “toward the end of this month, probably next month, and then recover in the last quarter of this year.”

Recall, we wrote days ago about how the Delta variant was stinging production in Malaysia. Malaysia is home to names like Infineon Technologies AG, NXP Semiconductors NV and STMicroelectronics NV, who all have operating plants in the country. With Covid infections soaring locally, plans for lifting lockdowns and re-opening production look as though they could fall by the wayside, according to Bloomberg.

Daily infections are up to 20,000 per day, up from just 5,000 per day in late June.

Just last week, Ford cited “a semiconductor-related part shortage as a result of the Covid-19 pandemic in Malaysia” as a reason for temporarily suspending production at one U.S. plant.

Malaysian companies were allowed to operate at 60% of capacity during June lockdowns and they will be able to move to 100% capacity when more than 80% of their workforce is vaccinated, the report says.

Despite this, factories have shuttered for weeks at a time for sanitation guidelines and the Delta variant is proving “difficult to stop”.

Samuel Tan, a semiconductor analyst with Kenanga Investment Bank, told Bloomberg: “This could be very disruptive for Infineon and other companies that have plants of a few thousand workers.”

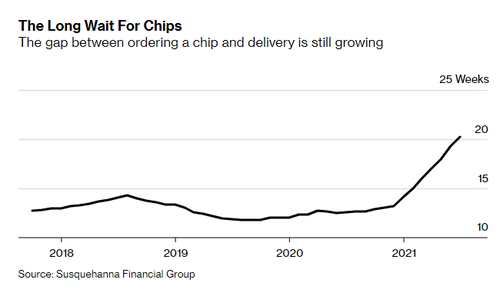

Lead times for chips increased by more than eight days to 20.2 weeks in July, from June. It is the longest wait time since Susquehanna Financial Group began tracking the data.

Tyler Durden

Tue, 09/07/2021 – 02:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com