In Legislative Hail Mary, Democrats Link Debt Ceiling To Spending Bill

In a risky move inviting a showdown with Republican lawmakers, House Democrats are linking a suspension of the US debt ceiling to a must-pass spending bill required to keep the government operating past September.

If it works, the debt ceiling – which GOP leaders have balked at raising – would be suspended through December 2022.

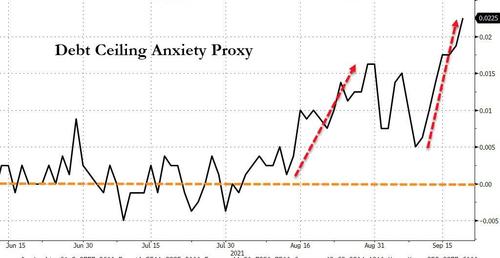

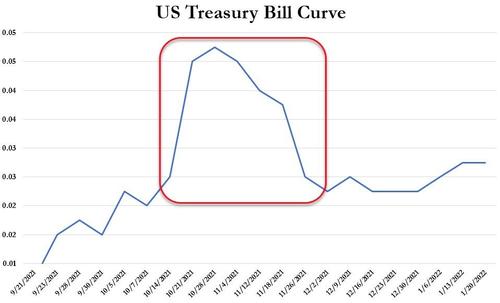

If nothing is done, the federal government will shut down and default on payments as soon as next month – a prospect which already has anxiety through the roof as measured by the spread between Oct and Nov T-bill yields.

“This week, the House of Representatives will pass legislation to fund the government through December of this year to avoid a needless government shutdown that would harm American families and our economic recovery before the September 30th deadline,” said House Speaker Nancy Pelosi (D-CA) and Senate Majority Leader Chuck Schumer (D-NY) in a joint statement. “The legislation to avoid a government shutdown will also include a suspension of the debt limit through December 2022.”

New @SpeakerPelosi & @SenSchumer statement: “The legislation to avoid a government shutdown will also include a suspension of the debt limit through December 2022 to once again meet our obligations and protect the full faith and credit of the United States.” pic.twitter.com/fXMoSmZbjT

— Sahil Kapur (@sahilkapur) September 20, 2021

“On debt limit, the Republicans are doing a dine and dash of historic proportions,” Chuck Schumer says.

He says McConnell “always comes up with some sophistry as to why it’s different” now, argues it’s similar to 2017 when Dems helped a GOP-led gov’t extend debt limit.

— Sahil Kapur (@sahilkapur) September 20, 2021

More via Bloomberg:

The majority party aims to pressure Republicans into backing down on their threat to vote against a debt ceiling increase by attaching it to the stopgap bill, which would keep the government open. The legislation includes money for hurricane and wildfire disaster aid, which could make the package more difficult for some Senate Republicans to vote against.

The federal debt ceiling came back into effect, at $28 trillion, in August and the Treasury Department has warned that without congressional action it may run out of extraordinary accounting measures to avoid a payment default as soon as “sometime” in October.

Needless to say, it’s unclear what Democrats will do if their Hail Mary play linking spending and the debt-ceiling fails to pass the Senate, which will require at least 10 GOP votes to over come the 60-vote threshold for ending debate. We assume they would move to plan-B; passing it via reconciliation, however they’ve thus far declined to do so, and argue that raising the debt is the responsibility of both parties.

In response, Senate Minority Leader Mitch McConnell (R-KY) said: “Democrats control the whole government. They admit they are fully capable of addressing the debt limit alone. They just want bipartisan cover so they can pivot as fast as possible to ramming through an historically reckless taxing and spending spree on a pure party-line vote,” adding in a subsequent tweet: “Democrats do not get to ram through radical, far-left policies on party-line votes, brag about how they are transforming the country, but then demand bipartisan cover for racking up historic debt.”

“As I’ve said since July, they will need to address the debt limit themselves.”

Democrats control the whole government. They admit they are fully capable of addressing the debt limit alone. They just want bipartisan cover so they can pivot as fast as possible to ramming through an historically reckless taxing and spending spree on a pure party-line vote.

— Leader McConnell (@LeaderMcConnell) September 20, 2021

Democrats do not get to ram through radical, far-left policies on party-line votes, brag about how they are transforming the country, but then demand bipartisan cover for racking up historic debt.

As I’ve said since July, they will need to address the debt limit themselves.

— Leader McConnell (@LeaderMcConnell) September 20, 2021

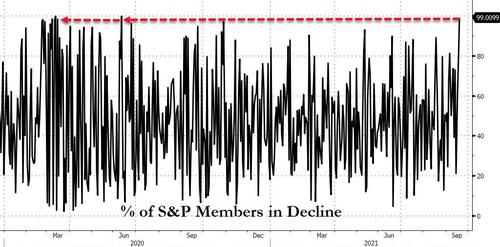

Meanwhile, the percentage of S&P members in decline has reached levels not seen since June 2020, while 1Y US sovereign credit default swaps are have just gone vertical.

The market is not amused.

Tyler Durden

Mon, 09/20/2021 – 16:19![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com