Forget The Taper: All Hell Will Break Loose If The Fed’s 2022 Dot Signal 1 Rate Hike

For all the concerns about the Fed’s tapering, the real news – and potential surprise – in today’s FOMC announcement will be the dot plot.

First, let’s address the upcoming tapering where we mostly know where we stand. As we noted yesterday, at the conclusion of today’s 2-day meeting, the FOMC is likely to provide the promised “advance notice” that tapering is coming, paving the way to announce the start of tapering at its November meeting, a move which was hinted in a recent trial balloon by the WSJ.

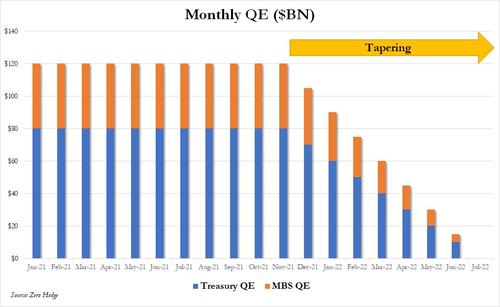

Addressing this topic, Goldman recently said that the bank’s standing forecast is that the FOMC will taper at a pace of $15bn per meeting, split between $10bn in UST and $5bn in MBS, ending in September 2022, although one possible alternative is for the Fed to accelerate the pace of tapering and cut each month instead of each meeting, thereby concluding its bond buying by next July.

As Goldman’s David Mericle wrote, “while the start date now appears set, the pace of tapering is an open question.Our standing forecast is that the FOMC will taper at a pace of $15bn per meeting, split between $10bn in UST and $5bn in MBS, ending in September 2022. But a number of FOMC participants have called instead for a faster pace that would end by mid-2022, and we now see $15bn per meeting vs. $15bn per month as a close call.”

Should the Fed react to the surging inflation and eventually announce a once-per-month taper, the QE over the next few months will look like this (market reaction notwithstanding, and it is very likely that should stocks tumble the Fed will be forced to put its tapering on hold or even reverse it and launch a brand new QE as Ray Dalio recently hinted).

In terms of messaging, Goldman expects that the September FOMC statement will include language similar to that used in July 2017 to foreshadow the start of balance sheet normalization at the next meeting. For example, it might say something along the lines of:

“The Committee expects to begin reducing the pace of its asset purchases relatively soon, provided that the economy evolves broadly as anticipated.”

Separately, Goldman does not expect the FOMC to reveal the pace this week, though the minutes to the September meeting might eventually provide a clue.

We will skip over the Fed’s economic projections (we discussed these in depth yesterday here), while providing an amusing interlued from UBS chief economist Paul Donovan…

The Federal Reserve meets, and Fed Chair Powell (who is not an economist) will offer some comments on the economy. The fabled dot plot of individual FOMC members’ interest rate projections will also be updated—the sole purpose of this release is to increase confusion and misunderstanding in financial markets.

… and instead focus on the dots starting with a benign take, which once again comes from Goldman.

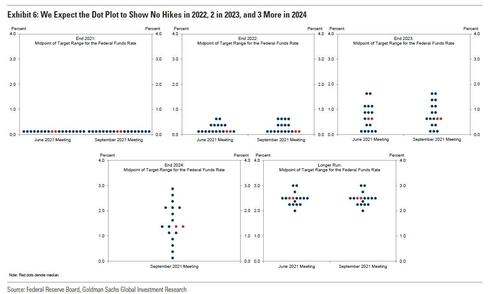

Here, the bank warns that the dots are a close call because a single participant could tip the balance upward relative to the bank’s forecasts, which are shown in Exhibit 6.

Specifically, for 2022, only two participants would have to add a hike for the median to show a half-hike and three for the median to show a full hike. Still, the reason why Goldman does not see the 2022 dots relaying a half or full hike is that most of the potential marginal voters who could swing the balance are Governors at the Fed Board, and they are likely to join Chair Powell in submitting a no-hike baseline. After all, as Mericle notes, “it would be surprising if Powell showed a hike next year just weeks after his dovish speech at Jackson Hole reiterated his view that inflation pressures are likely to be transitory.”

In light of the above, Goldman expects the median dot to show no hikes in 2022, 2 hikes in 2023, and 3 hikes in 2024, anticipating that a quarterly pace of tightening back toward the neutral rate will be appropriate if everything goes well. While this would put the dots well above market pricing, Goldman does not expect much of a market reaction because the dots are a “modal forecast” corresponding to an economic baseline in which most participants will assume that the conditions for tightening will be met. In other words, the market will know that 2023 and 2024 are meaningless, but 2022 – which is closest – does matter. Indeed, Goldman’s rates strategists recently showed that markets have tended to put little weight on the Fed’s three year ahead dots in the past.

But while Goldman does not see the 2022 dot moving higher, others are less sanguine.

One among them is Standard Chartered’s Steven Englander who agrees with Goldman on the taper, writing that “a November tapering decision will likely be signaled at the 22 September FOMC but without details on the pace of tapering or the path of subsequent policy rates hikes, except by inference.”

Here, however, Englander breaks with Goldman and agrees with us that the dots will be the focus of the market, the impact tempered by the relative market unimportance of Q4-2021 inflation and activity data releases compared to H1-2022 data releases. Cutting to the punchline, Englander thinks “the dots will suggest a more hawkish lean than is now priced in” and in a surprisingly hawkish forecast expects seven FOMC participants to indicate two 25bps hikes in 2022 – five a single hike and six no hikes.

This would leave the median dot indicating a single 2022 hike, “but with a hawkish lean given so many participants pointing to two hikes.”There is a risk that the hawkish 2022 skew could be even more pronounced, but we do not think the 2022 dots will show a two-hike median. We estimate that about 18bps is priced by end-2022, somewhat low given what we expect

In a slightly different take from Standard Chartered’s Steven Englander, he expects the dots will signal one 2022 hike (vs no hikes according to Goldman), and two added hikes in both 2023 and 2024. Specifically, he expects seven FOMC participants to indicate two 25bps hikes in 2022 – five a single hike and six no hikes. The would translate into the median dot representing a single 2022 hike, “but with a hawkish lean given so many participants pointing to two hikes” with Englander warning that “there is a risk that the hawkish 2022 skew could be even more pronounced, but we do not think the 2022 dots will show a two-hike median. We estimate that about 18bps is priced by end-2022, somewhat low given what we expect.”

Looking into the outer years, Englander expects the dots to point to another two hikes in each of 2023 and 2024, adding that “Neither hawks nor doves want to give an indication that aggressive policy moves may be needed – doves because they don’t want to augment any downside growth risks and hawks because they don’t want premature pricing of policy tightening to derail markets. Inflation and growth data will speak in H1-2022, and there is no point in gratuitously unsettling markets far in advance of the decisive data.”

Englander also takes a look at the FOMC composition in 2022, writing that “the 2022 regional Fed presidents who vote on FOMC are all pretty hawkish – Bullard, George, Mester and Rosengren. On the board, Waller is emerging as a hawk and even Vice Chair Clarida has begun to acknowledge inflation risks. The reliable doves are Powell, Williams, Brainard and Bowman. It is likely that a hawkish Quarles will be replaced because of his unpopularity on regulatory issues with Democrats, and one Board seat is unoccupied. But President Biden would have to appoint unambiguous doves to guarantee even a 50-50 split.”

Why does this matter? Well, it will matter most when there is ambiguity on the need to act: “Hawkish FOMC voters may read an intermediate outcome, say 2.7% core PCE, as signalling a need to act, while doves might wish to give inflation more time to dissipate on its own. It is possible that the FOMC could split 7-5 or 6-6, or even that Fed Chair Powell could be outvoted. This is a very unusual situation for the FOMC, where dissents have been isolated in recent decades. The Chair being in the minority has not happened since the 1980s. We think the FOMC will look hard for ways to avoid such difficult outcomes.”

Englander is not the only one expecting a hawkish risk: as Nomura’s Charlie McElligott writes, “we see upside risk to the September “dot plot.” And while he thinks the median 2022 policy rate forecast will stay at the effective lower bound (ELB), he agrees with Goldman that the bar for a half or full hike is low. He also predicts that 2023 will continue to show two rate hikes, while 2024 – a new addition in September – will show an additional two hikes, similar to Englander, although he cautions that “concerns over inflation could result in more than four forecasted cumulative hikes by end-2024.”

What does this mean for stocks?

Well, according to McElligott, whose note we discussed in detail earlier, the market is poised for a sharp move in either direction, but would need a “hawkish surprise”—particularly out of the ‘dot plot’, which would “drive some much-needed Rate Vol / upper left movement, via a UST selloff (today’s 133-00 TY straddle currently implying 4.65bps of yield move…so would need to see a larger magnitude selloff to indicate surprise vs mkt expectations).”

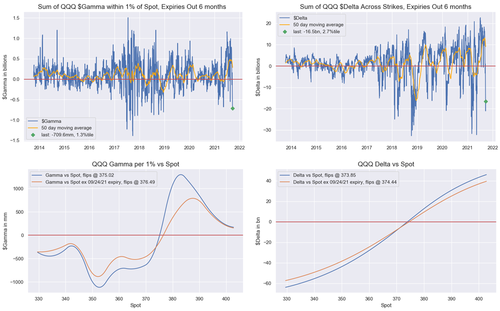

And, as McElligott concludes, “IF…big IF…we got a “hawkish surprise” Fed, one should look at those duration-proxy “Secular Growth” Equities as the area again most at risk, and where we see a LOT of market interest in downside protection in said QQQ / ARKK / Unprofitable Tech proxies.“

Skew still remains “extreme” for sure, but in signs of a potential “pivot” off the worst of the extremes, we did at least finally see it soften yesterday—1m 25d Put Call Skew flattened by 50bps in SPX, while QQQ Skew flattened by ~ 30bps

But no doubt, there is still “energy” there to overshoot in either direction with some very real accelerant flows remaining on account of Dealer options positioning: currently we see SPX / SPY Dealers short ~$9.2B of $Gamma (6.6%ile, flips positive above 4411) while $Delta remains negative at -$139.1B (11.2%ile, flips positive above 4400); similar for QQQ, with REALLY negative $Gamma at -$709.6mm (1.3%ile, flips up at 375.02) and negative $Delta at -$16.5B (2.7%ile, flips positive above $373.85)

TL/DR: all hell could break loose if the Fed shocks the market hawkishly, and the median 2022 dot shows 1 rate hike.

Tyler Durden

Wed, 09/22/2021 – 12:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com