BOE Votes 7-2 To Keep Bond Buying Unchanged, Says Developments “Strengthen Case For Modest Tightening”

One day after the Fed issued a hawkish statement effectively advising the market tapering will begin in November, and just hours after Norway’s Norges Bank hiked rates to 0.25% (as expected) from 0% where rates had been since the covid crisis, moments ago the BOE voted unanimously to keep interest rates at 0.1% and by a majority of 7-2 to maintain the amount of quantitative easing at £875bn.

The Monetary Policy Committee voted unanimously to keep interest rates at 0.1% and by a majority of 7-2 to maintain the amount of quantitative easing at £895bn. https://t.co/vBNgvGdPT8 #BankRate pic.twitter.com/XZ3ksTbHST

— Bank of England (@bankofengland) September 23, 2021

Coming in generally as expected, the surprise was that Ramsden joined Saunders in “preferring to reduce the target for the stock of UK government bond purchases from £875 billion to £840 billion.”

Separately, while the BOE statement was expected to come in dovish – which it did – the bank acknowledged that developments since its August meeting appear to have strengthened the case for modest tightening although caveated that “considerable uncertainties remain.”

At its previous meeting, the Committee judged that, should the economy evolve broadly in line with the central projections in the August Monetary Policy Report, some modest tightening of monetary policy over the forecast period was likely to be necessary to be consistent with meeting the inflation target sustainably in the medium term. Some developments during the intervening period appear to have strengthened that case, although considerable uncertainties remain.

The BOE also added that “the Committee will be monitoring closely the incoming evidence regarding developments in the labour market, and particularly unemployment, wider measures of slack and underlying pay pressures; the extent to which businesses pass on wage and other cost increases, as well as medium-term inflation expectations.”

Elsewhere, as Vanda Research strategist Viraj Patel added, there was “nothing new but uncertainty around GDP and labor market is apparent in this statement. Dovish relative to market expectations.”

Some more highlights from the statement:

- Since the August MPC meeting, the pace of recovery of global activity has showed signs of slowing. Against a backdrop of robust goods demand and continuing supply constraints, global inflationary pressures have remained strong and there are some signs that cost pressures may prove more persistent.

- Some financial market indicators of inflation expectations have risen somewhat, including in the United Kingdom.

- There remained a range of views on the Committee about whether the conditions of that guidance were met, but all members agreed that the previous formal guidance was no longer useful in the present situation.

- At its previous meeting, the Committee judged that, should the economy evolve broadly in line with the central projections in the August Monetary Policy Report, some modest tightening of monetary policy over the forecast period was likely to be necessary to be consistent with meeting the inflation target sustainably in the medium term. Some developments during the intervening period appear to have strengthened that case, although considerable uncertainties remain.

- While base effects accounted for the majority of the increase in CPI inflation between July and August, global cost pressures have continued to affect UK consumer goods prices.

- To a lesser degree, the reopening of the economy has led to a further increase in some consumer services prices.

- Indicators of households’ medium-term inflation expectations have increased in recent months, with the Citi/YouGov five-to-ten year ahead measure at its highest level since 2013 in September.

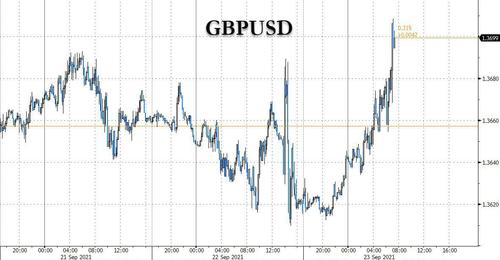

In kneejerk response to the guidance for policy tightening namely that “some developments during the intervening period appear to have strengthened that case, although considerable uncertainties remain.” money markets brought forward rate-hike pricing of 15bps to March’ 2021 from May’2021 prior to the announcement, helping push cable sharply higher.

Alongside this Gilts fell to fresh session lows and the UK 10yr yield spiked to 0.82%; note, as recently as Monday the yield was above this mark.

Tyler Durden

Thu, 09/23/2021 – 07:29![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com