Goldman Slashes 2021 Global Auto Production Estimates, Citing Semiconductor Shortage

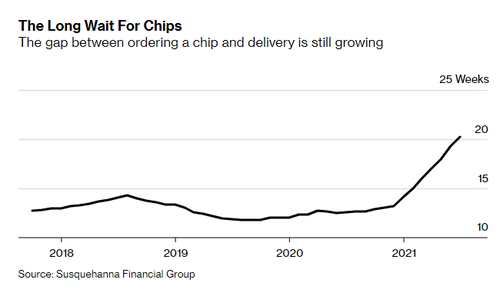

The expectations for the global automobile industry continue to look more and more pessimistic as the ongoing semiconductor shortage that has stung the industry for more than a year now shows no signs of letting up.

Among the latest pessimists were Goldman Sachs, who cut their 2021 production estimate for the industry today, but who also said the bad news may already be priced in, given the declines in the Stoxx 600 Automobiles & Parts Index the past 3 months, according to Bloomberg.

Goldman said that they see global production increasing 2.3% YOY this year, which was “materially below” their expectations at the start of the year.

The cuts were attributed to “lower output estimate, with most significant cuts at suppliers, while volume lost at carmakers is partly offset by strong price/mix,” Bloomberg reported.

Goldman says the weakness this year is eventually going to give way to an investing opportunity for 2022. Next year, production growth will be “more meaningful”, the investment bank said. Pricing is expected to stay strong into 2022.

2021’s production is “largely derisked” at the company’s new estimates but Goldman again warned that the supply chain for semiconductors is opaque and that part-makers are “not protected by pricing if volumes fall short of expectations”.

Recall, early in September, the heads of German manufacturing names warned that the semi shortage “may not just disappear”.

Volkswagen Chief Executive Officer Herbert Diess said on Bloomberg TV early this month: “Probably we will remain in shortages for the next months or even years because semiconductors are in high demand. The internet of things is growing and the capacity ramp-up will take time. It will be probably a bottleneck for the next months and years to come.”

Ola Kallenius at Daimler and Oliver Zipse of BMW also added to the pessimism. Kallenius said that the shortage “may not entirely go away” in 2022, according to Bloomberg. Zipse said there could be another 6 to 12 months left in the shortage.

Kallenius noted that some are holding out hope for the shortage to let up in the fourth quarter. However, he also predicts that a “structural” demand issue will affect the industry in 2022.

Deiss said dealing with the Covid outbreak in Malaysia comes first, and that it may resolve “toward the end of this month, probably next month, and then recover in the last quarter of this year.”

Recall, we wrote last month about how the Delta variant was stinging production in Malaysia. Malaysia is home to names like Infineon Technologies AG, NXP Semiconductors NV and STMicroelectronics NV, who all have operating plants in the country. With Covid infections soaring locally, plans for lifting lockdowns and re-opening production look as though they could fall by the wayside.

Tyler Durden

Mon, 09/27/2021 – 12:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com