Albert Edwards: “It’s Starting To Feel A Bit Like July 2008”

One of the theories seeking to explain the Lehman collapse and the ensuing financial crisis points to the record surge in oil prices which rose as high as $150 in the summer of 2008, and which combined with tight monetary conditions, precipitated a giant dollar margin call which in turn pricked the housing bubble with catastrophic consequences. In his latest note, SocGen’s resident permabear draws on that analogy and writes that “as energy prices surge with a backdrop of central bank tightening it’s starting to feel a bit like July 2008″ referring to that moment of “unparalleled central bank madness as the ECB raised rates just as oil prices hit $150 and the recession arrived.”

Is today any different?

Pointing to the recent surge in global energy prices (described in detail in Gasflation), Edwards writes that “the current high energy prices will hugely impact the debate about whether the post-pandemic surge in inflation is transitory or permanent.” And while we wait for the Fed (and to a much lesser extent the ECB) to commence tapering as neither will be willing to admit they were wrong about “transitory” being permanent, financial conditions are already sharply tighter with breakeven inflation rates (a proxy for market inflation expectations) surging, especially in Europe, and especially in the UK where the Retail Price Index points to 7% inflation as soon as April.

While market are perhaps hoping that central banks will reverse their path similar to what, the Fed did in Dec 2018, a toxic price/wage spiral has already taken hold as “ultra-tight labor markets conspire with households being bludgeoned by higher energy prices and the cost of living generally.”

Meanwhile, even though central bankers repeat like a broken record that they view inflation as transitory, Edwards notes that “the increasing threat of transitory inflation becoming more permanent is prompting central banks around the world to begin their tightening cycles, either with actual hikes in rates (Norway and New Zealand) or threats of hikes next year (UK), or tapering QE (US and eurozone).”

So a double whammy of soaring prices and tighter financial conditions? July 2008 indeed.

Looking ahead, Edwards sees even tighter financial conditions as bond yields continue to drift higher due to the more inflationary backdrop together with the threat of Fed tightening (like Morgan Stanley’s Michael Wilson, Edwards notes that “I do think that tapering is tightening”). As the evidence shifts, Edwards expects 10y yields to attempt to reach 2-2¼% – the upper bound of the long-term secular Ice Age downtrend.

And while this move would not violate the bond bull market, “it would certainly feel like a violation to equity investors” especially if it is rapid, and nobody would be hit harder than tech investors who have built nose-bleed valuations on ultra-low bond yields (Edwards discusses this in depth below). So while it is possible that we could yet see a Dec-2018-like Powell Pivot just weeks into a Fed Taper – as a reminder in late 2018 the “Ghost of 1937” emerged, forcing the Fed to ease long before it reached its target rate, Edwards asks “what about the R-word?”

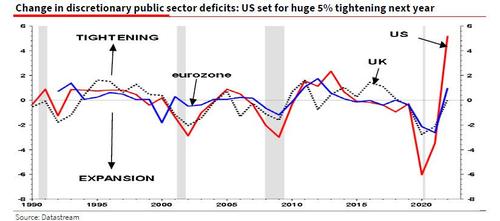

He is, of course, referring to a coming recession (borne out the current global economic stagflation), yet which virtually nobody anticipates. One reason why he sees the US as especially vulnerable to a recession is because the OECD is estimating a huge 5% fiscal tightening next year, the result of trillions in fiscal stimuli fading and turning into outright headwinds.

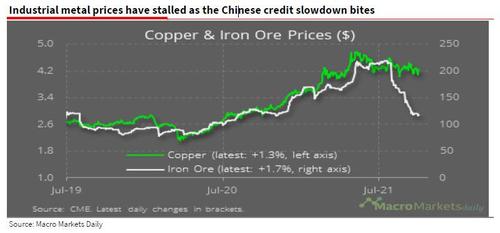

Real-time economic indicators already suggest that the slowdown has arrived: Edwards points to the latest Atlanta Fed GDPNow forecast which has fallen to just 1.3% for Q3, while Goldman recently forecast zero sequential growth in China this quarter. While this can be dismissed as all Covid (Delta) related, it could be something more, especially as the ongoing tightening Chinese credit impulse discussed here and elsewhere continues to punish the economy.

But while the economy is set to suffer from rising inflation and a concurrent increase in rates, it is markets that are even more exposed.

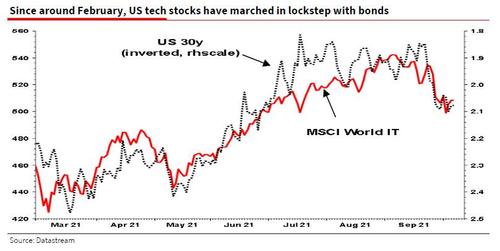

To demonstrate just how much, Albert pulls a chart from BCA Research which showed how conjoined global tech stocks have been with the US 30y bond yield since the start of this year. The SocGen strategist then notes that “if the US 30y yield rises to 2.4% from the current 2.1%, it would knock some 15% off tech stock prices. Imagine if the US 10y rose from 1.5% currently to 2¼%! We could see quite a bear market in tech!“

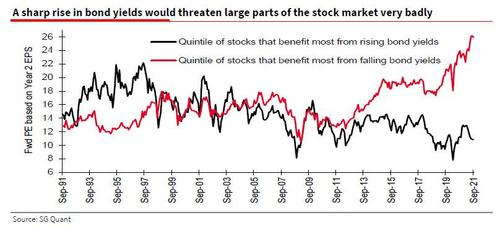

It’s not just tech stocks that are jeopardy should rates rise: defensives – which are mostly a proxy for long-term yields – are too. Edwards’s SocGen colleague, Andrew Lapthorne, shows that the bond sensitivity valuation gap among stocks has never been wider!

Incidentally one can blame the Fed for this staggering move: as the next chart shows, the polarization in forward PE valuations for the US tech sector against both ‘Value’ and the market kicked off after Powell’s infamous Dec-2018 pivot.

Putting it all together, Edwards is concerned that a bigger risk to Nasdaq than higher bond yields would be a follow-on recession (like 1982). Noting that the US tech sector continues to enjoy extraordinarily robust profits growth, particularly during the 2020 Covid recession, it is this earnings growth “that allowed the tech cyclicals to continue in the pretense that they were also ‘Growth’ stocks by turning in a robust profit performance.” The problem is that even a garden variety recession “would put these ‘growth’ imposters to the sword, just as they were in 2001.”

That’s why, in a world where the dreaded “stagflation” word – which few dared to breathe in “polite society” – has seen a record surge in recent article usage…

… Edward’s advice to equity investors is to “think hard about the likelihood that higher energy prices and bond yields will trigger a ‘wholly unexpected’ recession. For that is where the biggest risk might lie for investors.”

Incidentally, Edwards isn’t exactly correct: in a study published overnight by former BOE central banker David Blanchflower (who set interest rates at the BOE during the 2008 financial crisis) and Alex Bryson of University College London, the two say that consumer expectations indexes from the Conference Board and University of Michigan tend to predict American downturns 18 months in advance. Their conclusion: the U.S. economy is already in recession even though employment and wage growth indicate otherwise, to wit: “downward movements in consumer expectations in the last six months suggest the economy in the United States is entering recession now.”

Tyler Durden

Fri, 10/08/2021 – 13:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com