How Big Is The Impact Of Soaring Nat Gas Prices On CPI

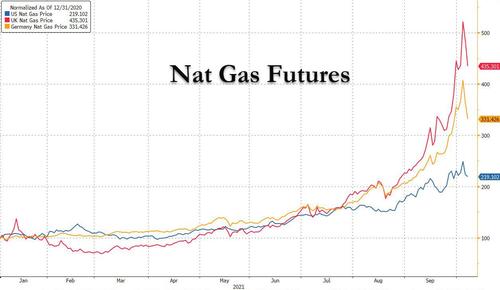

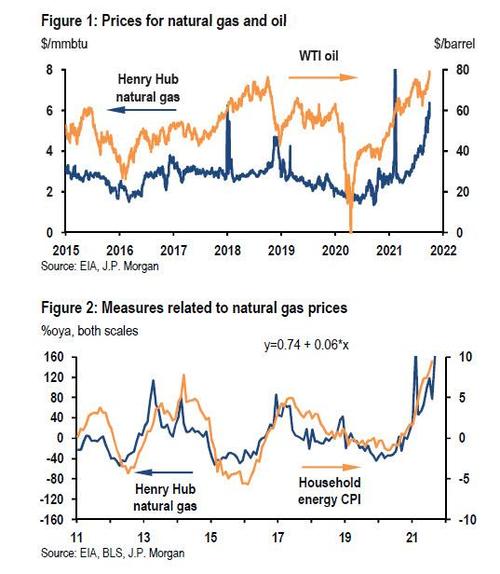

The surge in natural gas prices in 2021 has put even crytpocurrencies to shame: US Henry Hub spot prices have been averaging around $6/mmbtu, up about 40% from early in August and a surge of around 200% relative to prices at the start of the year; prices in German and the UK are orders of magnitude higher.

The dramatic price increase has prompted questions how it will impact inflation prints in the near-term, both headline and core, and indeed as JPM economist Daniel Silver writes today, “this recent jump is notable and should boost consumer prices.”

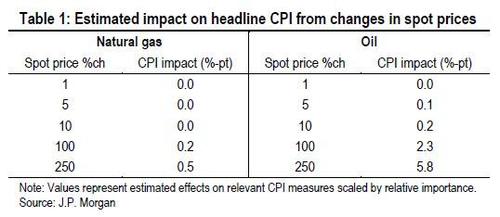

As Silver explaions, while consumer prices for related services don’t fluctuate by nearly as much as spot prices and related products only account for a small share of the goods and services included in the main consumer price aggregates, even keeping all of that in mind, the massive surge in natural gas prices over the past year probably will add about a half of a percentage point to the change in the headline CPI over the same period.

Meanwhile, oil prices have also spiked – in the case of WTI to the highest since 2014 – and while the percentage increase has not been nearly as large as the increase in nattie, the impact of the oil price increase on the CPI could be about four times as large as the effect of the surge in natural gas prices

Naturally, changes in nat gas prices impact the prices that consumers pay for household energy, which includes gas services, electricity, and various fuels, but there are also fixed costs and other factors that influence these consumer prices. According to JPM, over the past decade or so, the changes in consumer prices for household energy generally have been about 1/16 the size of natural gas spot price changes. Based on this rough relationship, a 250% increase in natural gas prices would generate about a 15% jump in the related CPI measure, which itself accounts for about 3.3% of the goods and services included in the CPI basket. Therefore, the massive 250% increase in natural gas prices could boost annual headline CPI inflation by about 0.5% (3.3%*15%).

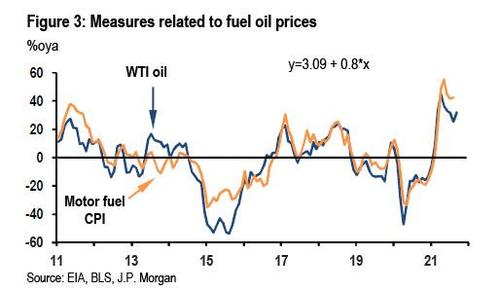

By contrast, the prices for some other types of energy goods are much more responsive to changes in nat gas spot pricing. Motor fuel prices in the CPI, for example, move almost one-to- one with WTI oil prices.

As a result, JPM concludes that changes in oil prices have much larger effects on the CPI than comparable changes in natural gas prices. But large enough changes in natural gas prices, like those seen seen over the past year, will also have a clear impact on headline inflation.

Table 1 displays estimates for how hypothetical changes in spot prices could impact headline inflation. Even though the increase in natural gas prices over the past year has been about 2.5 times the increase in oil prices, the oil price boost to the CPI should be about four times as large as the boost coming from natural gas.

Tyler Durden

Mon, 10/11/2021 – 05:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com