Global Markets Grateful For Trade Deal Optimism, Levitate To All Time Highs

With little out there to threaten the melt-up in global stocks, and with hte occasional “trade deal optimism” trickling in from Trump’s tweets or Chinese soundbites, traders were thankful for yet another all time high in S&P futures while world markets made another push for a record high on Wednesday after Trump said Washington and Beijing were in the final throes of inking an initial trade deal.

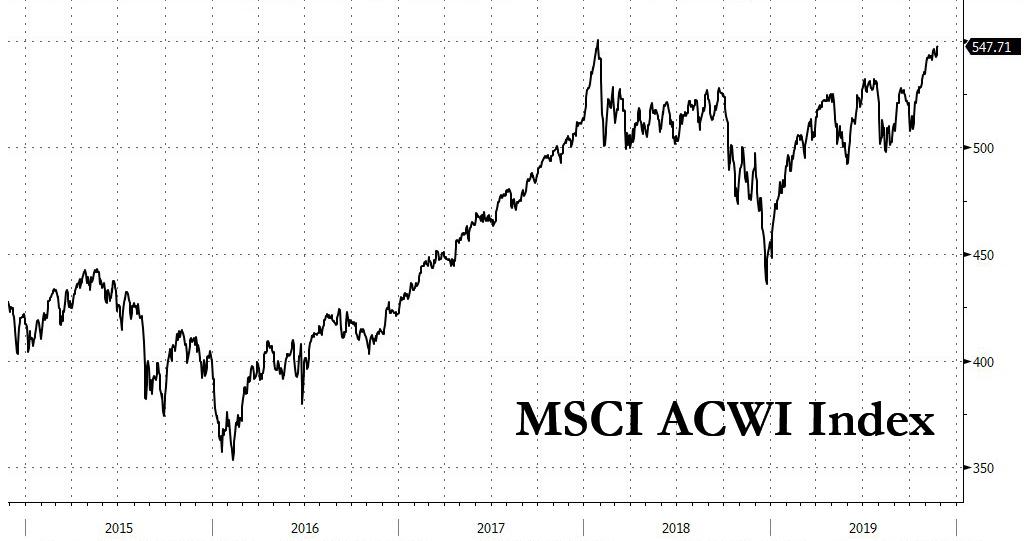

The MSCI’s all-country world index was just within 0.4%, or 2 points, of its record high from January 2018…

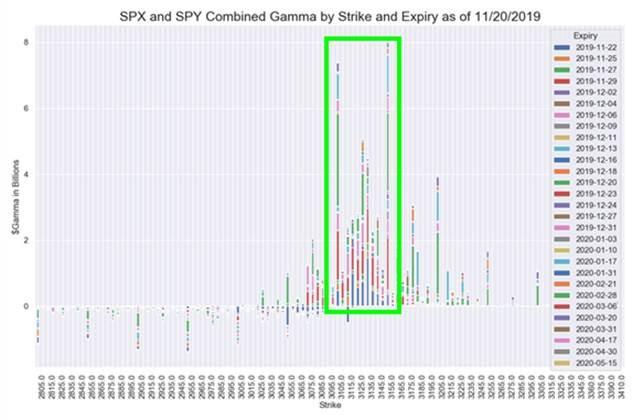

… while US equity futures rose all night until they rebounded off the giant gamma wall at 3,150…

… which we discussed previously has set the trading range for the S&P between 3,100 and 3,150. And so, having hit the top end of the dealer sweet spot, the S&P may now revert lower… but don’t hold your breath.

Europe’s Stoxx 600 index also rose to within 1% of its record close, with 15 of 19 sector groups advancing amid very subdued volumes.

Earlier in the session, Asian stocks advanced for a fourth day, led by tech firms, with the MSCI Asia Pacific index adding 0.3% in overall quiet trading, and while Shanghai struggled after Chinese industrial company profits plunged the most since 2011, Australian shares reached record highs and Japan’s Nikkei drew support from the growing likelihood of extra fiscal stimulus, while the Topix added 0.3%, driven by electronics and machinery makers, as foreigners extended their buying of Japan equities for a seventh week, its longest stretch in two years. A senior Japanese ruling party official said on Wednesday he believed the government was striving to compile a supportive spending package worth about 10 trillion yen ($92 billion).

The Shanghai Composite Index closed 0.1% lower, with China Yangtze Power and Ping An Insurance Group among the biggest drags. Profits at Chinese industrial companies fell for a third month, dropping by the most since at least 2011. India’s Sensex rose, heading for a fresh record, as Housing Development Finance and Kotak Mahindra Bank offered strong support.

As usual, the big topic of discussion, or rather diversion, was trade, even though China continues to slow not due to the trade war but its inability to stimulate a credit impulse, while the only reason why US stocks are at record highs is QE4.

“Something will come out of the phase one (Sino-U.S. trade) talks,” said TD Securities Senior Global Strategist James Rossiter. “Rolling back tariffs to where they were in August, with the December ones put on hold or canceled maybe.” But he said the two countries were unlikely to go beyond that, and China’s declining industrial profits underscored the economic strain exerted by the tensions.

Another signal of the rising market confidence was the VIX plunging to 7 month lows. It is now less than half the level it was in August, when U.S.-China talks looked close to collapsing, and a third of last December’s level when stock markets were pulled lower by trade angst and rising interest rates. Kay Van-Petersen, global macro strategist at Saxo Capital Markets in Singapore, said while Sino-U.S. trade headlines may be driving some tactical, near-term moves in the market, they were mostly just “noise”. And echoing what we said, the Saxo strategist said that the broader market direction is “about the accommodative Fed and accommodative monetary policy and the fact that structurally the meta-trend is still lower in yields and rates,” he said.

In FX, the dollar relentless levitation continued, and the greenback was stronger against developed and emerging currencies, with dollar/yen holding above 109 and euro/dollar steady at $1.10. That was despite softer-than-expected U.S. economic data on Tuesday, which showed a fourth straight monthly contraction in consumer confidence and an unexpected drop in new home sales in October. Sterling initially dropped then spiked as pre-election opinion polls showed some narrowing of the Conservative lead over opposition parties, although Prime Minister Boris Johnson is still favored gain an overall majority. The reaction to the polls squeeze has been modest as the prospect of another hung parliament raises the prospect of some form of coalition government made up of parties supporting a second Brexit referendum.

“So far, the market has been relatively complacent when it comes to the risks ahead,” said Thu Lan Nguyen, FX strategist at Commerzbank. “Yes, the Tories still have the lead, but they’re certainly not gaining.”

In emerging markets, traders were watching Brazil’s real, which fell to a record low, below the troughs of the 2015 recession, despite central bank intervention.

Among the main commodities, oil prices edged lower after reaching their highest since late September on the reassuring trade headlines. U.S. West Texas Intermediate crude was down 0.21% at $58.29 per barrel. Global benchmark Brent crude lost 0.11% to $64.20 per barrel.

Expected data include annualized GDP, durable-goods orders, and personal income and spending.

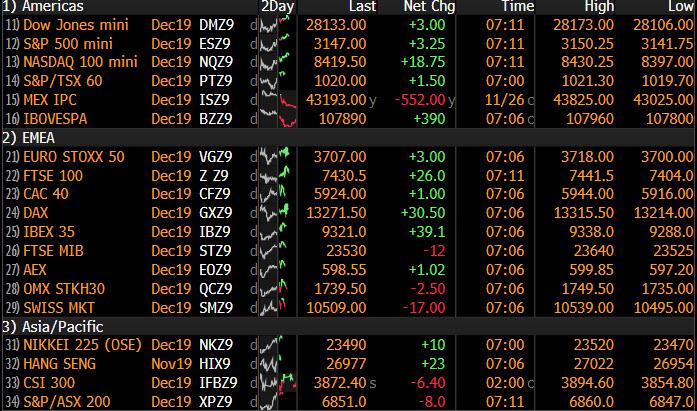

Market Snapshot

- S&P 500 futures up 0.2% to 3,149.75

- STOXX Europe 600 up 0.4% to 410.26

- MXAP up 0.3% to 165.63

- MXAPJ up 0.4% to 530.12

- Nikkei up 0.3% to 23,437.77

- Topix up 0.3% to 1,710.98

- Hang Seng Index up 0.2% to 26,954.00

- Shanghai Composite down 0.1% to 2,903.20

- Sensex up 0.4% to 40,972.32

- Australia S&P/ASX 200 up 0.9% to 6,850.60

- Kospi up 0.3% to 2,127.85

- German 10Y yield unchanged at -0.372%

- Euro down 0.1% to $1.1006

- Italian 10Y yield rose 0.6 bps to 0.824%

- Spanish 10Y yield fell 0.7 bps to 0.382%

- Brent futures up 0.3% to $64.46/bbl

- Gold spot down 0.2% to $1,459.24

- U.S. Dollar Index up 0.1% to 98.36

Top Overnight News

- Global central banks are approaching the end of the year with a collective shudder at the risky behavior that their low interest-rate policies are encouraging. Policy makers from European Central Bank and the Federal Reserve are among those raising cautionary flags at potentially unsafe investing stoked by their efforts to flood economies with ultra-cheap money

- President Donald Trump declared Tuesday that talks with China on the first phase of a trade deal were near completion after negotiators from both sides spoke by phone, signaling progress on an accord in the works for nearly two years

- Profits at Chinese industrial enterprises fell for a third straight month, dropping by the most since at least 2011 as producer prices continue falling and domestic demand slows

- China saw strong demand for its third offering of dollar bonds in three years, though U.S. investors largely left the deal alone amid the trade war. Fund managers were also a diminished presence from last year, with the bulk of the sale taken up by banks and the public sector — a group that includes central banks and sovereign wealth funds

- The earliest-available indicators of China’s economic performance point to a continued slowdown in November. Economic growth was already the slowest in almost three decades in the third quarter

- Elizabeth Warren’s steady rise in the polls has shifted into reverse as attacks from her Democratic rivals over her Medicare for All plan take a toll. A Quinnipiac poll released Tuesday found that Warren has dropped by 14 points since October, when she topped the field in the same poll. Joe Biden now has a clear lead and she is in a three-way statistical tie for second place with Pete Buttigieg and Bernie Sanders. Every other candidate had 3% support or less

- A White House budget official said he warned his superiors that a hold on security assistance for Ukraine could be illegal, and he waited months for an explanation for the delay he described as unusual, according to transcripts released Tuesday

- The road map for quantitative easing laid out by Reserve Bank of Australia Governor Philip Lowe is spurring a rally in the nation’s bonds as investors seize on his comments to bet on deeper interest-rate cuts

- The earliest-available indicators of China’s economic performance point to a continued slowdown in November. Economic growth was already the slowest in almost three decades in the third quarter, and Bloomberg Economics’ gauge aggregating the earliest data from financial markets and businesses shows that continuing

- U.K. Labour party leader Jeremy Corbyn accused Boris Johnson’s government of secretly negotiating with the U.S. over the National Health Service as he sought to shift the focus from a spat over antisemitism that has embroiled his campaign for next month’s election

Asian equity markets traded broadly firmer after Wall Street extended on record levels once again, but with gains capped given the lack of material breakthrough from the recent slew of optimistic US-China trade rhetoric and following a further slump in Chinese Industrial Profits. ASX 200 (+0.9%) and Nikkei 225 (+0.3%) were positive with notable strength in Australia’s telecoms sector as Telstra was boosted in anticipation of a stronger performance in H2 and with gold miners underpinned after the precious metal found relief from support at USD 1450/oz, while Tokyo sentiment rode on the recent upward trajectory in USD/JPY and with Toshiba lifted by prospects of a sooner return to the main market following reports the Tokyo Stock Exchange will ease requirements to fast-track promotion to the main board as soon as next year. Hang Seng (+0.2%) and Shanghai Comp. (-0.1%) were somewhat indecisive with Hong Kong kept afloat by hopes protests were waning and that the university siege may have drawn to an end, although the mainland was choppy due to continued PBoC liquidity inaction and after Industrial Profits further deteriorated with its largest decline since 2011. Finally, 10yr JGBs ignored the mostly positive tone in stocks and extended on the prior day’s post-40yr auction rebound to briefly test resistance at the 153.50 level, with prices also supported by the BoJ’s presence in the market today with the central bank’s Rinban operations heavily concentrated on 5yr-10yr maturities.

Top Asian News

- Another Yield-Starved Japanese Bank Steps In to Buy CLOs

- Westpac Still Under Fire as Advisers Say Directors Must Go

- Investors in China Can’t Wait to Finally Own Alibaba Shares

- Hong Kong Sets Record in $5 Billion Land Sale to Sun Hung Kai

Major European bourses (Euro Stoxx 50 +0.2%) are higher in quiet but choppy trade, as global equities continue to build on recent momentum amid elevated trade hopes since the latest US President Trump comments that trade talks are in the “final throes”. Meanwhile, month-end factors continue to distort price-action. Sectors are in the green across the board, with outperformance seen in Materials (+0.3%) and Consumer Discretionary (+0.3%). In terms of individual movers; British American Tobacco (+2.1%) nursed losses seen at the open after the Co. noted that it is on track for a strong year despite a slowdown in the US vaping market. Elsewhere today’s notable gainers include Aroundtown Properties (+2.5%) whose shares advanced after the Co. posted strong gains in both revenue and EBITDA. In terms of the laggards, Knorr Bremse (-3.5%) is under pressure after the Co. posted earnings that missed on top line expectations. Meanwhile, Rolls Royce (-1.5%) and Compass Group (-2.5%) are both lower following downgrades at Morgan Stanley and SocGen respectively. Taking a broader view, Barclays continue to see moderate upside for European equity markets in 2020, forecasting a further 9% of upside for the Euro Stoxx 50 by next year’s end. Although “the tactical risk-reward has become less appealing following the latest rally, as macro recovery and reducing policy uncertainty appear to be widely expected… light positioning, the relative expensiveness of ‘safe assets’, the positive delta in activity & earnings and the easier financial conditions argue for an extension of the equity bull market into 2020” the bank concludes.

Top European News

- Better Macro Should Support European Stocks in 2020: Jefferies

- Bain, Fortress, Apollo Consider Investing in Monte Paschi: MF

- Lloyds to Cut Chief Executive Horta-Osorio’s Pension Award

- Vodafone Wins German Court Backing in Price Fight With Elliott

In FX, The Dollar remains on a firm footing ahead of a packed US agenda with data front loaded and compressed due to Thursday’s Thanksgiving holiday. The Greenback is up vs most G10 rivals, albeit rangebound as the DXY meanders between 98.407-259 parameters, and just shy of resistance at 98.450. Back to today’s raft of releases, Q3 GDP and October core PCE are likely to headline, but durable goods may steal the limelight given the erratic nature of that series.

- CAD/NZD/SEK/NOK – The major outliers and ‘outperformers’, as the Loonie maintains a degree of bullish technical momentum after Usd/Cad closed below the 200 DMA on Tuesday (1.3278) and the Kiwi benefits from favourable cross-winds with Aud/Nzd pivoting 1.0550 and Nzd/Usd holding relatively firmly above 0.6400 having largely shrugged off or taken in stride comments from RBNZ Governor Orr, the latest FSR and NZ trade data. Similarly, the Scandi Crowns have not really sustained serious or lasting damage from a dip in Swedish household lending, flip from trade surplus to a deficit twice the size or rise in the unofficial Norwegian survey-based jobless rate, as Eur/Sek tests support at 10.5500 and Eur/Nok straddles 10.1000.

- GBP/AUD/JPY/CHF/EUR – The Pound has recovered pretty well if not impressively from early weakness and a breach of yesterday’s low (circa 1.2835) that seemed partly Eur/Gbp related amidst reports of RHS demand for the end of November. Indeed, Cable has bounced ahead of last Friday’s base (around 1.2822) towards 1.2885 and eclipsing the 21 DMA (1.2881) and the cross is back near 0.8650 having climbed to within a few pips of its 21 DMA (0.8587), as Eur/Usd hovers just above 1.1000. Note, hefty options expire close by (2 bn from 1.0995-1.1000 and 1.1 bn between 1.1035-40), while a key Fib (1.0994) is also keeping the single currency in narrow confines. Elsewhere, broadly risk-on sentiment amidst latest positive US-China trade chat (phase 1 deal in final throes per President Trump) is capping the Yen and Franc just under 109.00 and over parity respectively, with expiry interest also in proximity for Usd/Jpy (3.3 bn from 108.95-109.00 and 1 bn at 109.15). Back down under, a couple of dovish RBA calls vs 1 less dovish has weighed on Aud/Usd and protected a serious approach on 0.6800, but the pair is holding above 1bn expiries between 0.6760-75.

- RBNZ Financial Stability Report noted that New Zealand’s financial system is resilient to a range of economic risks although global financial stability risks and domestic debt vulnerabilities remain, while it added that prolonged low long-term interest rates could generate excess leverage and overheated asset prices. Furthermore, the RBNZ stated negative OCR is not currently a central scenario in its published forecasts and it is considering potential impacts of unconventional monetary policy tools on bank profitability.

In commodities, the crude complex is slightly firmer, with Brent Feb’ 20 futures making fresh weekly highs above yesterday’s high (around USD 64.30/bbl) , as the market rebounds from overnight post bearish API inventory data lows as it opts to instead take its cue from better risk appetite spurred by trade hopes. Looking ahead, attention will be on EIA inventory data, where weekly crude stocks are seen drawing by 347k barrels, although if EIA crude stocks follow API’s lead and print a surprise build, this would mark a fifth straight week of builds. It is also the first day of the OPEC Economic Commission Board Meeting, which ends tomorrow, after which the board may provide policy recommendations to OPEC – although the recommendations are non-binding. Elsewhere, eyes turn to Libya following reports of military action around the El-Feel oilfield (circa. 100k BPD capacity), although no damage or production halts have been reported, the organisation stated that an escalation in violence could prompt evacuations and production shut-down. Looking at metals, gold prices continue to be subdued from lack of haven demand, with prices having briefly slipped below the USD 1460/oz mark. Meanwhile, copper prices continue to gain traction, as positive trade feels spur macro risk appetite, although prices did take a fleeting hit during overnight trade in the wake of abysmal IP data out of China.

US Event Calendar

- 8:30am: GDP Annualized QoQ, est. 1.9%, prior 1.9%

- Personal Consumption, est. 2.8%, prior 2.9%

- Core PCE QoQ, est. 2.2%, prior 2.2%

- 8:30am: Durable Goods Orders, est. -0.9%, prior -1.2%; Cap Goods Orders Nondef Ex Air, est. -0.2%, prior -0.6%

- 8:30am: Cap Goods Ship Nondef Ex Air, est. -0.2%, prior -0.7%

- 8:30am: Initial Jobless Claims, est. 220,500, prior 227,000; Continuing Claims, est. 1.69m, prior 1.7m

- 8:30am: Durables Ex Transportation, est. 0.1%, prior -0.4%

- 9:45am: MNI Chicago PMI, est. 47, prior 43.2

- 10am: Personal Income, est. 0.3%, prior 0.3%; Personal Spending, est. 0.3%, prior 0.2%

- 10am: PCE Deflator MoM, est. 0.27%, prior 0.0%; PCE Deflator YoY, est. 1.4%, prior 1.3%

- 10am: PCE Core Deflator MoM, est. 0.11%, prior 0.0%; PCE Core Deflator YoY, est. 1.7%, prior 1.7%

- 10am: Pending Home Sales MoM, est. 0.2%, prior 1.5%; Pending Home Sales NSA YoY, est. 6.0%, prior 6.3%

- 2pm: U.S. Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

I was on Bloomberg TV yesterday and one comment I made that had a few people asking me questions was the one where I said that I thought nominal yields will stay below nominal GDP for the rest of my career. I truly believe this is the only way of supporting the existing colossal global debt burden and what is likely to be more debt in the future. Central banks will end up being forced to own a lot more bonds as far as the eye can see to facilitate this but I do think both will eventually be forced higher by policy. Clearly for reasons of which I’m not aware of, my career might not have long left but given a new house this year, building renovations that cost the original estimate times Pi, and school/university fees into the 2040s that’s how long I might need to work and how long I think this period of financial repression might need to last. We talk about this a lot in this year’s long-term study on debt. See here for a reminder.

Today markets will wind down ahead of Thanksgiving tomorrow but this means that a number of important US releases are shoe-horned into one day. We’ll get the second reading for third-quarter GDP, which is expected to show no change to the headline number of 1.9% growth, though there are expectations for a 0.1pp downgrade to consumption. We’ll also get durable and capital goods orders for October, which are expected to decline a bit further month-on-month (by -0.9% and -0.2%, respectively) but watch for the impact of the GM strikes. Apart from the national accounts data, core PCE prices for October will be released, which should show below-target inflation of 1.7%, and the Chicago PMI is expected to rise +3.8pts to 47.0 after it hit its lowest level since 2015 last month at 43.2. We’ll also get the biggest opinion poll and subsequent seat model forecast of the U.K. election campaign so far tonight (more on this below).

Ahead of all this, it was another day of edging to fresh record highs for markets, with the S&P 500 (+0.22%), the NASDAQ (+0.18%) and the DOW (+0.20%) all advancing to new highs in response to yesterday’s news that there had been a phone call between the US and Chinese negotiators. It was a similar story in Europe, with the STOXX 600 up +0.10% at its highest level since May 2015. Trade-sensitive indices fell back, however, with the Philadelphia semiconductor index down -0.50%. That move came despite an assertion by President Trump that the two sides are in the “final throes” of negotiations, possibly as concerns intensified over the recently-passed Hong Kong bill, which President Trump has neither confirmed nor denied that he will sign. If he does not sign or veto the bill by December 3, it will become law regardless.

Meanwhile, after the US markets closed, President Trump said in an interview for former Fox News Bill O’Reilly’s website that he’s holding up the trade deal to ensure better terms for the US while saying, “We can’t make a deal that’s like, even. We have to make a deal where we do much better, because we have to catch up.” President Trump also spoke of Hong Kong in the interview and said that the US wanted to see things “go well in Hong Kong” while adding that he was confident of a good outcome.

Overnight, the US Department of Commerce has released an advanced notice for proposed rulemaking (ANPRM) that will implement last May’s executive order on information and communications technology and services supply chain security. Also of note is that it did not name China as an “adversary nation”, as suggested in an earlier draft.

A quick refresh of our screens this morning show that Asian markets are mostly trading up with the Nikkei (+0.45%), Shanghai Comp (+0.07%) and Kospi (+0.42%) all higher while the Hang Seng is trading flat. As for FX, all the G10 currencies are trading weak against the dollar with the Australian dollar (-0.21%) leading the declines. Elsewhere, futures on the S&P 500 are up +0.06% while WTI crude oil prices are down -0.21% after a report from the American Petroleum Institute indicated that US crude inventories increased by 3.64mn barrels last week. As for overnight data releases, China’s October industrial profits declined by -9.9% yoy (-5.3% yoy last month), the largest decline in the 8 years we can find data at this time of the morning. However, the series is quite volatile in nature.

In other news, S&P said in an overnight report that Australia’s AAA credit rating – one of only 11 in the world – would come under increased “downward pressure” if the government opted to deploy fiscal stimulus that changed the trajectory of the budget while adding that the top ranking is reliant on “strong fiscal outcomes.” This perhaps helps to explain the Australian government’s determination to return to a balanced budget in the backdrop of a slowing economy.

Back to yesterday and it’s worth highlighting that volatility has now returned to very low levels, with the VIX index down by -0.12pt to 11.75 – its lowest level since October 2018, while in Europe the V2X was down -0.29pts to 12.10pts – just 1.1pts off its low for the year.

Sovereign bonds also advanced on both sides of the Atlantic, with 10yr Treasury yields down -1.9bps to 1.736%. However, the 2s10s curve snapped a run of 9 successive sessions flatter as the curve steepened by +1.1bps with 2yr yields -2.8bps. Yields fell in Europe too, with 10yr bunds (-2.4bps), OATs (-2.3bps) and gilts (-4.4bps) all lower. Bank stocks underperformed as a result, with the STOXX Banks index down -0.66%, and the S&P Banks industry group down -0.31%.

Possibly supporting the bull steepening move were comments from Fed Governor Brainard, who explicitly said that she supports a form of yield curve control targeted at the front end of the yield curve. Her proposal would cap front-end Treasury yields to reinforce forward guidance and ideally drive down longer-end rates as a result. She says that this policy would be better than outright QE, though she did say that she would support QE in a severe downturn. Brainard also committed to supporting a flexible inflation target, to “anchor inflation expectations at 2 per cent by achieving inflation outcomes that average 2 per cent over time or over the cycle.” Such a change in the Fed’s target appears increasingly likely as a result of their ongoing policy review.

Earlier in the day, Dallas Fed President Kaplan said that “I think policy is in the right place now”, but also said that “We think the fourth quarter is going to be weak”. Kaplan is going to be a voting member on the FOMC next year. He expects growth around 2% for 2020, and would likely need to see a downside surprise versus that figure before supporting any change in policy.

In FX markets, sterling fell -0.26% yesterday as narrowing opinion poll leads for the Conservatives led to investor concern that there might be continued uncertainty over Brexit moving forward into next year. Following Monday’s ICM poll which had a 7pt Tory lead, yesterday morning saw another from Kantar with the lead falling from 18pts to 11pt lead in a week. As such sterling moved from being the best performing G10 currency on Monday to the worst yesterday. A YouGov poll later also showed an 11pt lead, only down 1pt since Friday.

Tonight, market attention will be on the release of YouGov’s MRP (multilevel regression and post-stratification) model at 10pm GMT, used to forecast the result. At the last election, this model predicted a hung Parliament over a week before the elections in contrast to expectations that there’d be a larger Conservative majority, so it’ll be fascinating to see if it’s forecasting any surprises this time round (albeit slightly further out from polling).

Staying with FX, the Brazilian Real depreciated -0.17% to its weakest-ever level against the dollar yesterday, in spite of intervention from the central bank. The move came after Brazil’s Economy Minister commented that a weaker currency is not a problem. Meanwhile, The Brazilian central bank has embarked on a series of rate cuts recently, with 50bp reductions at each of the last 3 meetings. Added to this has been general concerns over political stability in Latin America in light of recent protests across the continent, while former President Lula’s release from prison has raised the prospects of a more radical, populist left-wing government further down the line as he re-enters the political fray. Overnight, Brazil’s central bank chief Roberto Campos Neto has said that the central bank will intervene further if they need to normalize the foreign exchange market.

Sticking with LatAm, yesterday Chile’s central bank said that it will hold its next monetary policy decision two days earlier than scheduled in a bid to provide “timely information” about the country’s economic situation following weeks of social unrest. The central bank will now make the rate decision on December 4 (earlier December 6) and present their quarterly monetary policy report, known as the IPOM, the next day at 8:30 am (earlier December 9).

Elsewhere, the dollar weakened -0.07% after 5 days of gains, while bitcoin (-1.22%) fell for a 10th consecutive session against the dollar, with the latter falling to its lowest level since May.

In terms of data out yesterday, the Conference Board’s consumer confidence reading came in slightly below consensus at 125.5 (vs. 127.0 expected), although the previous month’s reading was revised up by two-tenths. The present situation reading fell to a 5-month low of 166.9, although the expectations indicator rose to 97.9. Looking at the labour market indicators, the differential between those saying jobs were “plentiful” and jobs were “hard to get” fell to 32.1 (vs. 36.1 previously), also at a 5-month low.

Other US data releases included new home sales beating expectations in October, coming in at a seasonally adjusted annual rate of 733k (vs. 705k expected), while the previous month was revised up by +37k to 738k. That means that new home sales have had their best two months in over 12 years and adds to a run of strong data on the US housing market. Elsewhere, the Richmond Fed’s manufacturing survey fell to -1 (vs. 5 expected), and amidst the ongoing trade war, the advanced goods trade deficit for the US fell to $66.5bn in October (vs. $71.0bn expected), its lowest level since May 2018.

In Europe, the main data out yesterday was the GfK consumer confidence reading from Germany, with the December forecast up to 9.7 (vs. 9.6 expected). More notable, however, was the expectations indicator, which rose to 1.7 in November, up from -13.8 the previous month, which was the biggest single-month increase in expectations since July 2010.

To the day ahead now, and this morning’s data include French consumer confidence for November, along with Italian consumer confidence, manufacturing confidence and economic sentiment for the month. Meanwhile, ahead of tomorrow’s Thanksgiving holiday we have a raft of US data releases, including the second reading of Q3 GDP, along with personal consumption and core PCE. Then there’s the preliminary October reading of durable goods orders and non-defence capital goods orders. And to round it off, there’s the MNI Chicago PMI reading for November, personal income and spending data for October, pending home sales for October, and the weekly initial jobless claims and MBA mortgage applications. Turning to central banks, the Fed will be releasing their Beige Book, while we’ll hear from the ECB’s Lane again.

Tyler Durden

Wed, 11/27/2019 – 07:56![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com