S&P’s Line-In-The-Sand For Today’s OpEx

The last few days have seen US equity markets explode higher on a relief rally that perhaps, just perhaps, stagflation is not in the near future (despite The Fed’s imminent taper and rate-hike trajectory looming). The real driver has been short-covering and gamma-squeeze but today’s options expirations suggests a shift in that move is imminent.

SpotGamma points out that its clear that intraday options volumes were heavily involved in this rally.

The vanna models from yesterday (bottom, left) showed a left skew which implied high volatility, and that has not flipped (bottom, right).

Today’s chart holds a right skew which implies dealers have a heavy amount of futures to short on rallies providing resistance in the 4450-4500 level.

To frame the options positioning in a slightly different light, we have posted the Combo (SPX + SPY) gamma profile below.

Note how <4460 the gamma bars are flat to negative, implying that not much support sits underneath. Further we note the Vol Trigger (ie where gamma flips from positive to negative) now sits at 4400, which we consider critical support for this market.

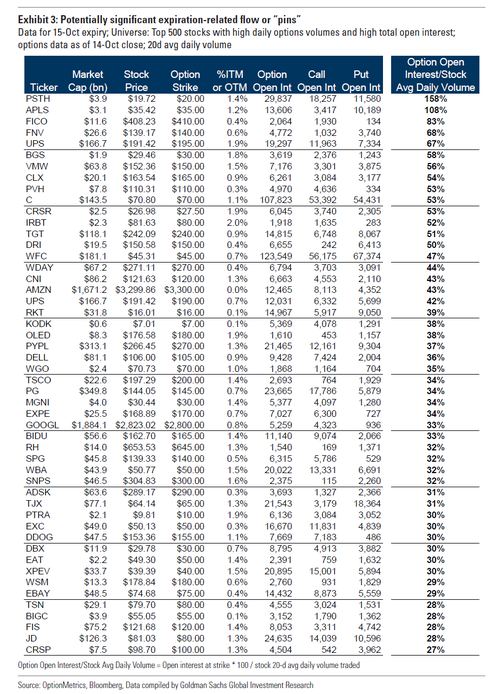

Away from the indices, $703bn of single stock options will expire today (15-Oct), the 3rd highest notional for a non-January expiration.

Goldman Sachs notes that expiration-related trades may cause trading activity to pick up for stocks with a significant amount of ATM open interest. We identify possible focus stocks with large ATM open interest expiring today, and compare to the average daily volume of the underlying stocks. Large market cap names include UPS, VMW, C, TGT and AMZN. Expiration-related activity is likely to have more of an impact if the open interest represents a significant percentage of the stock’s volume.

As SpotGamma concludes: If the S&P closes >4460 today it should have decent support into Monday.

The S&P is also hovering right at its 50DMA…

A close under that line places the market at risk of entering the air pocket that this expiration has created (recall many puts expire today <4400).

Historically we look for volatility to increase in the week after OPEX, and due to the large amount of gamma expiring today (>30%) we see ample reason for caution into Monday.

Tyler Durden

Fri, 10/15/2021 – 09:20![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com