China Coal Prices Soar To Record As Winter Freeze Spreads Cross The Country

One week ago we discussed why the “worst case” scenario for China’s property crisis is gradually emerging; to this we can now add that China’s worst case energy crisis scenario is also about to be unleashed as cold weather swept into much of the country and power plants scrambled to stock up on coal, sending prices of the fuel to record highs.

Electricity demand to heat homes and offices is expected to soar this week as strong cold winds move down from northern China, according to Reuters with forecasters predicting average temperatures in some central and eastern regions could fall by as much as 16 degrees Celsius in the next 2-3 days.

Shortages of coal, high fuel prices and booming post-pandemic industrial demand have sparked widespread power shortages in the world’s second-largest economy. Rationing has already been in place in at least 17 of mainland China’s more than 30 regions since September, forcing some factories to suspend production and further disrupting already broken supply chains.

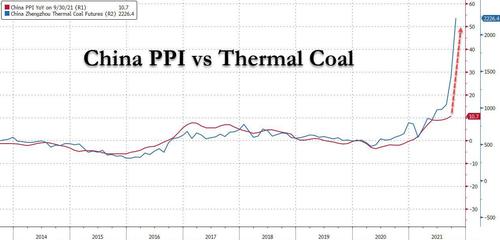

On Friday, the most-active January Zhengzhou thermal coal futures closed at a record high of 2,226 per tonne early. The contract has risen almost 200% year to date.

China’s three northeastern provinces of Jilin, Heilongjiang and Liaoning – also among the worst hit by the power shortages last month – as well as several regions in northern China including Inner Mongolia and Gansu have started winter heating, which is mainly fuelled by coal, to cope with the colder-than-normal weather.

Meanwhile, even though Beijing has taken a slew of measures to contain coal price rises including raising domestic coal output and cutting power to power-hungry industries and some factories during periods of peak demand, so far all measures have failed with coal surging by 40% in just the past three days. Beijing has also repeatedly assured users that energy supplies will be secured for the winter heating season, and went so far as to order energy firms to “secure supplies at all costs.” Well, the energy firms heard it, because on that day, thermal coal closed at 1,436 yuan. Two weeks later it is some 800 yuan higher.

Unfortunately for Beijing, the power shortages are expected to continue into early next year, with analysts and traders forecasting a 12% drop in industrial power consumption in the fourth quarter as coal supplies fall short and local governments give priority to residential users.

Earlier this week, we reported that China undertook its boldest step in a decades-long power sector reform when it allowed coal-fired power prices to fluctuate by up to 20% from base levels from Oct. 15, enabling power plants to pass on more of the high costs of generation to commercial and industrial end-users. read more

Steel, aluminium, cement and chemical producers are expected to face higher and more volatile power costs under the new policy, pressuring profit margins.

Meanwhile, the latest Chinese “data” on Thursday showed factory-gate inflation in September hit a record high; but since thermal coal is the one commodity that correlates the closest to PPI, absent a sharp drop in coal prices in the next few weeks, expect the next PPI print to be far higher. Meanwhile as the power crisis leads to further shutdowns in domestic production, some banks – such as Nomura – have gone so far to predict that China’s GDP is set to shrink in coming quarters.

China, which laughably aims to be “carbon neutral” by 2060 even as its president announced he will skip the COP26 UN Climate Change Conference in Glasgow, has been “trying” to reduce its reliance on polluting coal power in favor of cleaner wind, solar and hydro. But coal remains the source for some 70% of China’s electricity needs.

Of course, China is not the only nation struggling with power supplies, which has led to fuel shortages and blackouts in many European countries. and threatens to send US heating bills up as much as 50% this winter. he crisis has highlighted the difficulty in cutting the global economy’s dependency on fossil fuels as world leaders seek to revive efforts to tackle climate change at talks next month in Glasgow.

China will strive to achieve carbon peaks by 2030, Vice Premier Han Zheng said in a video message at the Russian Energy Week International Forum, according to state-run news agency Xinhua late on Thursday. He also said that China and Russia are important forces leading the energy transition and they should cooperate and ensure smooth progress of major oil and gas pipeline and nuclear power projects.

Translation: Russia better save that nat gas and not ship it to Europe as China will soon be needed even BCF Russia an provide. As for China

Tyler Durden

Fri, 10/15/2021 – 22:50![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com