Futures Tumble After Trump Signs Bill Backing Hong Kong Protesters, Defying China

Less than an hour after Trump once again paraded with yet another all-time high in the S&P…

New Stock Market Record today, AGAIN. Congratulations USA!

— Donald J. Trump (@realDonaldTrump) November 27, 2019

https://platform.twitter.com/widgets.js

… it appears the president was confident enough that a collapse in trade talks won’t drag stocks too far down, and moments after futures reopened at 6pm, the White House said that Trump had signed the Hong Kong bill backing pro-democracy protesters, defying China and making sure that every trader’s Thanksgiving holiday was just ruined.

In a late Wednesday statement from the White House, Trump said that:

I signed these bills out of respect for President Xi, China, and the people of Hong Kong. They are being enacted in the hope that Leaders and Representatives of China and Hong Kong will be able to amicably settle their differences leading to long term peace and prosperity for all.

Needless to say, no differences will be “settled amicably” and now China will have no choice but to retaliate, aggressively straining relations with the US, and further complicating Trump’s effort to wind down his nearly two-year old trade war with Beijing.

The legislation, S. 1838, which was passed virtually unanimously in both chambers, requires annual reviews of Hong Kong’s special trade status under American law – and sanctions against any officials deemed responsible for human rights abuses or undermining the city’s autonomy. The House cleared the bill 417-1 on Nov. 20 after the Senate passed it without opposition, veto-proof majorities that left Trump with little choice but to acquiesce, or else suffer bruising fallout from his own party. the GOP.

While many members of Congress in both parties have voiced strong support for protesters demanding more autonomy for the city, Trump had stayed largely silent, even as the demonstrations have been met by rising police violence.

Until now.

In the days leading up to Trump’s signature, China’s foreign ministry had urged Trump to prevent the legislation from becoming law, warning the Americans not to underestimate China’s determination to defend its “sovereignty, security and development interests.”

“If the U.S. insists on going down this wrong path, China will take strong countermeasures,” said China’s foreign ministry spokesman Geng Shuang at a briefing Thursday in Beijing. On Monday, China’s Vice Foreign Minister Zheng Zeguang summoned the U.S. ambassador, Terry Branstad to express “strong opposition” to what the country’s government considers American interference in the protests, including the legislation, according to statement.

The new U.S. law comes just as Washington and Beijing showed signs of working toward “phase-one” of deal to ease the trade war. Trump would like the agreement finished in order to ease economic uncertainty for his re-election campaign in 2020, and has floated the possibility of signing the deal in a farm state as an acknowledgment of the constituency that’s borne the brunt of retaliatory Chinese tariffs.

Last week China’s Vice Premier and chief trade negotiator Liu He said before a speech at the Bloomberg New Economy Forum in Beijing, that he was “cautiously optimistic” about reaching the phase one accord. He will now have no choice but to amend his statement.

In anticipation of a stern Chinese rebuke, US equity futures tumbled, wiping out most of the previous day’s gains…

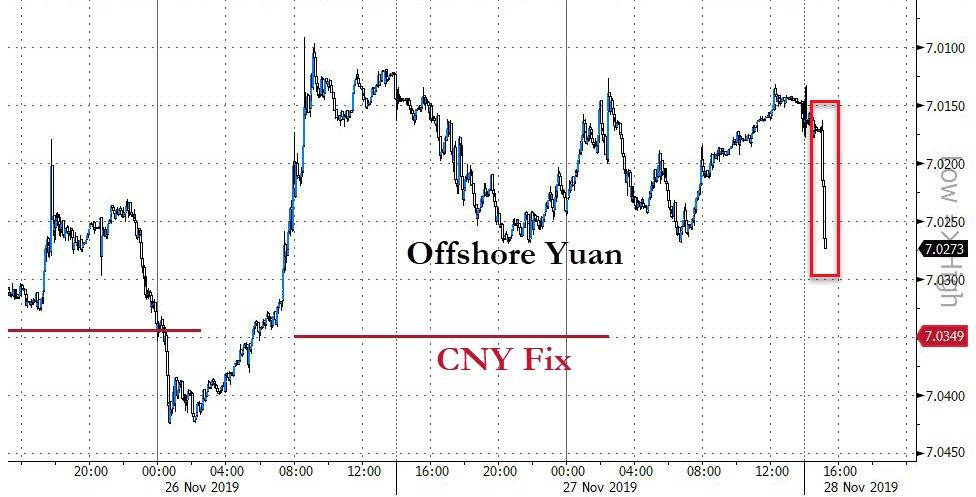

… while the yuan slumped over 100 pips in kneejerk response.

Still, the generally modest pullback – the S&P was below 2,900 when Trump announced the Phase 1 deal on Oct 11 – suggests that despite Trump’s signature, markets expect a Chinese deal to still come through. That may be an aggressive and overly “hopeful” assumption, especially now that China now longer has a carte blanche to do whatever it wants in Hong Kong, especially in the aftermath of this weekend’s landslide victory for pro-Democracy candidates.

Tyler Durden

Wed, 11/27/2019 – 18:20

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com