Supply Chain Disruptions Curtail Union Pacific’s Intermodal Volumes

By Joanna Marsh of Freightwaves,

Extended chassis dwell times and a lack of dray drivers dampened Union Pacific’s intermodal traffic in the third quarter, but the railroad hopes volumes will rebound once the disruptions clear and consumer activity picks up post-pandemic, executives said during UP’s third-quarter earnings call.

“There are some really good-looking markers that tell us the economy is in a pretty strong place. And maybe we’ll stay there for a while,” President and CEO Lance Fritz said on the Thursday call.

“There’s a lot of cash on deposit accounts that people are sitting on. And that is dry powder yet to be deployed in spending. As long as consumers continue to spend on things, that’s really good for the goods economy, which of course is the part of the economy that we participate in.”

Fritz continued:

“[Once] the COVID pandemic gets under control and [we] get continued signs of normalcy … consumers will spend that money and the low inventory-to-sales ratio is going to drive a need for continued stocking. … Certainly as we head into 2022, it looks like a strong environment.”

Easing supply chain disruptions means putting more attention on ensuring adequate workforce numbers among dray drivers, at warehouse and distribution centers, and at the ports, according to Fritz.

“I believe the Biden administration has identified basically increasing the throughput capability and the capacity capability, and understands the need to help put labor that’s available into those jobs and make more labor available for the jobs. … If we could snap our fingers on the back end, we would love to see more dray and warehouse distribution capacity. That’s the first thing that we would love to see. I think that would fundamentally change the street time for chassis and boxes,” Fritz said.

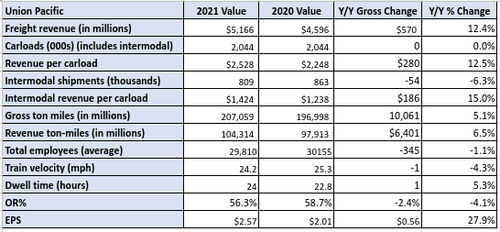

UP’s intermodal volumes in the third quarter slipped 6% year-over-year to 809,000 units, although intermodal revenue rose 8% to $1.15 billion. UP attributed the volume decline to the tight dray market and not having enough dray capacity to support the overall supply chain.

To ease supply chain disruptions inland, the railroad has been utilizing its previously idled Global III facility near Chicago, and it has placed 5,000 cars strategically throughout the network, according to Eric Gehringer, executive vice president of operations. UP has also extended hours at selected ramps, and it has changed the hours of operation at the ICTF in Los Angeles to run 24 hours a day, Gehringer said.

“We can take the volume. We can handle the volume efficiently, [but] we need the back end of the supply chain with warehouse capacity, warehouse labor, dray capacity and dray labor to be there to answer that call,” he said.

As supply chain issues subside, opportunities to provide customers with visibility on network flows should be a focus for UP and the broader industry, Fritz said.

The railroad should “keep our eyes open on opportunities to basically be better for customers. Step one in that has a lot to do with transparency and visibility in the existing supply chain across partners,” Fritz said. “We’re working very hard in that space with each of the supply chain partners that we have, whether it’s a technology platform that we can all use to see everybody’s KPIs and current status, or something more.”

Third-quarter financial results

Despite supply chain challenges globally and domestically, UP achieved an operating ratio (OR) of 56.3%, a third-quarter record and up from an OR of 55.1% in the second quarter of 2021.

Investors sometimes use OR to gauge the financial health of a company, with a lower OR implying improved health. UP’s third-quarter net profit was $1.7 billion, or $2.57 per diluted share, compared with net profit of $1.4 billion, or $2.01 per diluted share, in the third quarter of 2020.

“The Union Pacific team successfully navigated global supply chain disruptions, a major bridge outage and additional weather events to produce strong quarterly revenue growth and financial results,” Fritz said in a release. “In the quarter, the team delivered solid core pricing gains, leveraged business development to produce a positive business mix, and generated productivity to offset flat volume. We also set a quarterly record for fuel consumption rate as we continue to make strides towards our goal to reduce our absolute greenhouse gas emissions.”

Although third-quarter volumes were flat year-over-year, freight revenue rose 12% to $5.17 million on “higher fuel surcharges, strong pricing gains and a positive mix,” said Kenny Rocker, executive vice president for marketing and sales.

“Gains in our bulk and industrial segments were driven by market strength and our business development efforts. Those gains were offset by declines in our premium business group, as our served markets continue to be impacted by semiconductor chip shortages and global supply chain disruptions,” Rocker said.

Operating expenses rose 9%, to $3.13 million, on an 81% increase in fuel expenses.

Meanwhile, wildfires and other weather events challenged UP’s network operations, with quarterly freight car velocity down 13% to 195 daily miles per car, UP said.

UP maintained its 55% OR target for 2022, although it now expects volume growth closer to 5% for 2021, down from a previous guidance of 7%.

“Industrial volumes remain consistent and strong across many sectors like forest products, metals and plastics. So we are bullish on several fronts,” CFO Jennifer Hamann said. “But as you are also well aware, headwinds in autos and intermodal persist. Global supply chain disruptions, semiconductor shortages and the additional pressure with international intermodal volumes … continue to constrain our premium volumes.”

Tyler Durden

Sat, 10/23/2021 – 18:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com