Tesla Rockets To Record Highs On 100,000 Vehicle Order From Hertz, $1600 Bull-Case Price Target From Morgan Stanley

Tesla shares are rocketing to all time highs in the pre-market session this morning on news of Hertz reportedly buying 100,000 of their vehicles, in addition to an upgrade from Morgan Stanley that came over the weekend.

Shares were already bumping higher on the MS upgrade when the Hertz headlines hit the wire around 0730EST, sending shares to the $950 level.

Even though Hertz is just about four months out of bankruptcy, it is implementing an “ambitious” plan to electrify its fleet, beginning with plans to buy 100,000 Teslas, Bloomberg reported Monday morning.

The order marks the “single-largest purchase ever for electric vehicles” and will equate to about $4.2 billion in revenue for Tesla, sources told Bloomberg.

The order will be delivered over the next 14 months and Model 3 vehicles will be available to rent at most Hertz locations starting in November, the report says.

Hertz is also going to be building its own charging infrastructure, in addition to allowing customers to have access to Tesla’s Supercharger network.

Hertz is planning on electrifying “almost all” of its half a million cars and trucks worldwide. The order marks about 10% of Tesla’s total production capacity for a year and may also prevent competitors from making similar purchases from the automaker.

The plan is “ambitious” enough for people to have doubts right off the bat.

Teslas aren’t exactly optimized for rental-fleet duty. I get that it’s what’s available right now if you want to order an EV fleet, but it seems… ambitious on Hertz’s part. $HTZ $TSLA https://t.co/RrH5iATkwk

— John Rosevear 🇺🇸 (@john__rosevear) October 25, 2021

Regardless, the plan, if implemented, is likely a negative for GM who, in 2020, was Hertz’s largest car and truck supplier.

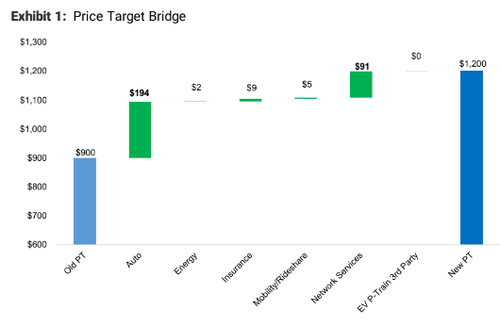

This news came after a Morgan Stanley upgrade, where analyst Adam Jonas slapped a $1200 price target on the company and reiterated his “overweight” rating on the name. Jonas made his “bull case” target on the name $1600 per share.

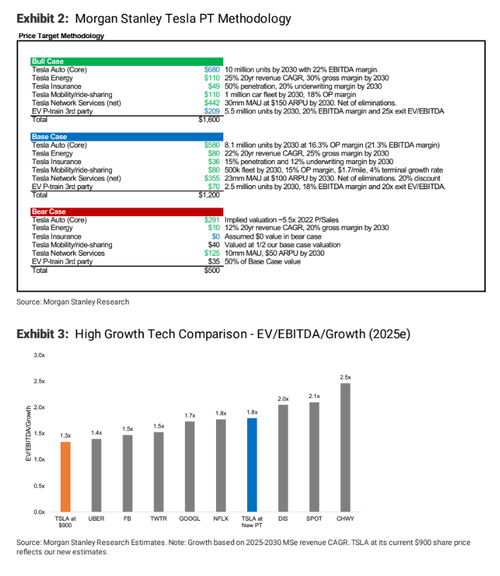

“The next 12 months can demonstrate Tesla’s manufacturing leadership, a step change in costs/complexity and higher growth in the vehicle user base. Our $1,200 price target implies roughly 1⁄2 the company’s growth target, a ‘constrained’ China and virtually no autonomy,” Jonas wrote.

Among the top reasons for the raised price target was “higher volume” – something that the Hertz order, if it is consummated, will help along in a big way.

Jonas also alluded to new and better models on their way. “The Tesla you see today is the product of pre-COVID, sub $100bn Tesla,” he wrote. “The Tesla you’ll likely see over the next 12 to 18 months would demonstrate the capabilities of the Trillion $ Tesla… emphasizing step-changes in manufacturing, cost reduction… expansion in capacity, model lineup and services offerings.”

MS called the company’s Q3 results meaningful due to the extraordinary top line growth and “industry leading” profitability.

Jonas wrote:

The combination of better than expected growth and margins under difficult industrial circumstances gives us an opportunity to narrow the gap in our forecasts to management’s long term targets. The company targets an annual ‘long term’ growth rate of >50%. Prior to 3Q, our forecast of unit volume from 2021 to 2030 was 23%, lagging the overall EV market growth (26% on our forecast).Following 3Q results, we now assume Tesla’s unit volume CAGR from 2021 to 2030 is 28%… slightly above our forecast of overall EV market growth.

Finally, defending his price target he wrote:

At our $1,200 PT, we see ~33% upside from current share price. Our New Bull Case valuation moves to $1,600 (from $1,272) which represents 78% upside. Our Bear Case valuation moves to $500 (from $450) which represents 44% downside.

On 2025 MS estimates, at $900 Tesla is trading at 5x sales,24x EBITDA or 50x P/E. Looking out further to 2030 (we expect ‘steady-state’ for Tesla to be much later now given our growth forecast),at our new $1,200 PT, Tesla is trading at 3x sales, 14x EBITDA or 29x P/E. We expect Tesla to grow at a 30% 10yr revenue CAGR or grow 18% from 2025 to 2030.For the standalone auto business, our revised valuation of $645bn represents a 17x EV/EBITDA multiple on 2025 Automotive EBITDA assumptions of $37bn which we believe is warranted given Tesla’s leadership in: EV manufacturing, growth and margins.

Tyler Durden

Mon, 10/25/2021 – 08:16![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com