“We’re Near The Very End”: Lawrence Lepard On Bitcoin, Gold & The Coming Crash

Submitted by QTR’s Fringe Finance

This is part 1 of an exclusive Fringe Finance interview with fund manager Lawrence Lepard, where we discuss the state of the economy, gold, bitcoin, catastrophic outcomes for the market, the supply chain in the country and more.

Larry manages the EMA GARP Fund, a Boston based investment management firm. Their strategy is focused on providing “Monetary Debasement Insurance”. He has 38 years experience and an MBA from Harvard Business School. On Twitter he is @LawrenceLepard.

Q: Hi, Larry. Thanks for joining me today. I wrote earlier this week about why I thought the NASDAQ could be primed for a crash. Let’s get right into it off the bat: what do you think could be the most likely catalyst for a market crash right now?

A: Very hard to say, think of it as like an avalanche. What snowflake is going to be the last one before it breaks free?

The market is insanely overvalued, but until now has proven that what is insane can become more insane. So you can’t short it. Frankly all price signals are broken and we could be in a “crack up boom”.

I do see signs of weakness (Evergrande, yield curve heading toward inversion, Fed reducing QE won’t help). Personally I think we are near the end and close to a crash, but I have thought that for some time and have obviously been wrong.

Inflation coming in hot and being persistent is probably the most likely catalyst. Inflation will reduce profit margins and will make the current multiples look even more insane. Catalyst: psychology changes. Technically upward momentum has slowed. I think we are very near the end.

What do you think could be the LEAST noticed cause for a crash?

I think the precious metals and Bitcoin are about to go on another run, and that this will signal inflation and that will cause awareness that the stock market is overvalued.

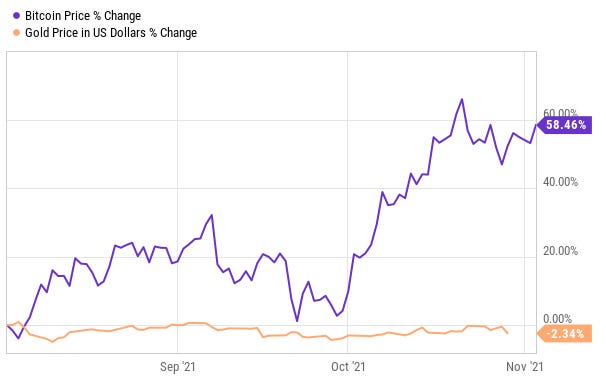

If Bitcoin and gold start performing better than the stock market (Bitcoin has, just needs to continue) that will suck money out of the stock market because everyone is a trend follower these days.

You are an advocate for owning crypto as well as gold – how much excess do you see in the crypto space right now?

I see a lot of excess in the crypto space (NFT’s and Doge are two good examples), but I make a very firm distinction between crypto and Bitcoin. Bitcoin is a crypto currency, but all crypto currencies are not like Bitcoin. I think Bitcoin is legitimate signal. I think all the other cryptos are mostly noise.

Do you only stick to BTC or do you own other cryptos – why or why not?

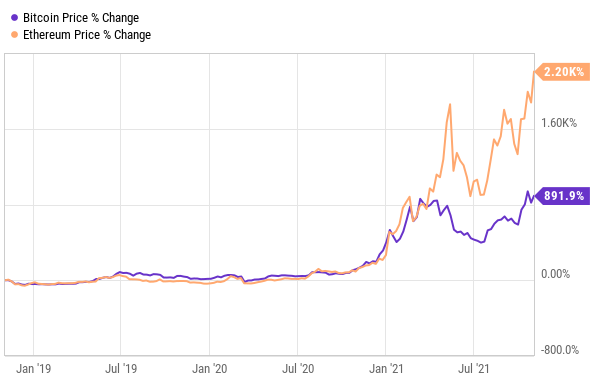

I am exclusively BTC and do not own any other cryptos.

I understand BTC and I think it works for a store of value which is my primary goal since the government is destroying the currency. Ethereum is a nice development layer and it and other use case cryptos will emerge and survive but they are something different than stores of value and therefore I do not own them.

Also, I think many cryptos are frauds and bad things. Tether comes to mind. I think pump and dump bad cryptos have hurt the legitimate store of value coin: Bitcoin. This is sad in my opinion. People should take the time to learn about and understand Bitcoin. It is very important in my view. My Twitter thread has my New Orleans Gold Show speech where I directly address this topic.

Despite all our crowing, the price of metals still seems to be the only commodity that hasn’t caught the inflation bug yet. Why is that, do you think?

The metals were early to the party and are now taking a breather while all the other commodities catch up.

Gold was up over 50% in a two year window. It is down 15% in the past year. It is crazy and partly due to price suppression by the Central Banks, but they cannot hold it down forever and the next run will take it to new all time highs quickly in my opinion.

You’ll be able to read Part 2 of this interview here.

You can listen to Lawrence’s last appearance on my podcast here:

—

If you enjoyed this post, I would love to have you as a subscriber. Zerohedge readers get 10% off a subscription for life by using this link.

—

DISCLAIMER:

Lawrence owns Bitcoin and precious metals, as disclosed. I own exposure to ETH, BTC, Silvergate Capital (SI), and exposure to gold and silver. None of this is a solicitation to buy or sell securities. It is only a look into our personal opinions and portfolios. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe.

MORE DISCLAIMER:

These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. If I am here listing things I got right or things I think will happen in the future, note that there are likely twice as many things I got wrong over the same period of time. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. Leave me a alone and do your research elsewhere. If you can find somewhere to rate this Substack one star, please do so as to save future readers from the misery of my often wholly incorrect prognostications

Tyler Durden

Thu, 11/04/2021 – 06:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com